Throughout the year, cber.co produces four types of research that measure the performance of the state economy;

- Economic forecast of Colorado.

- Periodic economic updates throughout the year.

- Special reports on key topics and copies of presentations.

- Periodic blog posts.

Please refer to the monthly Economic Updates tab for the most current revisions!

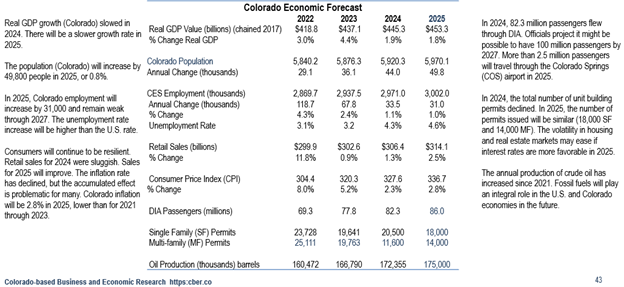

Colorado Economic Forecast 2025 (June 2025 update)

The 2025 forecast is available at 2025 Economic Outlook and Trends for Colorado and the United States

The year has not unfolded as expected. Inflation has steadily improved, but at a slower rate than desired. The election uncertainty has morphed into speculation, which has increased the uncertainty about the impact of administrative policies. The road has been bumpy at times, and it will continue to be bumpy. The United States economy will outperform the economy in Colorado.

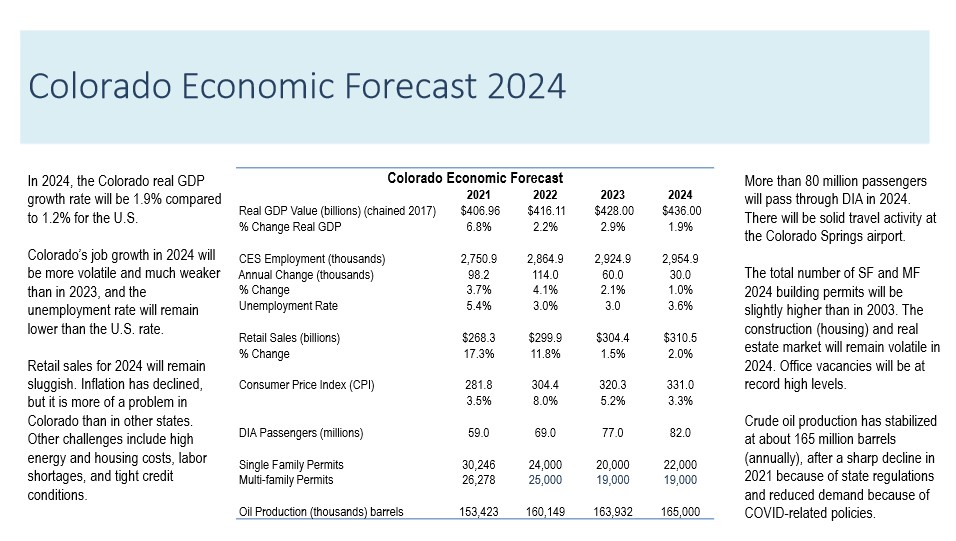

Colorado Economic Forecast 2024 (January 2024)

The 2024 forecast is available at 2024 Economic Outlook and Trends for Colorado and the United States

The Colorado forecast called for a recession in 2023. Fortunately, it has not happened – yet. Employment increased by 60,000, but slower job growth and possibly a recession are on tap for 2024. Colorado will continue to be challenged by many of the problems it faced in 2023. Housing permits (a leading indicator) will remain lower than usual, the office vacancy rate in Denver is around 30%, retail sales have slowed, inflation will remain higher than in other states, and companies will continue to struggle to find workers despite low unemployment rates.

