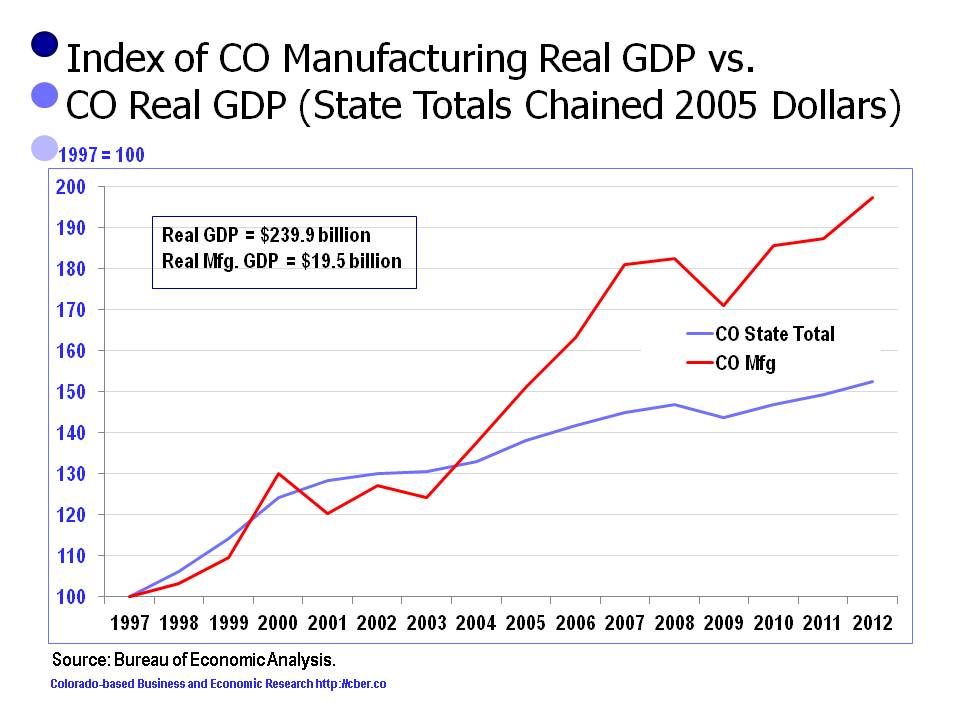

The Manufacturing Sector is critical to the Colorado economy because it is a source of primary jobs that pay higher than average wages. In addition, manufacturers bring in revenue from outside the state that is spent in Colorado and they export goods to domestic and international destinations.

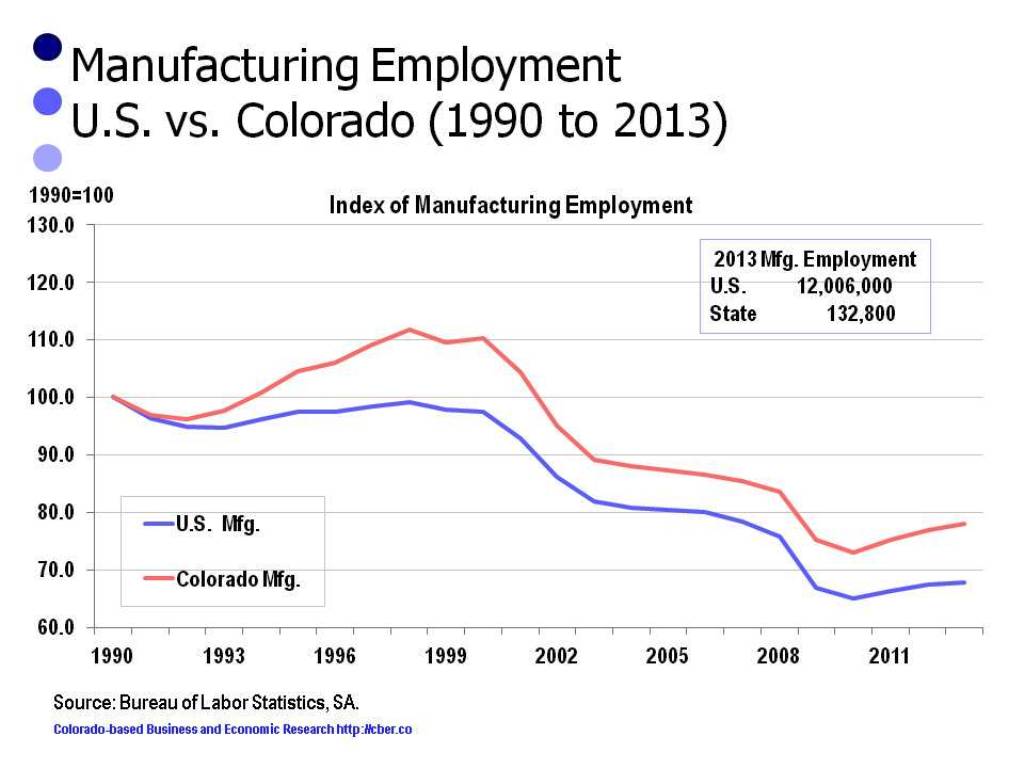

In 1990, manufacturers accounted for 11.3% of total state employment. In 2014, only 5.6% of Colorado’s employees were in the manufacturing sector. Around 2000 the number of manufacturing workers in Colorado and across the U.S. declined as companies outsourced and off shored. As well, the back-to-back recessions in the 2000s forced manufacturers to become more efficient. They accomplished this by investing in capital expenditures rather than labor.

