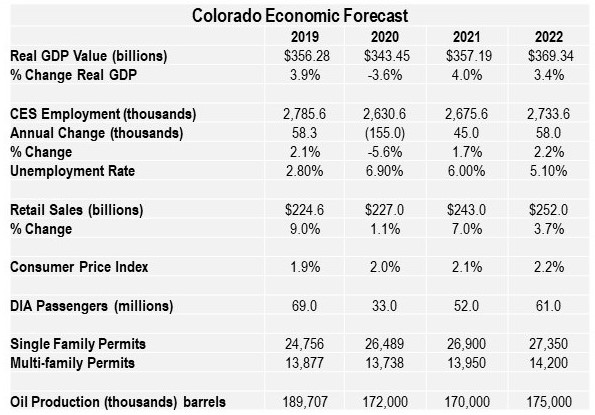

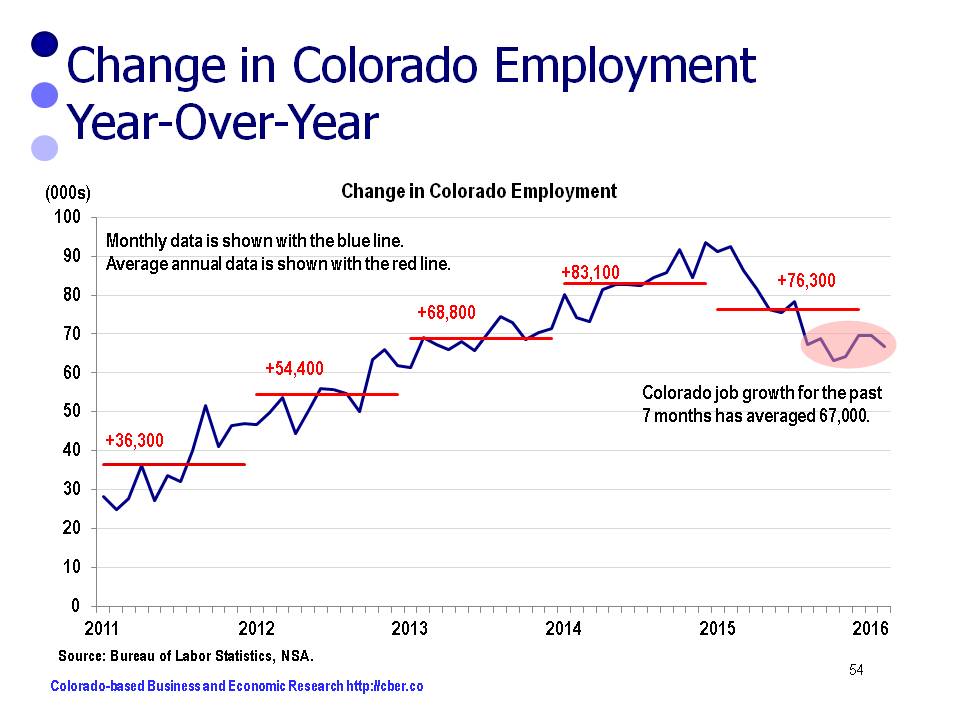

There has been a streak of bad economic news within the past ten days; however, the fundamentals of the U.S. and Colorado economies are solid and the sky is not falling!