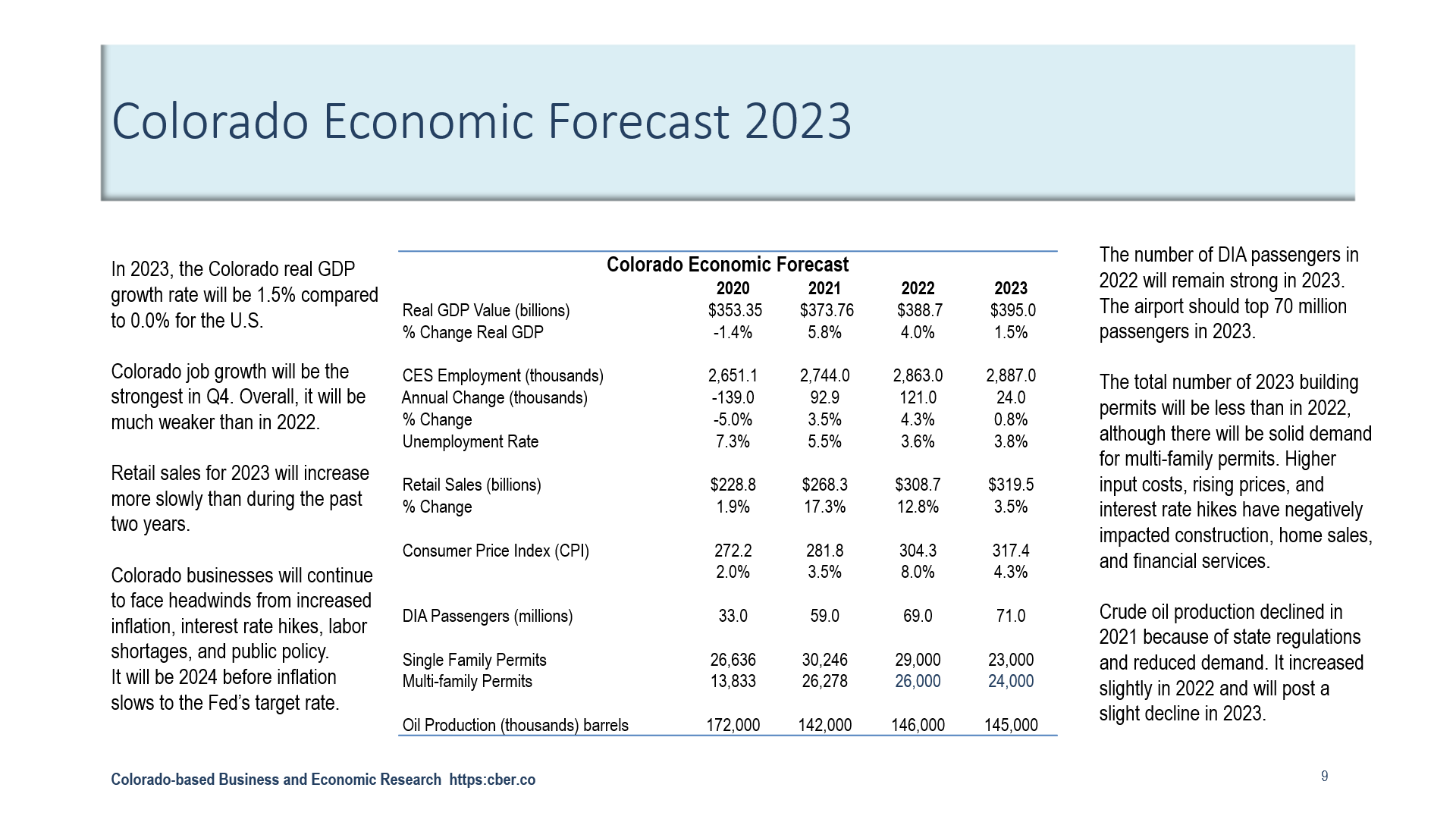

Colorado Economic Forecast 2023 (January 2023)

The Colorado real GDP growth rate for 2023 will be 1.5% compared to 0.0% for the U.S.

The state labor market will be weak, 24,000 jobs will be added.

Retail sales will decline in 2023 as a result of inflation, higher interest rates, other headwinds, and ineffective public policy.

