One of many signs of a solid Colorado economy is the growth in the number of new vehicle registrations. Increased registrations are usually a function of a growing population and solid job growth.

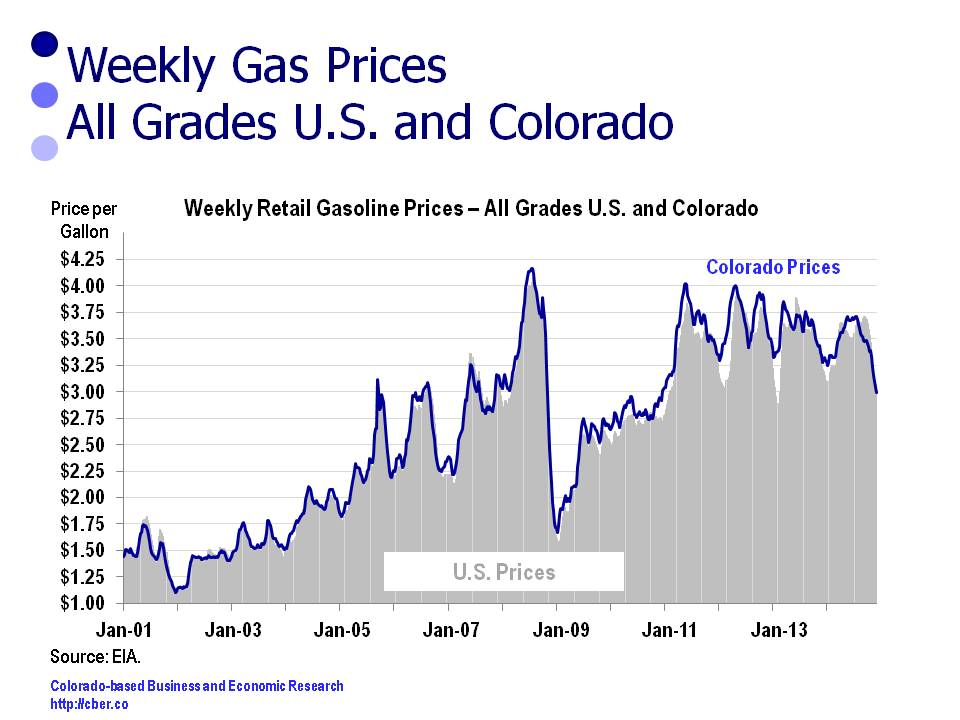

New registrations are also stimulated by low interest rates and higher consumer confidence. As well, lower gas prices may fuel the sales of models that have lower gas mileage, such as large pickups or four-wheel drive vehicles.

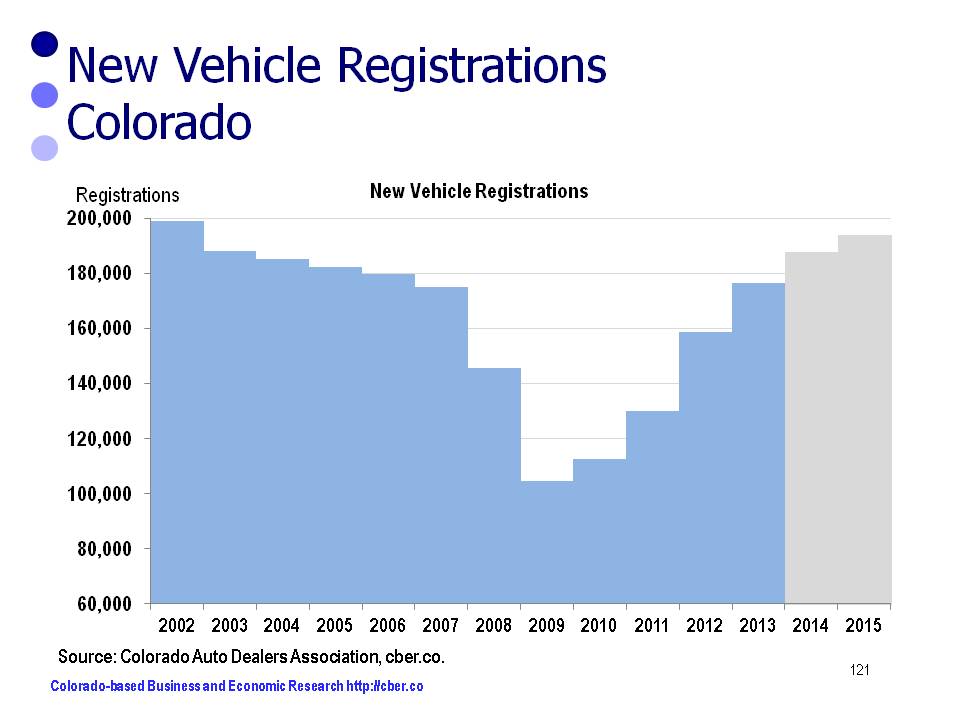

The number of new vehicle registrations in Colorado decreased from 198,910 in 2002 to 104,687 in 2009. Even though there was a steady increase in the state population, back-to-back recessions caused the sharp decline in registrations.

A solid recovery began in 2010 followed by double digit growth in 2011, 2012, and 2013. In 2013 there were 176,433 new vehicle registrations.

The estimated rate of growth will slow to 6.5% in2014 with 187,901 registrations. In 2015 there will be a 3.2% growth rate to 194,000 registrations. The “slowdown” in the rate of growth will occur as sales will increase at a more sustainable rate. In addition, uncertainty in the extractive industries will cause some consumers to be more cautious.