Compared to most other parts of the country, Colorado has never been a strong manufacturing state. It is the proud home to world-class manufacturers such as Ball Aerospace, Miller Coors, and Leprino Foods. Most manufacturers are small businesses that produce everything from tacos to optical mirrors.

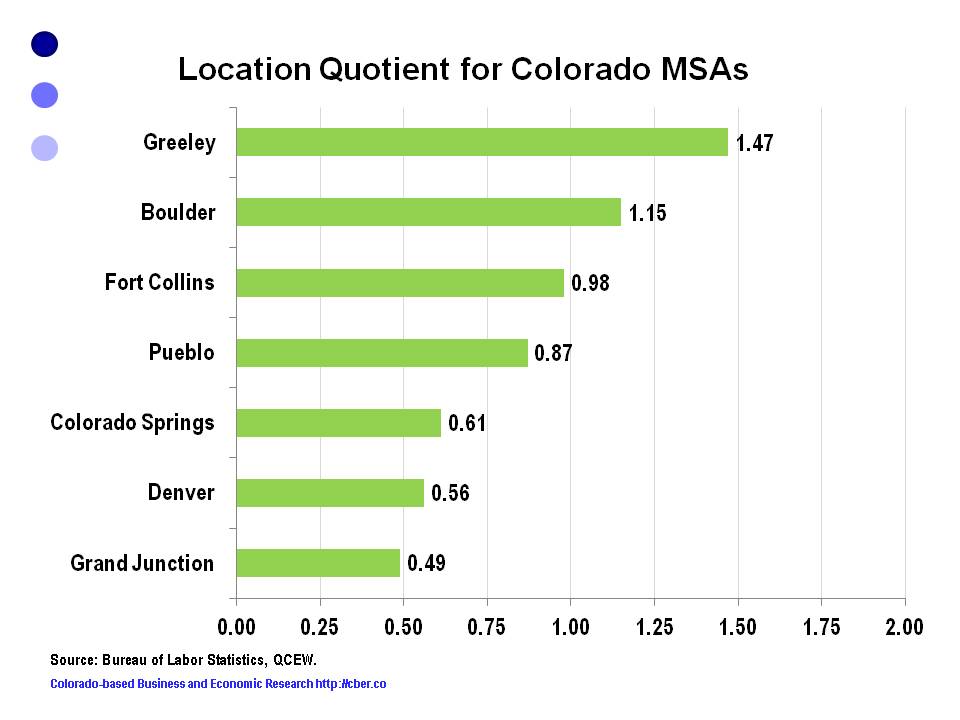

The state’s manufacturing sector is concentrated in pockets along the Front Range:

• Boulder County is at the forefront for its high tech manufacturers.

• Weld and Pueblo Counties are strong in renewable energy. Vestas has been a significant source of manufacturing job growth over the past decade. In addition, Weld County is home to various ag-based manufacturers.

• A majority of the state’s manufacturers are located in Denver.

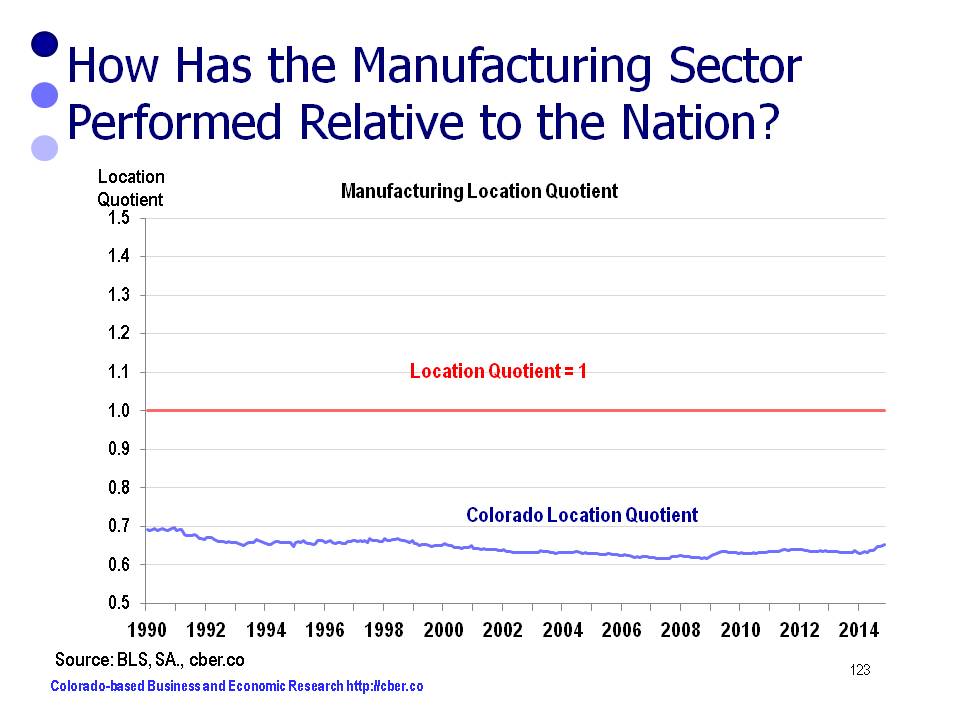

The location quotient for all wage and salary manufacturing workers, or the concentration relative to other industries, is well below 1.0. It trended downward from 1990 to 2001, but has been relatively flat since then.

Here’s to growth for the Colorado manufacturing sector in years to come.