There has been concern by some that the freefall in the price of a barrel of oil last year would cause a sharp downturn in the Colorado economy.

In fact, the University of Colorado Leeds School of Business has projected that the loss of oil and gas jobs will cause total employment to grow at a rate less than 2.0% this year. That means that average employment for the year would be less than 50,000. It would also mean that average job growth for the last three quarters of the year would be at most 41,000 jobs.

The 2015 cber.co forecast projected a slight decline in the rate of growth (+73,000 to 79,000 jobs), in part because of uncertainty in the oil and gas industry. It seems unlikely the decline will be as severe as projected by the Leeds School.

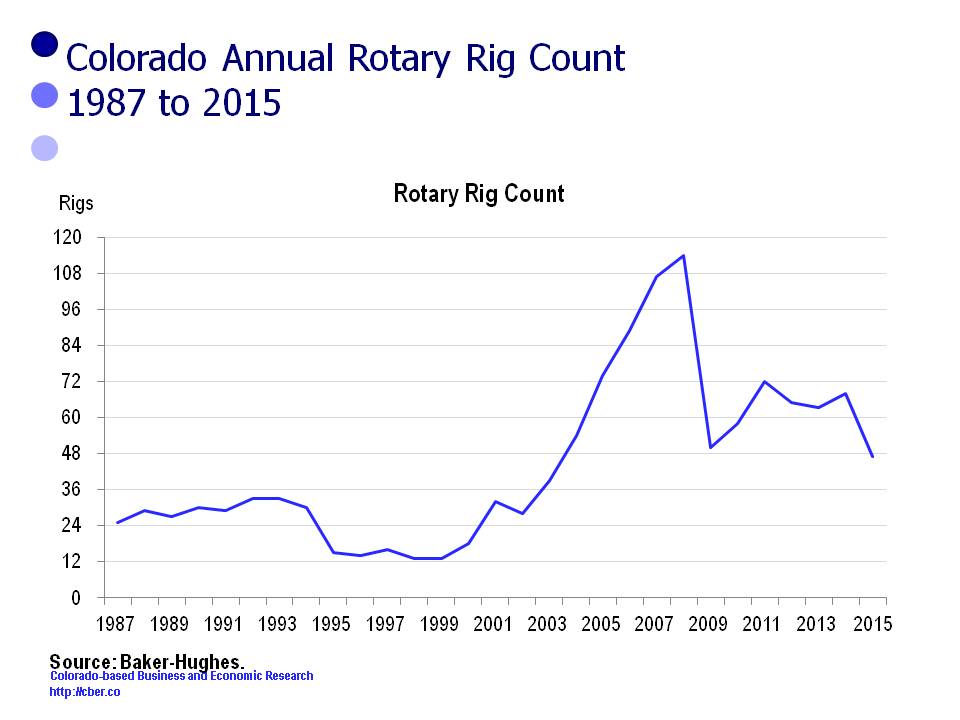

A frequently quoted data set is rig count. The data shows a sharp drop-off in the number of rigs. The immediate reaction is that “the sky is falling.”

Industry experts state this decline in the number of rigs has occurred, in part, because companies have taken their older and poorer performing rigs off-line to increase their efficiency. This is no different than the Denver Broncos cutting Champ Bailey. A decrease in the number of rigs will eventually point to a decline in the number of employees.

In addition, some companies are adopting improved technology, which has the potential to make the drilling process much more efficient and environmentally friendly. Increased efficiency means that when some of these jobs go away they won’t ever come back. In that sense, the oil and gas industry is moving down the same path as manufacturing and other industries.

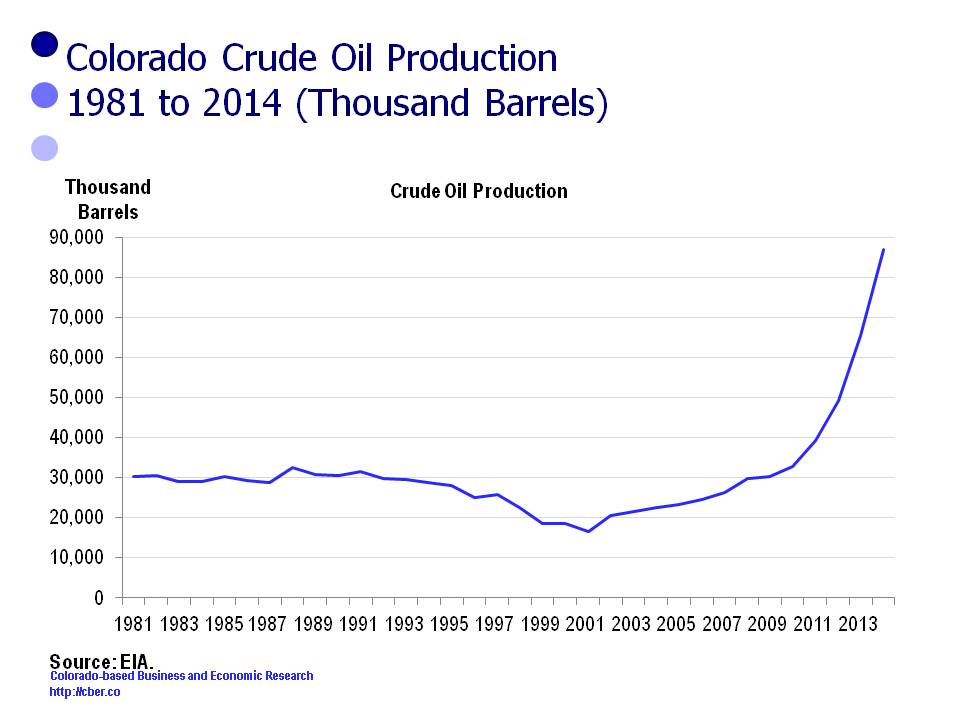

Another interesting data set is oil production.

Colorado oil production reached records levels in 2014 and is expected to remain strong through Q1 2015. Levels of production may drop off in Q2 as storage becomes an issue.

Another issue affecting production levels is demand. Global demand for oil has been declining as alternate sources of energy have become more available. In addition, more efficient automobiles and other devices have reduced consumption. Despite the decline in demand, the U.S. has become less dependent on foreign countries for our oil supplies. In turn that will drive demand for U.S. oil.

Looking ahead – employment in the Colorado oil and gas industry will either grow at a slower rate or decline slightly in 2015. The state economy is on solid enough footing that many of those lost jobs will be offset by increases in other industries such as construction, finance, and manufacturing.

In short, the Colorado Oil and Gas Industry is in a state of flux, but it is unlikely that volatility will cause a noticeable downturn in state employment.