All jobs are important to the economy for different reasons.

For example, health care jobs make it possible for us to maintain a high quality of life. Construction jobs allow us to build new homes, commercial space, and maintain and improve the quality of our roads. Tourism jobs make it possible for us to enjoy the mountains, the waterways, and the natural beauty of Colorado.

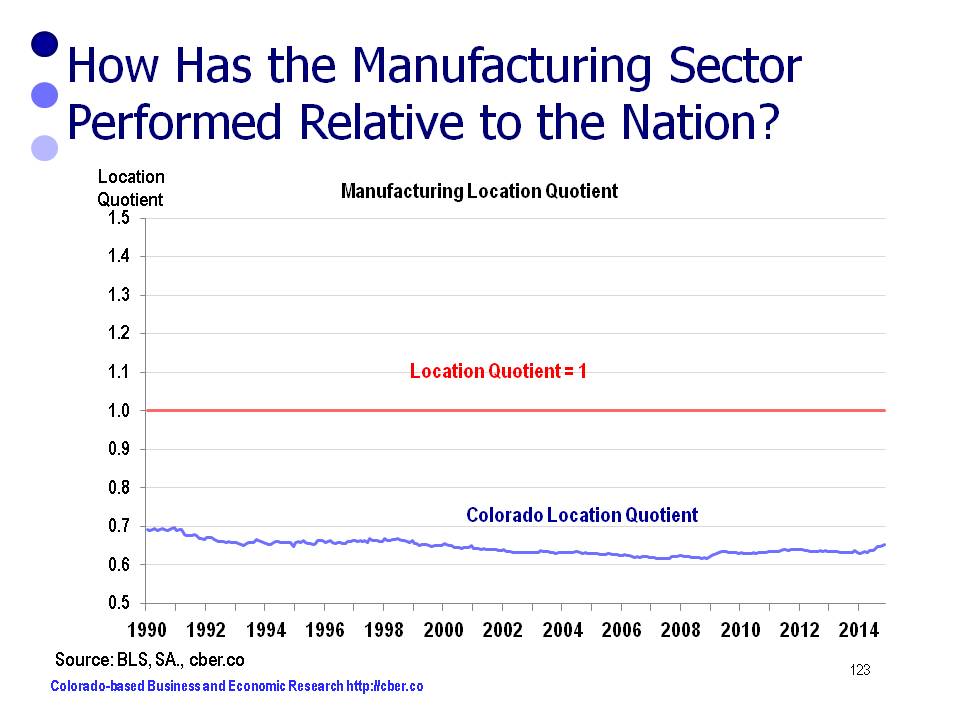

Primary jobs are particularly important because they bring in wealth from outside the state to produce products that are then exported. Manufacturing jobs, such as those at Vestas or Ball Aerospace, are examples of primary jobs. Quite often primary jobs have higher than average wages.

On the topic of wages…

In 2014, average Colorado private sector wages for all industries were $53,068.

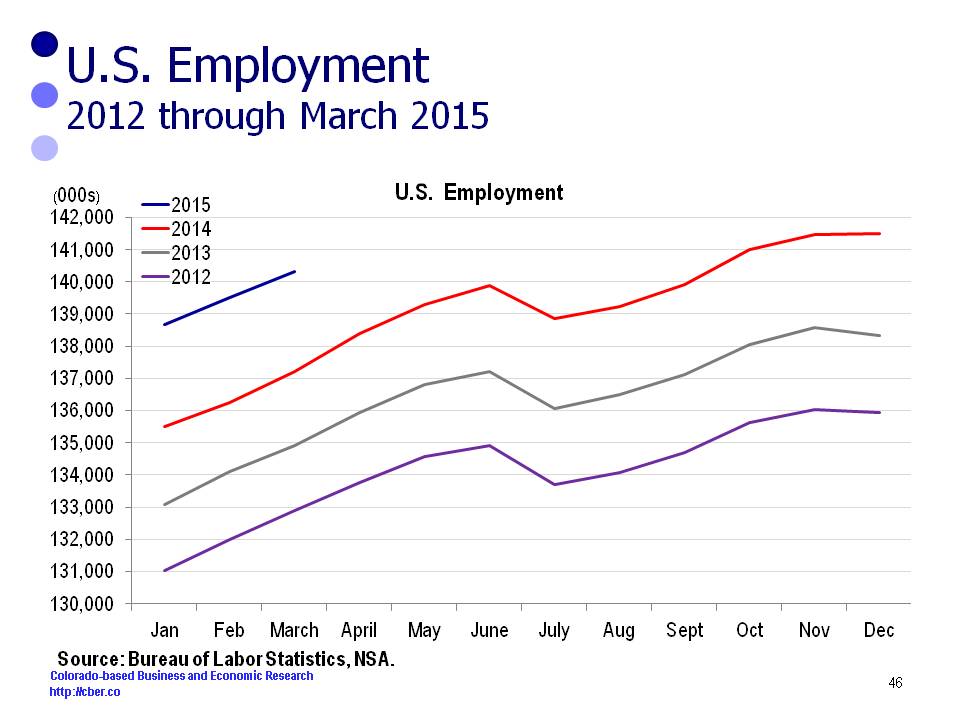

Although 2015 has been a solid year for job growth, there have been concerns the state has been adding too many low-paying jobs and that wage increases have not kept up with inflation.

