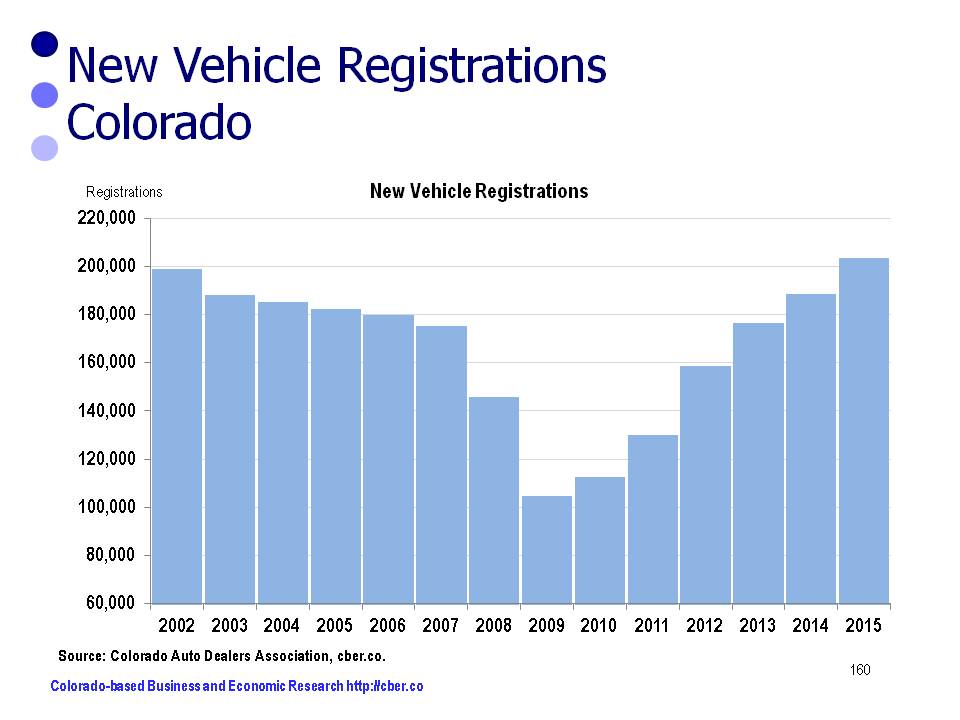

Colorado auto dealers had a banner year in 2015 reaching a record 203,471 new car registrations. This topped the previous high of 198,910 in 2002. Auto sales were driven by low gasoline prices, easy access to credit and low interest rates. In addition, Colorado experienced strong net migration and solid employment growth in 2015.

After peaking in 2002, the number of new registrations gradually tapered off until 2007. At that point they plummeted to 104,687 in 2009.

The number of new car registrations has almost doubled between 2009 and 2015.

About 35% of the 2015 new registrations were light trucks and 65% were autos. Light truck new registrations increased by 15.3% compared to only 3.5% for cars.

| Category | 2014 | 2015 | % Change |

|---|---|---|---|

| Total | 188,416 | 203,471 | 8.0% |

| Cars | 73,112 | 70,561 | 3.5% |

| Light Trucks | 115,304 "132 | 910" | 15.3% |

Almost 45% of the 2015 new registrations were for Japanese brands and 39% were for the top three Detriot brands. Slightly more than 10% were European brands and the remaining 6% were Korean brands.

The new registrations for Detroit and European brands increased by almost 10%, while the Japanese brands increased by slightly more than 7.4%. There was a decline in the number of new registrations for the Korean Brands.

| Category | 2014 | 2015 | % Change |

|---|---|---|---|

| Detroit Three Brands | 71,962 | 79,113 | 9.9% |

| European Brands | 19,450 | 21,293 | 9.5% |

| Japanese Brands | 84,896 | 91,154 | 7.4% |

| Korean Brands | 12,108 | 11,911 | -1.6% |

The vehicle segments with the largest gains in market share, 2015 vs. 2014, were compact and compact luxury SUVs. The largest losers were standard mid-size cars and sub-compact cars.

Winners – 2015 vs. 2014

| Category | Change in Market Share (points) |

|---|---|

| Compact SUV | 1.4 |

| Compact luxury SUV | 0.9 |

| Compact pickup | 0.8 |

| Full size pickup | 0.7 |

| Full size crossover SUV | 0.4 |

| Full size van | 0.2 |

| Full size luxury SUV | 0.1 |

| Mid-size crossover SUV | 0.1 |

| Minivan | 0.1 |

Losers – 2015 vs. 2014

| Category | Change in Market Share (points) |

|---|---|

| Sub-compact car | -1.5% |

| Standard mid-sized care | -1.5% |

| Entry car | -0.7% |

| Large mid-size car | -0.3% |

| Luxury car | -0.3% |

| Mid-sized luxury SUV | -0.2% |

| Sport-compact car | -0.1% |

The categories where there was no change in leadership were:

• Near luxury car

• Full-size SUV

• Mid-size SUV

• Sports car

If the economy stays healthy, car sales will likely show record growth in new car registrations again in 2016.

The source for the data in this post is the Colorado Auto Dealers Association.