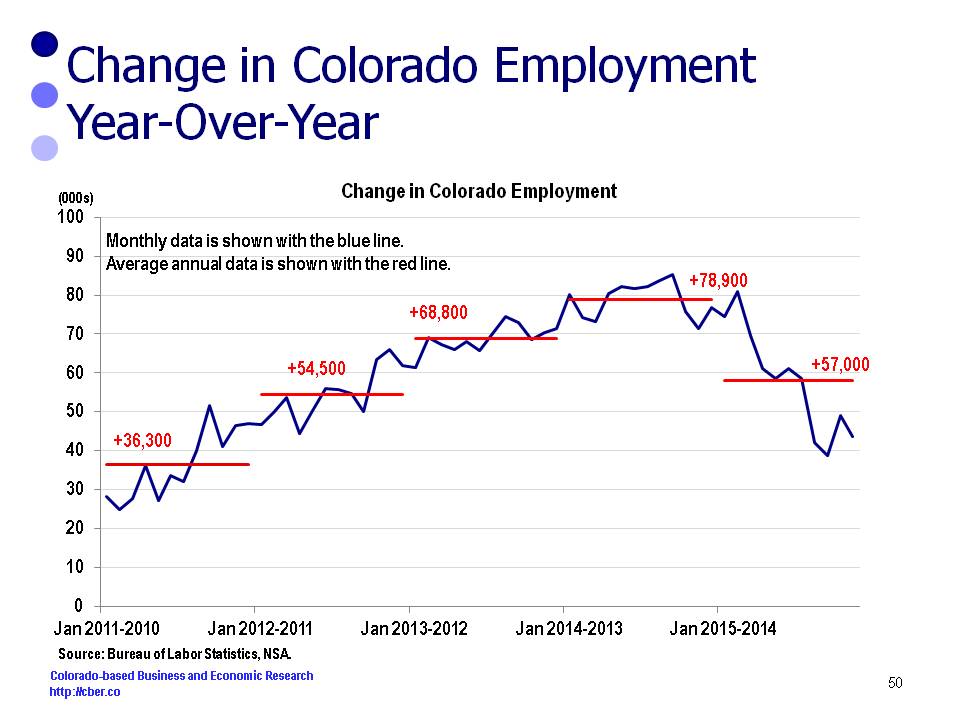

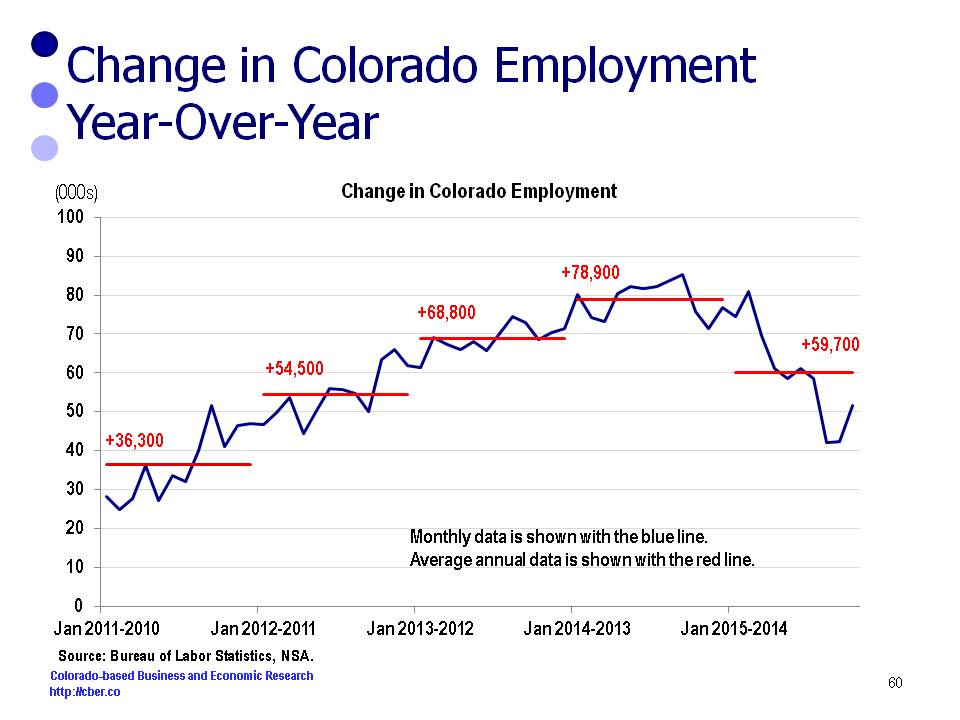

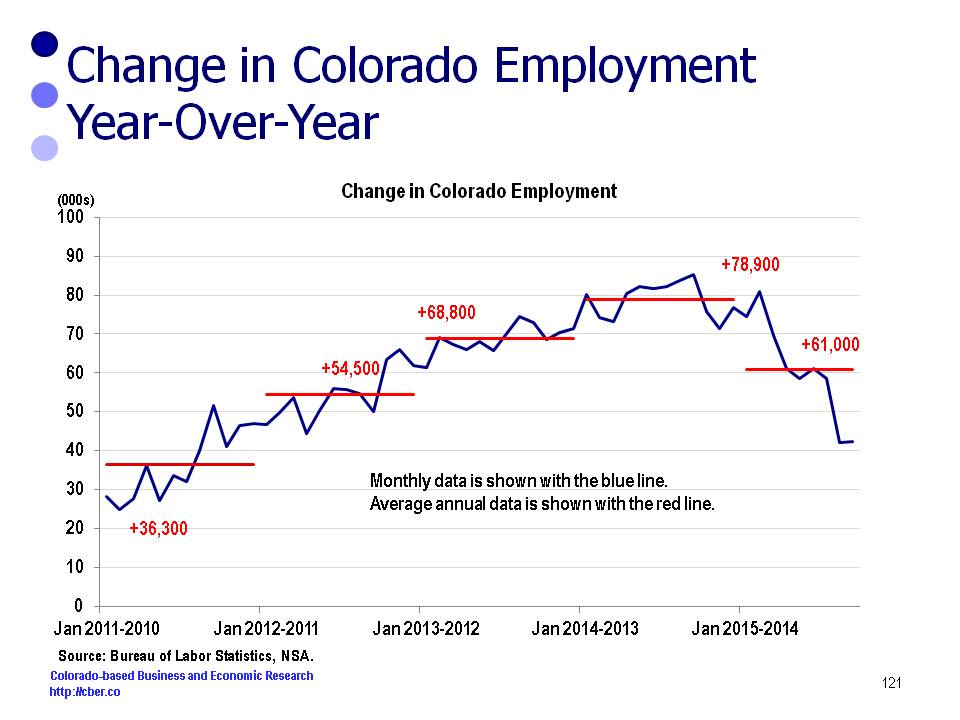

The Bureau of Labor Statistics released wage and salary employment data for November that shows the level of Colorado job growth continued to deteriorate. In October, the jobs data reported there were 49,000 more jobs than 2014 and the difference for November was 43,600 jobs.

On a quarterly basis employment gains for 2015 are as follows:

• Q1 75,000

• Q2 60,200

• Q3 46,400

• Q4 46,300 (estimated).

The current employment data shows the state is on track to add 57,000 jobs in 2015. Henry Sobanet, Director of the Governor’s Office of State Planning and Budgeting recently stated the slowdown in the rate of job growth could be attributed to two things – the lower price of oil and the slower growth in the Chinese economy. In other words, the slowdown is a “bump in the road” and not a major recession.

Through the first eleven months of the year:

• About 78.8% of the total jobs added were in the top five sectors: Health Care; Accommodations and Food Services; Construction; Professional, Scientific, and Technical Services; and Financial Activities.

• Approximately 24.8% of all jobs added were in Leisure and Hospitality (Accommodations and Food Services plus Arts, Entertainment, and Recreation).

• About 10.9% of total jobs added were in the PST, Manufacturing, and Information Sectors. These sectors are the source of primary and advanced technology jobs.