Through the first six months of 2015 average wage and salary employment for the private sector is 63,500 greater than the same period in 2014.

For the first half of 2014 the leading sectors for job growth were:

• Private Education and Health Care added 15,400 jobs. The sector accounted for 24.3% of total jobs added. Average annual wages for 2014 were $45,879.

• Accommodations and Food Services added 12,900 jobs. The sector accounted for 20.3% of total jobs added. Average annual wages for 2014 were $19,445.

• Construction added 12,700 jobs. The sector accounted for 20.0% of total jobs added. Average annual wages for 2014 were $53,664.

Only the wages for the Construction sector were slightly greater than the state average.

These three sectors accounted for about two-thirds of the jobs added in the first half of 2015. Estimated average annual wages for these sectors was $39,973, based on 2014 average wages.

Average annual wages for the following sectors were below the state average.

• Administrative and Wage Management.

• Arts, Entertainment, and Recreation

• Other Services

• Retail Trade

In the first half of 2015 they accounted for slightly more than 9% of jobs added. Estimated average annual wages for these sectors was $31,677, based on 2014 average wages.

The seven sectors mentioned above accounted for about three-fourths of the job growth in the first half of 2015, yet the average wages for these jobs were about $38,945. This is well below the state average.

The following sectors were responsible for slightly more than one-fourth of the state’s job growth in the first half of the year. All sectors have average annual wages above the state average.

• Corporate Headquarters (MCE)

• Financial Activities

• Information

• Manufacturing

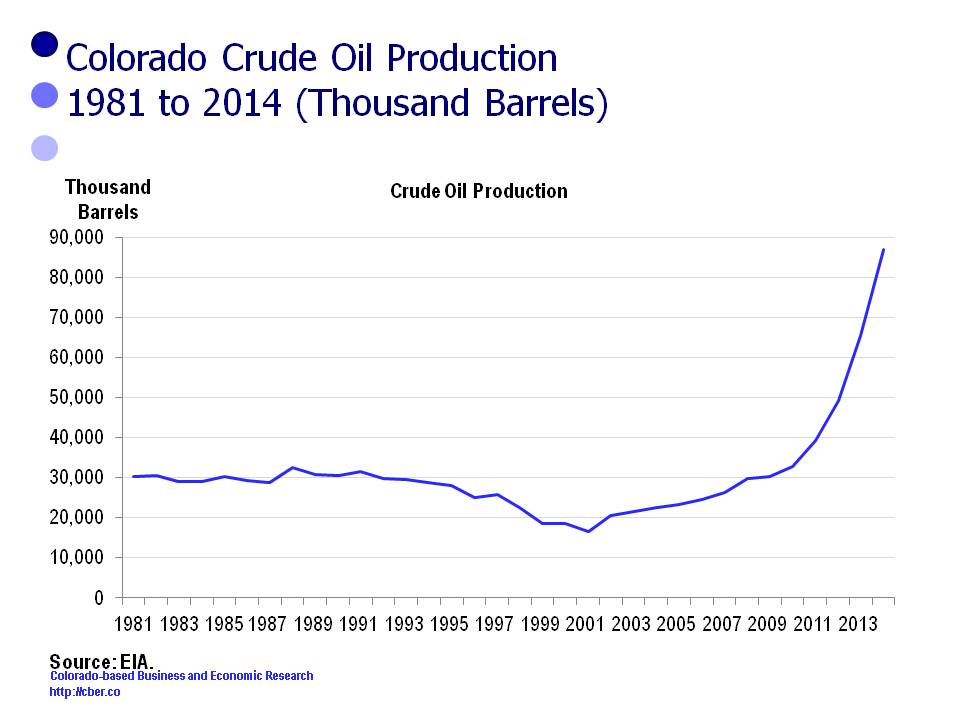

• Natural Resources and Mining

• Professional and Scientific

• Transportation, Warehousing, and Utilities

• Wholesale Trade

Estimated average annual wages for these sectors was $78,685, based on 2014 average wages.

