On March 20th, the Bureau of Labor Statistics will release its benchmark revisions for 2014 Colorado employment. Most likely the number of jobs added will be at least 73,000. The revisions will provide insight about how the following issues will be addressed as the state moves forward in 2015.

Unemployment – The state’s unemployment rate is well below that of the U.S. Will Colorado companies begin to encounter job shortages in key occupations? Will companies face pressure to raise wages because of these shortages? Will companies be able to hire workers even if they raise wages?

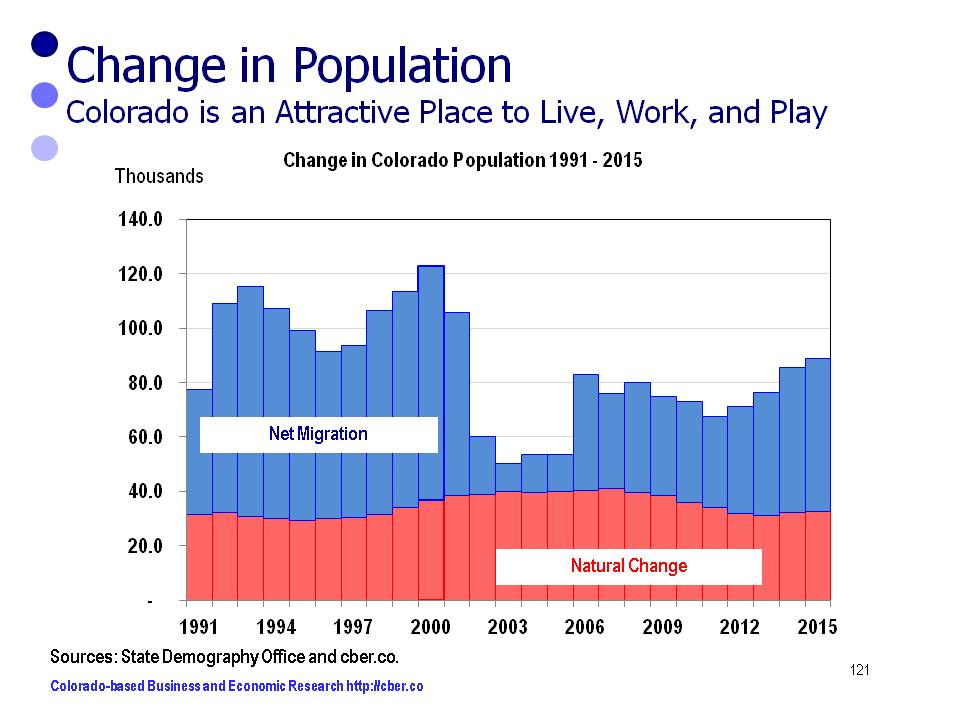

Housing – How much will demand for new homes drive growth of the construction industry? How will the rapid increase in prices shape the demand for the type of housing that will be built (single-family or multi-family)? Will the price of existing housing make it too expensive for outsiders to move to Colorado, i.e., will it stymie growth?

