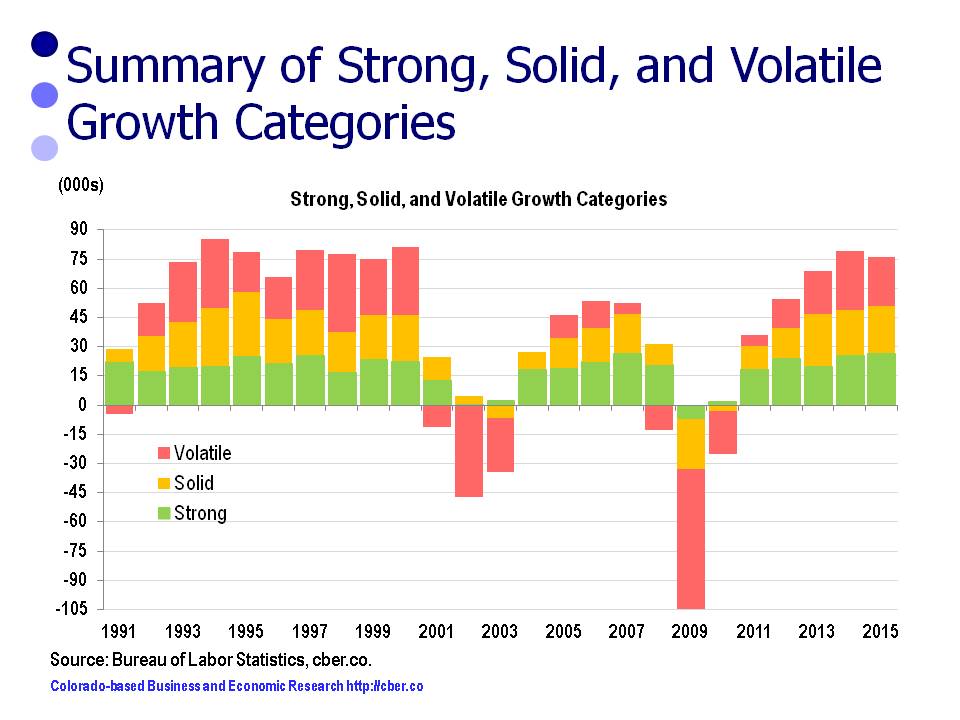

In preparing its annual forecast, cber.co divides the NAICS sectors into three categories. This portfolio approach makes it easy to see that some sectors consistently create jobs at a higher rate of growth, some show solid growth, and others are more volatile. Ultimately, the volatile category tends to have a greater influence on the magnitude of change in total job growth than the sectors with steady growth.

In March 2015 BLS released its benchmark revision of the 2014 data. The changes were more significant than usual.

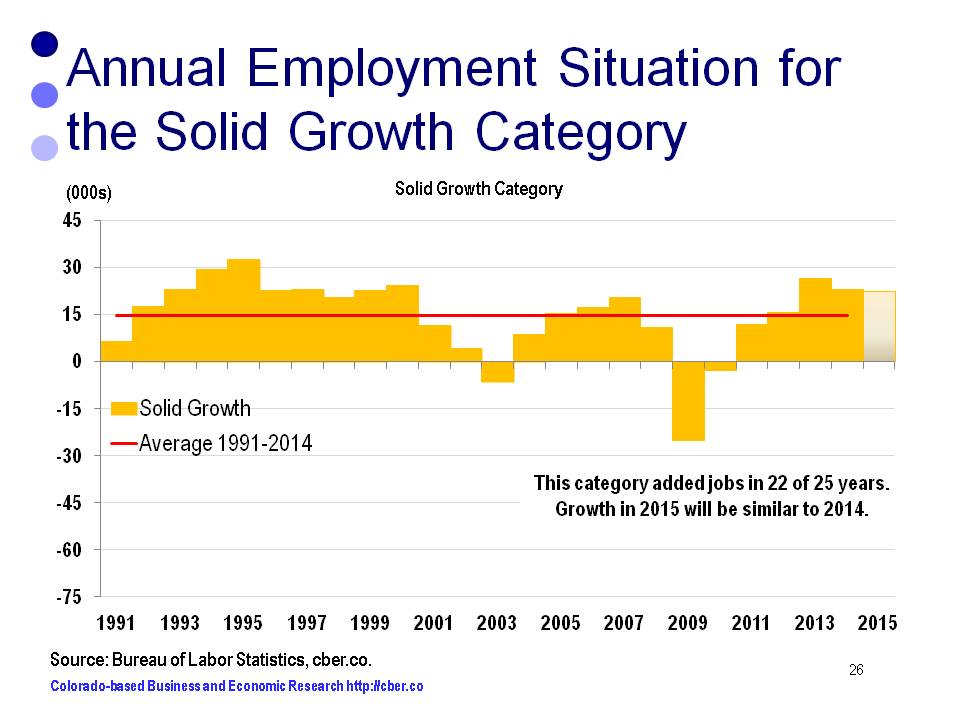

As a result cber.co fine-tuned the 2015 employment forecast to have a better understanding of categories and sectors that were driving the economy. This brief discussion highlights the revisions to the 2015 cber.co forecast. This post will evaluate the Solid Growth Category.

The Solid Growth Category

Over the past two decades the following sectors generally posted gains. The category posted stronger jobs gains during the 1990s than the 2000s.

• Wholesale Trade

• Retail Trade

• State (Not Higher Education)

• Higher Education

• Local (Not K-12 Education)

• K-12 Education

• Accommodations and Food Services

Total employment for this category was:

1994 685,400 workers, 39.0% of total employment

2004 848,000 workers, 38.9% of total employment

2014 961,100 workers, 39.0% of total employment.

Estimated Job Growth

As can be seen below there is a significant difference between the original estimates for 2014 (January 11) and Benchmark revisions for 2014 (March 27).

The original Solid Growth Category estimates/forecast (January 11 Forecast) was + 20,000 to 24,000 Employees.

• 27,600 jobs added in 2013

• 25,200 jobs added in 2014

• 964,000 employees in 2014

• In 2015, between 22,000 and 28,000 workers will be added at a rate of 2.6% to 2.8%. The rate of growth is similar to 2014.

The updated Solid Growth Category estimates/ forecasts, after benchmark revisions (March 27 Forecast) was+ 22,500 to 26,500 Employees.

• 26,700 jobs added in 2013

• 23,300 jobs added in 2014

• 961,100 employees in 2014

• In 2015, between 22,500 and 26,500 workers will be added at a rate of 2.3% to 2.8%

BLS overestimated the growth of jobs in the Solid Growth Category.

As a result changes were made to the 2015 category and total employment projections.

In 2015, the rate of growth will be 2.3% to 2.8%. This rate of growth is similar to 2014 and most years during the 1990s.

The recalibration of the 2015 forecast resulted in the following changes:

• The Strong Growth Category was revised upward by 4,500.

• The Solid Growth Category was revised downward by 1,500.

• The Volatile Category remained unchanged.

• The net change to the 2015 forecast was an upward revision of 3,000; however, the 2015 forecast is for total growth slightly below the 2014 total.

The change in the mix of jobs being added is equally as important as the change in the number of jobs being added.

For further information on the cber.co forecasts click here.