There are several takeaways from Colorado’s wage and job growth in the first half of 2015:

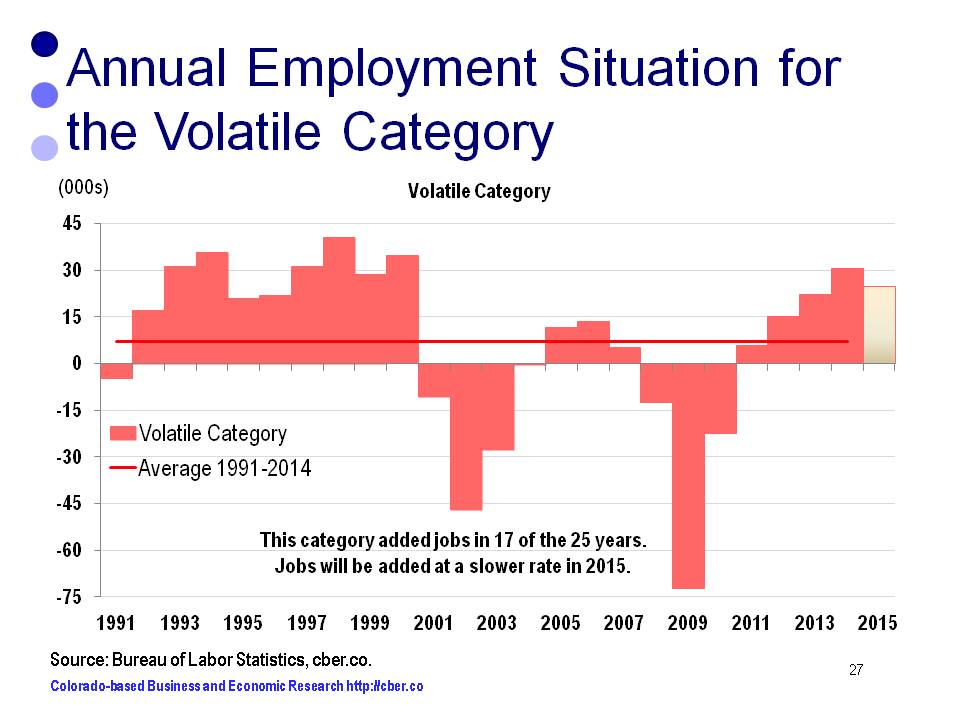

• Jobs and wages don’t expand at an even pace across all industries.

• Strong job growth is not always accompanied by strong wage growth.

• Strong growth in low paying sectors has been accompanied by declines or minimal growth in some higher paying sectors.

• The wage and salary employment data may not be accurately representing actual job growth in the state.

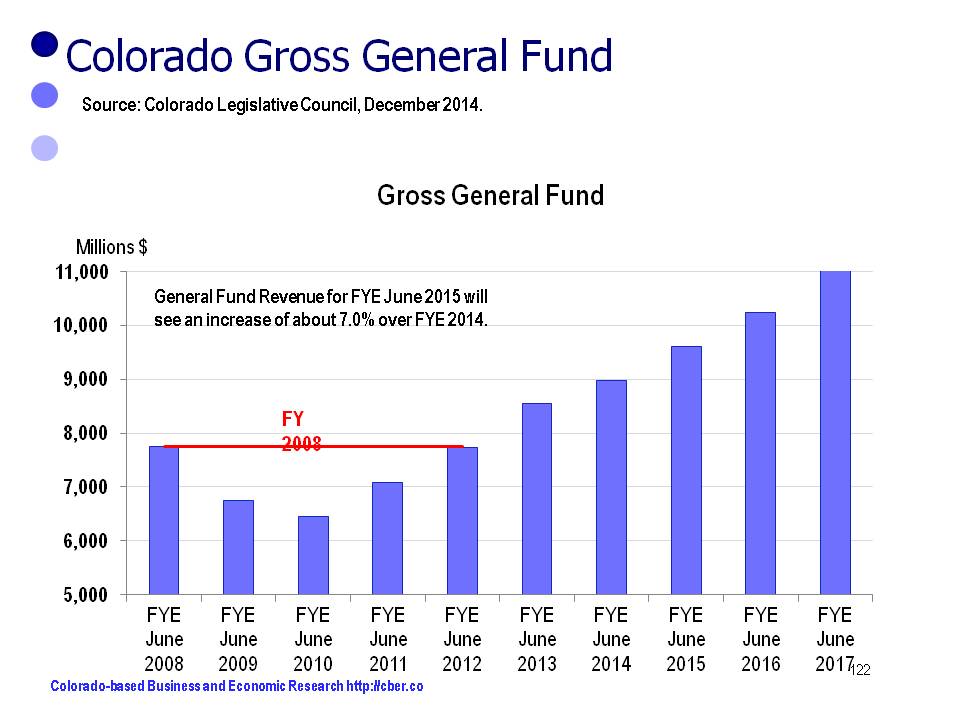

Strong job growth may not translate into increased consumption because average annual wages for many of the additional workers are well below the state average. In turn, the addition of a disproportionate number of lower wage jobs may result in lower than expected tax collections for state and local governments.

All jobs are important, but sometimes higher paying jobs have a greater importance than lower paying jobs.