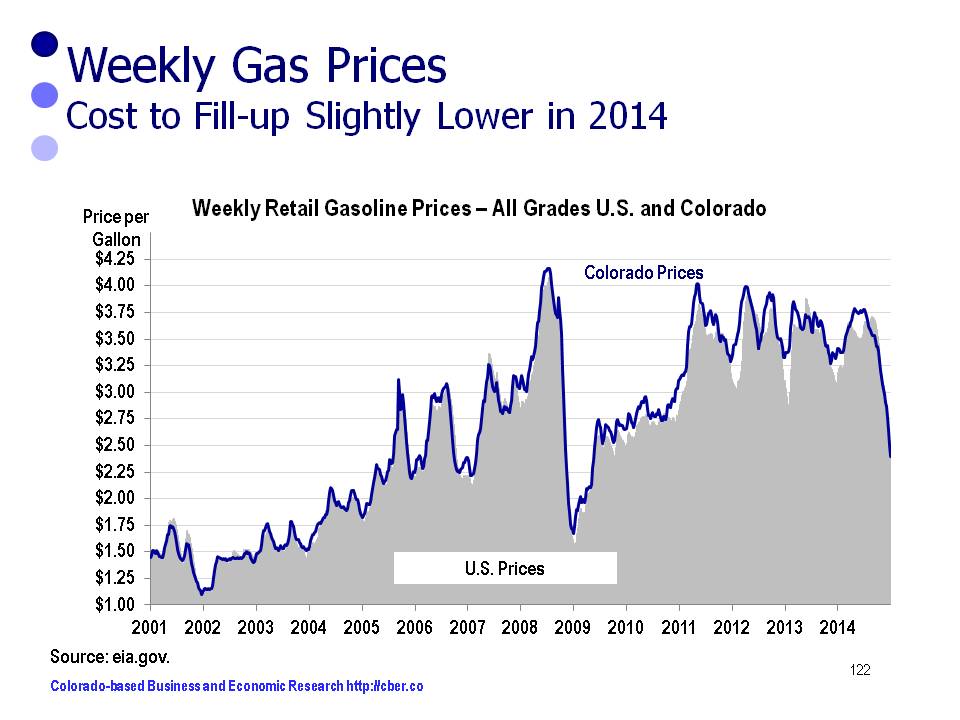

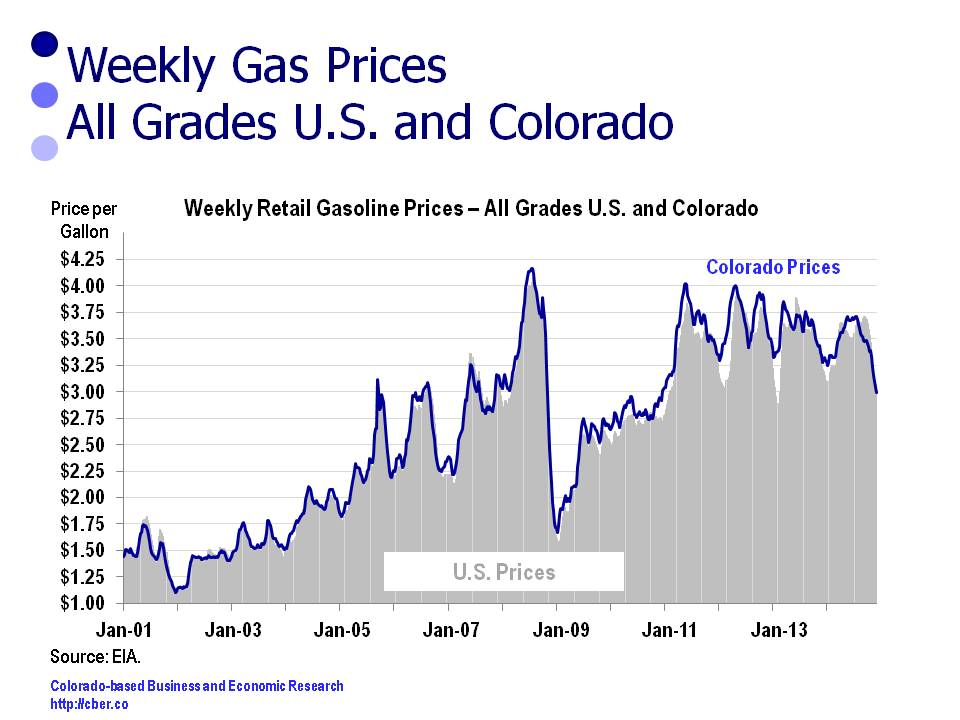

Price of oil – 2014 was a record year for oil production in Colorado. There will likely be a significant decline in 2015. How much will it affect the overall economy? How will this impact the unemployment rate and job growth in Weld, Garfield, La Plata and smaller counties that produce oil and gas? Will the layoffs allow the oil and gas companies to get rid of “dead wood” and become less “top heavy”? Is there new technology that will allow the oil and gas companies to operate more efficiently and in a more environmentally friendly manner? Will hiring at Vestas help offset the decline in the extractive industries and provide a workplace for some of the displaced oil and workers?

– The U.S. has enjoyed strong job growth over the past couple of years. How will Colorado companies be able to participate in that growth? To what extent will the rural counties support Colorado job growth in 2015?

Stay tuned for the release of the data and another exciting year ahead for the Colorado economy.