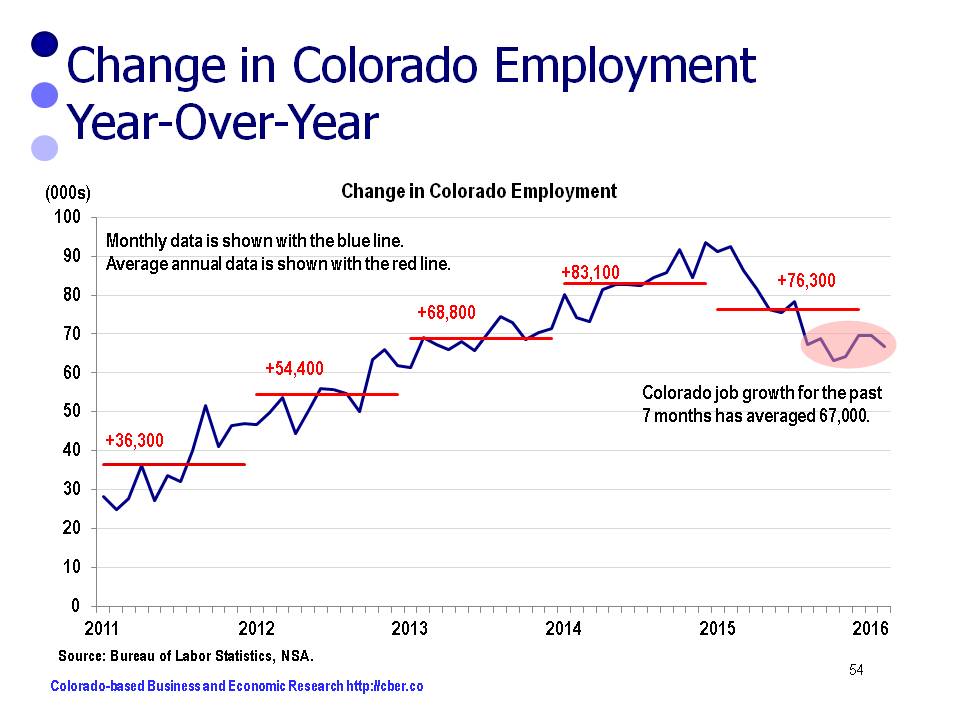

In early March the Bureau of Labor Statistics released revised employment data for Colorado showing that 2014 was the 3rd strongest year of job growth in the state’s history and 2015 was ranked 9th.

Data released near the end of March shows that average year-over-year Colorado job growth for the past seven months has been about 67,000 jobs greater than the previous 12-month period. The reduced rate of expansion has occurred for the following reasons:

• The slowdown in the Chinese economy has caused many countries to experience lower rates of GDP growth.

• Colorado’s extractive industries are continuing to contract.

• Just as the Broncos can’t win the Super Bowl every year, it is not possible to have “Super-Bowl-like” job growth all the time.

Although the rate of growth for employment and the GDP are less than last year, the economy will still experience solid growth for the following reasons:

• There is solid GDP growth across most Colorado sectors.

• Job growth is stable in most industries and occupations.

• Solid and diverse growth will continue in the state’s personal income, population, and per capita personal income.

• There is a strong outlook for the construction industry in Colorado and the U.S.

• Robust new car sales are a reflection of solid personal consumption.

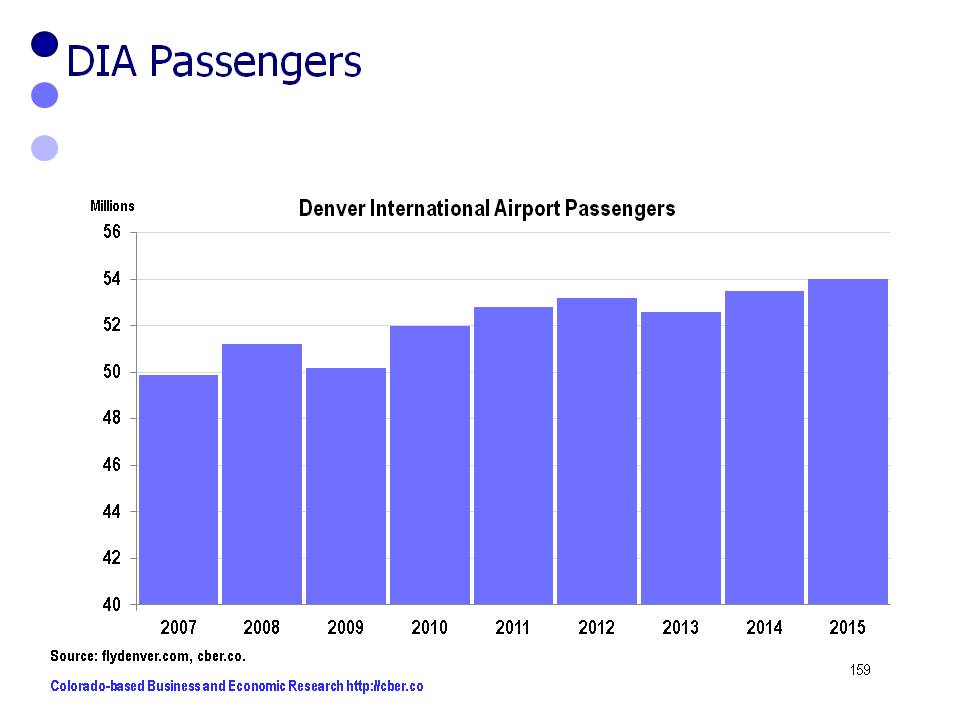

• There is increased activity at DIA and the area surrounding the airport.

• While low unemployment can be problematic it will drive higher wages.

• Higher wages will cause increased consumption and offset higher living costs.

Despite the headwinds, Colorado is on track for continued solid growth in 2016. For more details check out the most recent updates by clicking here or check out cber.co Colorado Economic 2016 Forecast.