——————————————————————————————————————–

The forecast is available at 2022 Economic Outlook and Trends for the Colorado and the United States

Please refer to the monthly Economic Updates tab for the most current revisions!

Colorado Economic Forecast 2022 (August 22, 2022 Update)

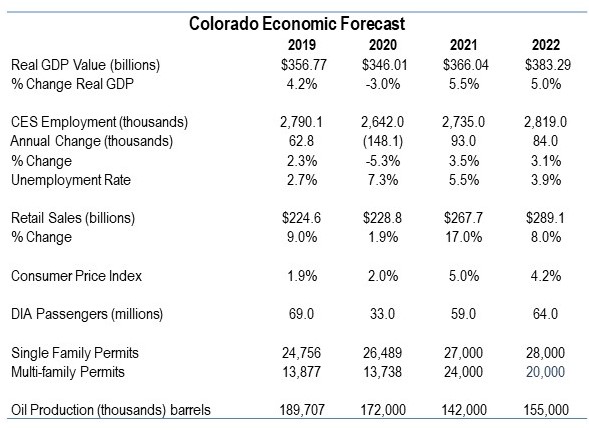

The Colorado real GDP growth rate for 2022 was revised downward to reflect slower growth in Q4.

The state labor market will remain strong through eight months, followed by a slowdown that continues into 2023.

Retail sales will remain strong in 2022. They will increase at a slower rate than in 2021. A portion of the 2022 growth reflects inflated prices.

Colorado businesses will face headwinds from increased inflation, supply chain disruptions, labor shortages, interest rate hikes, and ineffective public policy.

The number of DIA passengers has increased rapidly in 2022. The year-end total will be less than for 2019.

The demand (based on the number of building permits) will continue to exceed the supply because of in-migration and the Marshall Fire. The total number of building permits will be slightly more than in 2021. Higher input costs, rising prices, and interest rates will negatively impact construction, and home sales, and financial services.

The production of crude oil declined in 2021 because of state regulations. Oil production will increase slightly in 2022.

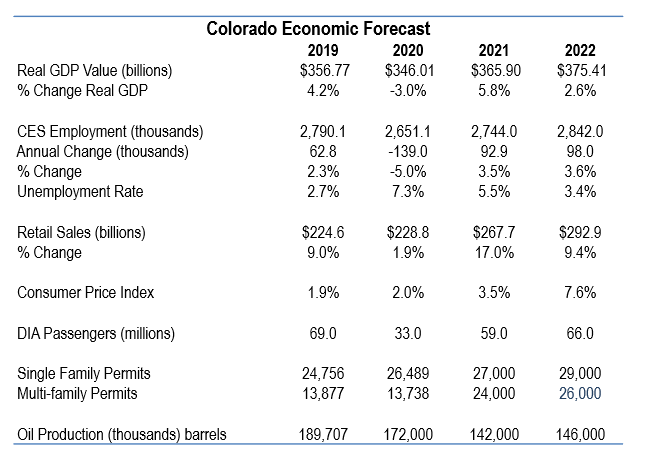

Colorado Economic Forecast 2022 (January 2022)

Colorado’s real GDP growth rate will be greater than the U.S. rate in 2021 and 2022.

Employment will return to its February 2020 level in the second half of 2022. The labor market expanded at a faster pace than expected in 2021. It will taper off in 2022.

Retail sales rebounded in 2021. Growth will be slower in 2022.

In 2021 and 2022, Colorado inflation will be greater than in recent years. The increased inflation will negatively impact economic growth in the months ahead. Typically, the Colorado CPI exceeds the national rate.

In 2021, DIA was one of the busiest airports in the country. The number of passengers was ten million less than the total for 2019. The number of passengers will increase by five million in 2022.

There was an increase in the number of building permits issued in 2021. The number of permits issued in 2021 as demand exceeds the supply and 1,100 homes were destroyed in the Marshall Fire.

The production of crude oil declined in 2011 because of state regulations. Oil production will increase slightly in 2022 as the economy returns to “normal.”