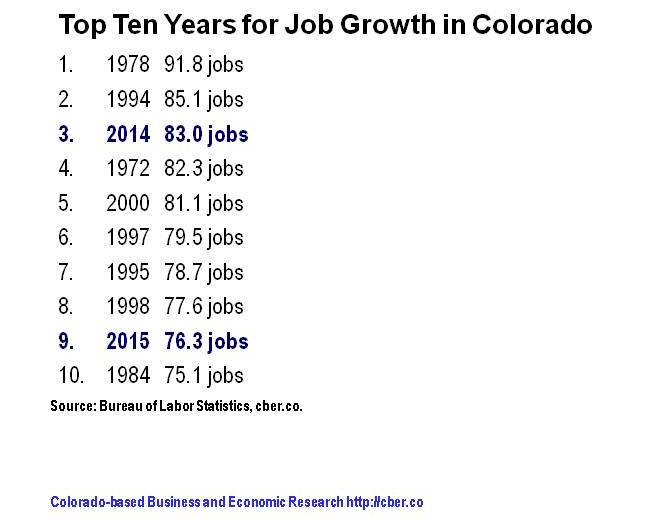

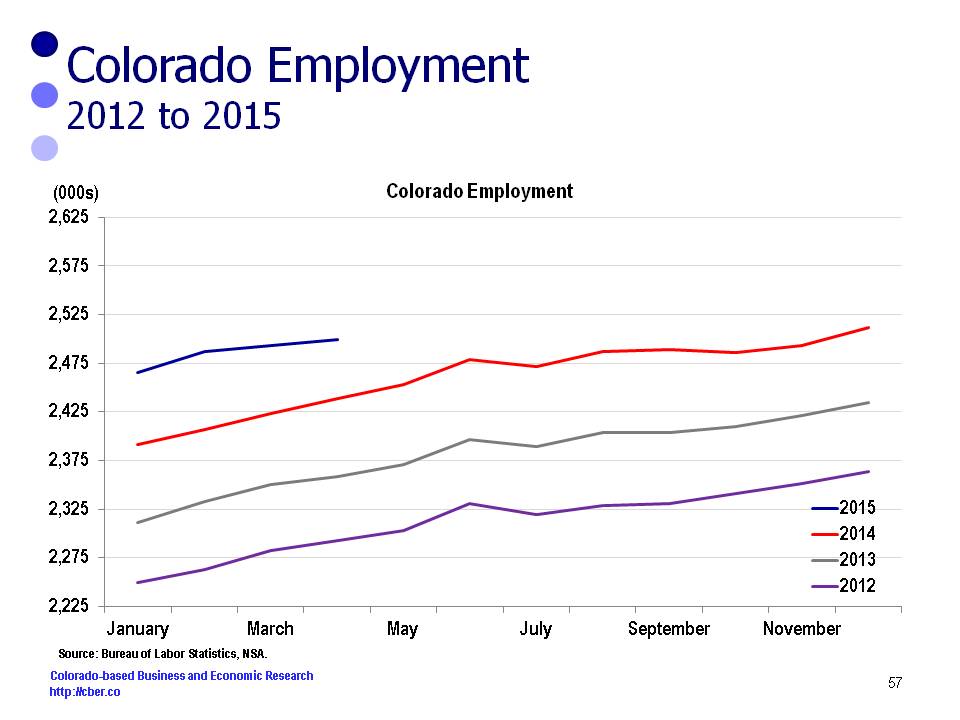

The Colorado Department of Labor and Employment announced the release of data showing that on average there are 65,900 more jobs for the first seven months of 2015 than the same period in 2014. The rate of increase is about 2.7%. While this level of job growth is solid, activity on the streets is much stronger.

Internationally, concerns have temporarily shifted away from violence in the Middle East. Worries have shifted to a slowdown in the economic growth of China, the magnitude of that slowdown, and the impact it would have on the global economy.

Earlier declines in the price of oil have not had the negative impact on the state that was initially expected by some economists. Colorado is a second tier state in terms of production and companies have taken numerous steps to increase their efficiency and maintain their profitability. Layoffs in the industry may be inevitable if the price for a barrel of oil remains at its current level, in the low $40s, for an extended period.

Through seven months average employment in the extractive industries is about 700 greater than last year. That number will approach zero by the end of the year.

The recent volatility in the equity markets may be the sign of a long-overdue correction or the start of a bear market. Uncertainty in the equities market may cause consumers to remain cautious.

On a more positive note, Colorado new car registrations have been strong this year. On a YTD basis, more new cars have been registered in 2015; however, the rate of growth has slowed to about 5.0% this year, down from 11.2% growth in 2013, and 6.5% growth last year.

Net migration remains strong as people find Colorado an attractive place to live, work, and play. In part that is a driving factor for the construction industry.

On a year-to-date basis the top sectors for job growth are:

• Healthcare 14,000

• Accommodations and Food Services 13,200

• Construction 12,100

Combined these three sectors account for about 59.6% of the jobs added or 39,300 workers. Average wages for many of the occupations in these industries are well-below the state average.

There are concerns that an insufficient number of primary jobs are being added in Colorado. Primary jobs are important because they bring in money from the outside that is invested in the state economy. In addition, primary employers often have a local supply chain that supports the local economy.

To that point, the average number of manufacturing jobs is 3,900 greater than a year ago. Many of these workers have been added in the renewable energy sector and its supply chain and they are located in Weld County. The addition of new jobs in this area will offset job losses associated with the decline in the price of oil.

So far this year, the major disappointment is the Information Sector. Declines are expected to continue through the end of the year.

On a year-to-date basis, the Government sector has added about 4,900 jobs. On a percentage basis, the greatest number of jobs has been added in K-12 and higher education. After seeing cutbacks for two years, the Federal Government is on track to add about 400 positions this year.

In addition to this data, CDLE will release a report later this month showing that Colorado job growth for the first quarter may be revised upward by 15,000 to 20,000. The bottom line is that Colorado’s employment is much stronger than currently being reported. Unequivocally, the sky Is not falling.