Projected revisions, which will be made in March 2016, are estimated to bring Colorado job growth closer to the lower limit of the 2015 cber.co forecast, a forecasted increase of 73,000 to 79,000 jobs.

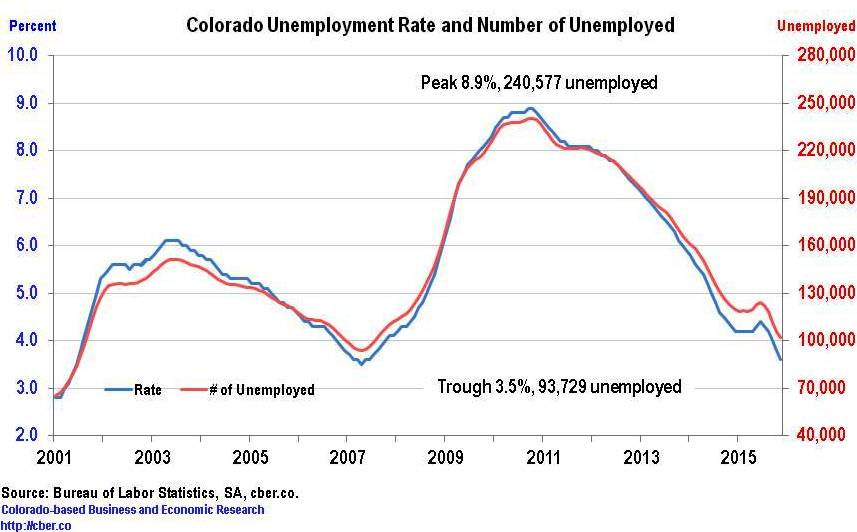

The total number of unemployed workers at the end of November 2015 was 102,035.

The total number of unemployed is 8,306 greater than the trough in May 2007 and 138,542 less than the peak in October 2010.

Lower unemployment rates have brought about shortages of trained workers in key sectors and occupations. The November 2015 unemployment rate of 3.6% is down from 4.3% in November 2014. In addition there are 19,567 fewer unemployed workers compared to a year ago.

The lower unemployment rates across the state are a mixed blessing. On the positive side, workers who are on the sideline will have more and better opportunities to find a job if their skills match the current openings. It is also likely that upward wage pressures my make it possible for them to be paid higher wages. On the downside there will be greater turnover at companies as people jump to “better” jobs, which may reduce productivity and drive up operational costs.

Looking ahead, 2016 stands to be a solid year if the unemployment rate will stabilize and job increases will be stronger than they were in the second half of 2015.