The U.S. economy remains on solid footing in anticipation of the upcoming release of BLS Colorado wage and salary employment data.

U.S. Employment and GDP

Earlier this month BLS reported the U.S. added 126,000 jobs in March compared to February. This was the weakest level of month-over-previous-month job growth for the seasonally adjusted data since 2013. Despite the slower rate of growth for March 2015, U.S. employment for March is about 2.29 million jobs greater than March 2014..

Currently, Colorado wage and salary employment is about 1.8% of the U.S. total. About 2.8% of U.S. job growth can be attributed to Colorado.

Most economists think U.S. Real GDP growth will be in the neighborhood of 2.5% to 3.0% this year. This past week The Conference Board bumped its 2015 projection for the U.S. output growth up to 2.9% based on projections for stronger personal consumption. This is notable given their conservative estimates over the past ten years. Meanwhile, other economists have bumped their forecasts down to the range of 2.5% to 3.0%

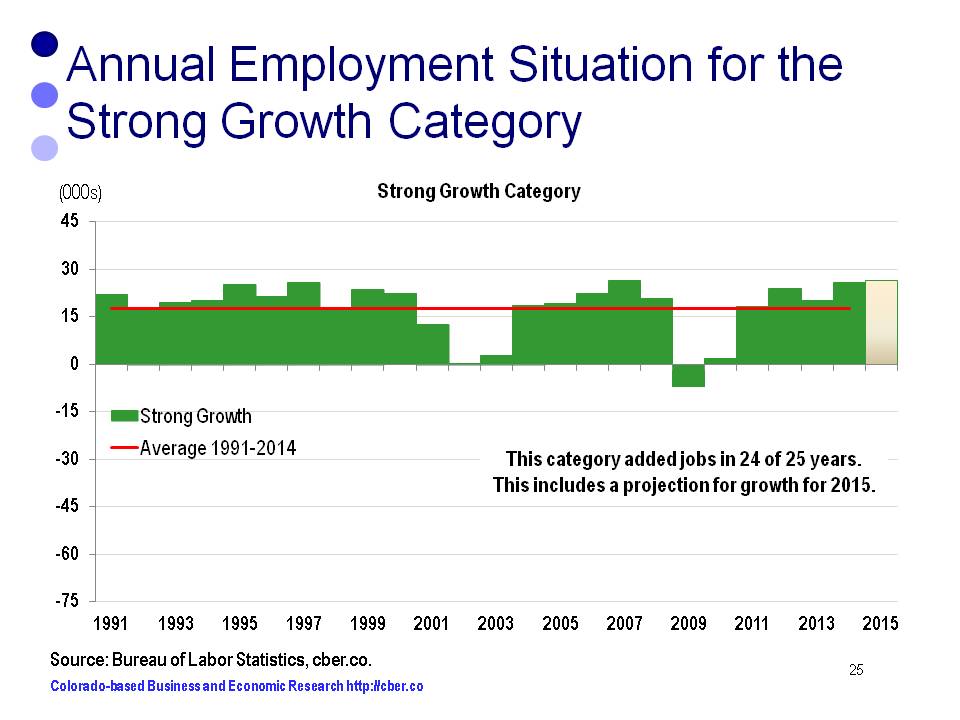

Stronger output growth should translate into a greater number of wage and salary workers. In other words, the slower rate of U.S. job growth in March appears to be a glitch rather than the start of a downward trend. The strong rate of U.S. job and output growth will ensure that in the short term Colorado with continue to add jobs at a rate similar to the past twelve months.

U.S. and Colorado Unemployment Rates

In March the U.S. unemployment rate remained steady at 5.5%, but down from 6.6% a year ago.

The U.S. Congressional Budget Office has indicated the natural rate of unemployment is currently 5.2%. The natural rate is the point of equilibrium or the rate at which an economy will operate most efficiently.

When the unemployment rate drops below the natural rate there will be upward wage pressures and companies will be challenged to find qualified workers. The economy will operate inefficiently for different reasons than when the rate of unemployment is above the natural rate.

In Colorado, the February unemployment rate of 4.2% was well below the U.S. rate. Some Colorado industries are currently experiencing symptoms of an economy that is operating below the natural rate of unemployment. They are experiencing difficulty finding qualified workers in select occupations. In addition, there are upward wage pressures in industries such as construction and agriculture. Anecdotal evidence suggests some companies are not able to find workers even when they pay higher wages.

The state’s rate of unemployment is expected to remain below 4.5% in the near-term, although there are concerns the layoffs caused by lower oil prices will cause an increase in the unemployment rate. At the state level the direct impact of oil and gas layoffs may not have a major impact on total state employment and unemployment data, but it will definitely affect regions where the oil and gas industry has played a significant role in the economy, such as Weld and Garfield counties.

Expect continued solid growth in Colorado wage and salary employment in the short-term.