The recent release of BLS wage and salary employment data for Colorado showed that after four months the state is on track to add 71,400 workers. This is slightly below the cber.co forecast range of 73,000 to 79,000.

The softness in job growth may be attributed to the decrease in the price of oil, which bottomed out at $43 per barrel on March 17. A prominent Boulder economist has stated that average annual state employment for the year would fall to 40,000 because of the decline in oil prices. So far, the impact has been minimal.

In April there were 34,400 jobs (NSA) in the Mining and Logging Sector, which includes the mining and oil and gas industries. This is down about 1,300 jobs from December but about 1,800 jobs above the April 2014 total. The sector had record employment this past December.

Some of the factors that have affected demand are:

• Over time global demand for oil has declined, in part because of increased energy efficiency and an increase in the number of alternate sources. That decrease is expected to continue in the future.

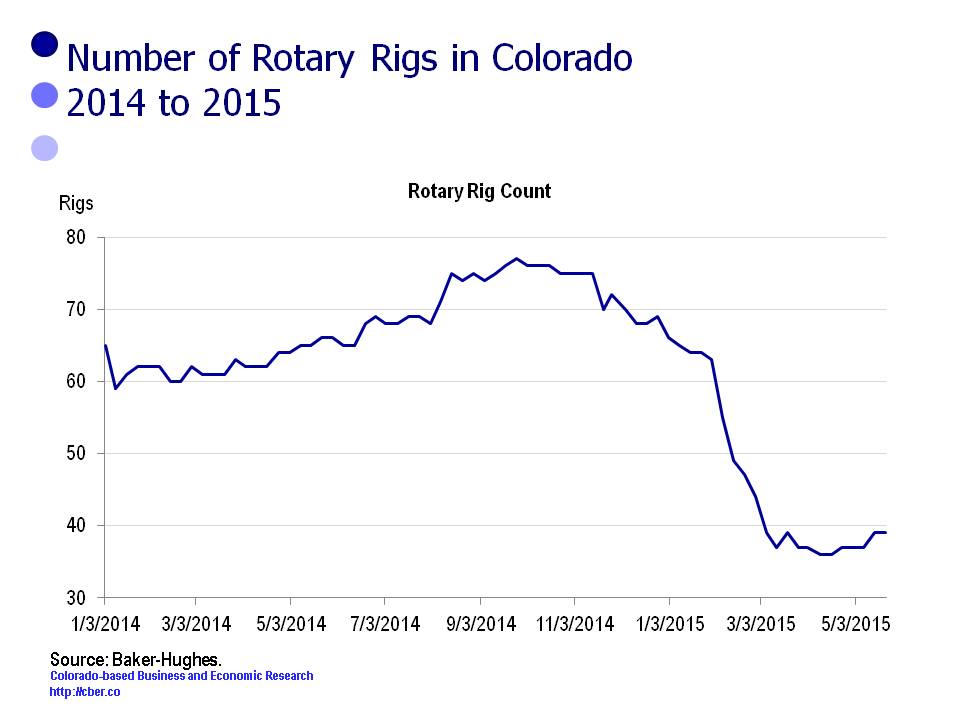

• The number of Colorado rigs in operation has dropped sharply in the past six months.

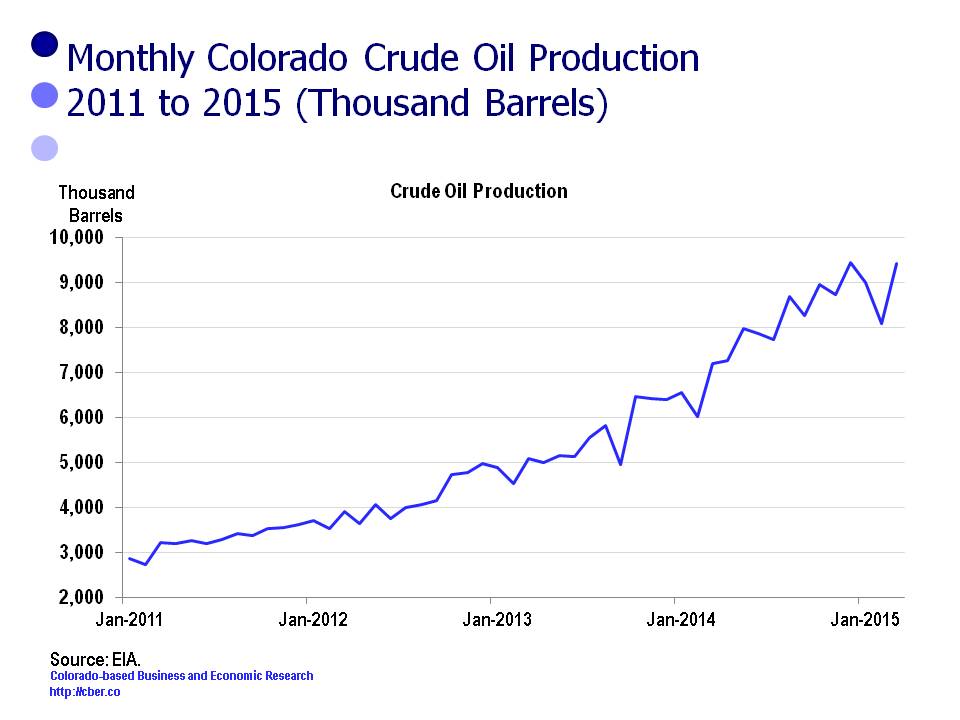

• Oil production in Colorado reached a record high in 2014. Despite the decline in oil prices, monthly production has remained near record levels; however, at some point reduced production is expected if prices remain suppressed for an extended period.

• Nationally, Colorado is a second-tier state for production; however, the oil and gas industry is a significant contributor to the state’s Gross Domestic Product. Today, the U.S. is producing about 80% of the oil used domestically, a significant change from five years ago. This means that Colorado producers will continue to drill, although production may be at lower levels.

• The price per barrel and the breakeven point are less critical than they were five years ago. Producers have become more efficient by reducing overhead and adopting improved technology such as super-fracking. In addition they have capped wells that are older or less efficient. Through increased efficiencies, companies have been able to lower the break-even point for many of their plays and adjust to lower prices per barrel.

• Since March 17th, the price per barrel has risen and reached $60 per barrel in early May. The consensus is that it will remain around that level for the remainder of the year.

These factors will have the following implications on the state:

• Colorado has a diverse energy industry. It is a strong second tier oil and gas state, it has companies that manufacturer solar and wind energy equipment, and significant energy research is conducted locally. Because energy is critical to the security of the U.S., the state will benefit from having a balanced energy portfolio.

• The reduction in the number of rigs will result in a fewer workers in the industry and its supply chain.

• Because production has remained at a high level, the industry’s contribution to the state GDP may not be as adversely impacted as originally thought.

• Oil and gas companies are evolving in a manner similar to manufacturing and other industries – they are becoming much more efficient. Increased efficiencies are expected to continue and many of the jobs that are being eliminated will not return.

Increased efficiencies will allow American companies to continue to be competitive, which in turn will help the U.S. be an “energy independent” nation. In a convoluted way, the Colorado oil and gas industry may actually benefit in the long run from the recent drop in the price of oil.