The U.S. economy got off to a horrendous start with weak employment in January and -2.6% real GDP growth in Q1. There has since been enough improvement in Q2 for the Federal Reserve to announce it will end QE3 in October. As well, interest rate hikes are likely to occur in 2015, which is good news for some and bad news for others.

It appears the Fed has satisfactorily unwound the quantitative easing program, something many economists feared might not happen at the time it was put in place. Today, most members of the Fed are bullish on the economy, at least for the remainder of 2014. Several members have expressed short-term concerns because retail sales, healthcare spending, and residential construction are underperforming.

A strong U.S. economy bodes well for Colorado.

The equity markets have been volatile in 2014, but the Dow has passed 17,000 and continues to establish new record – highs. Improved equity markets have increased the personal wealth of Coloradans and given them reason to remain optimistic about the growth of the economy.

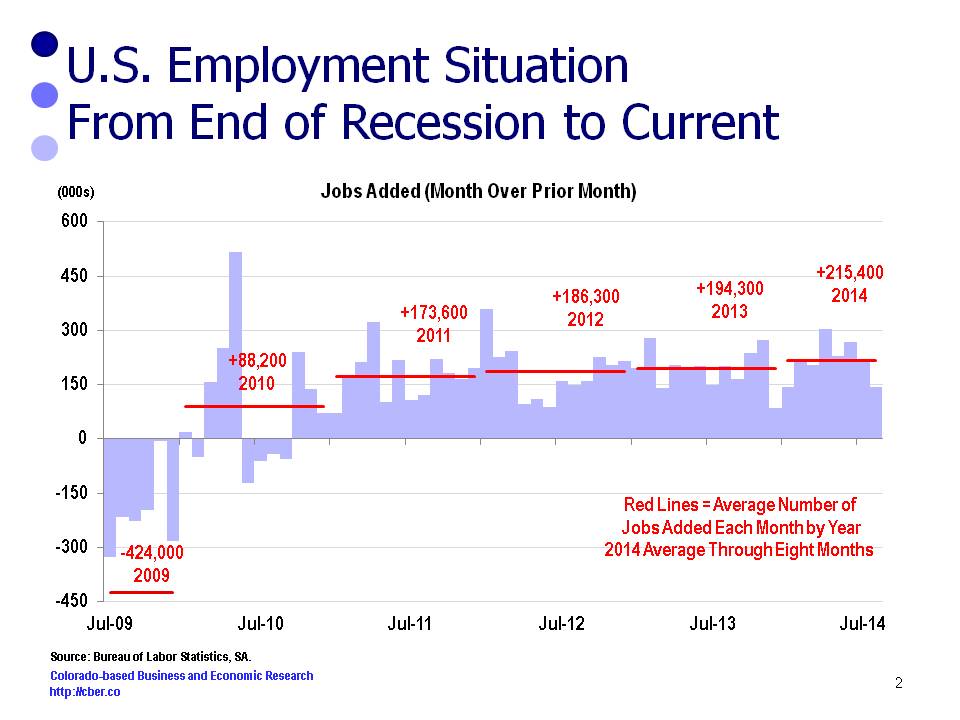

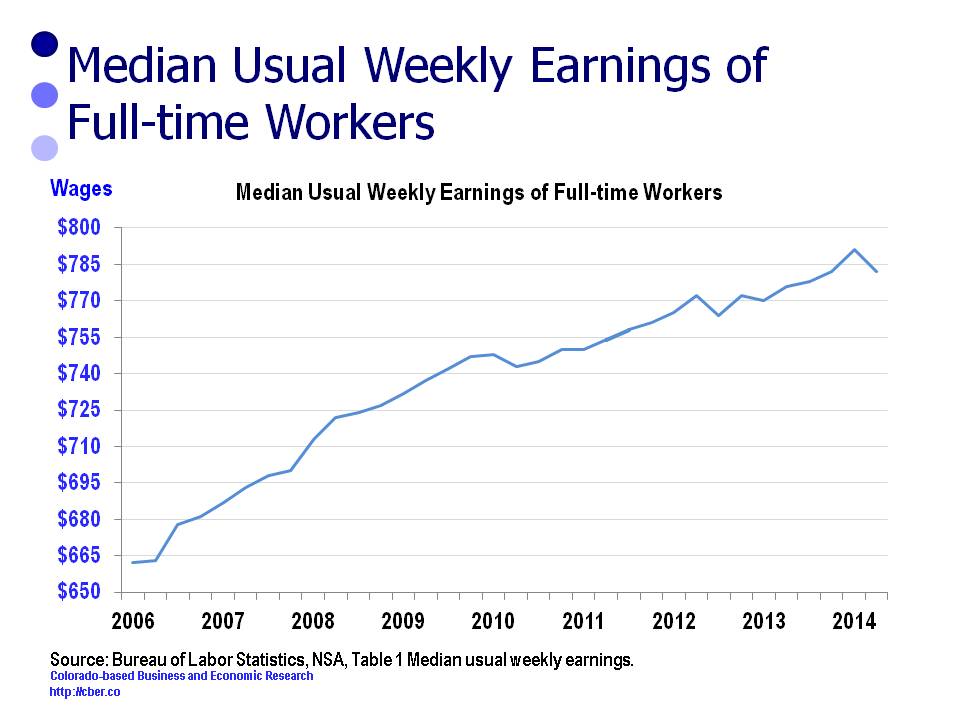

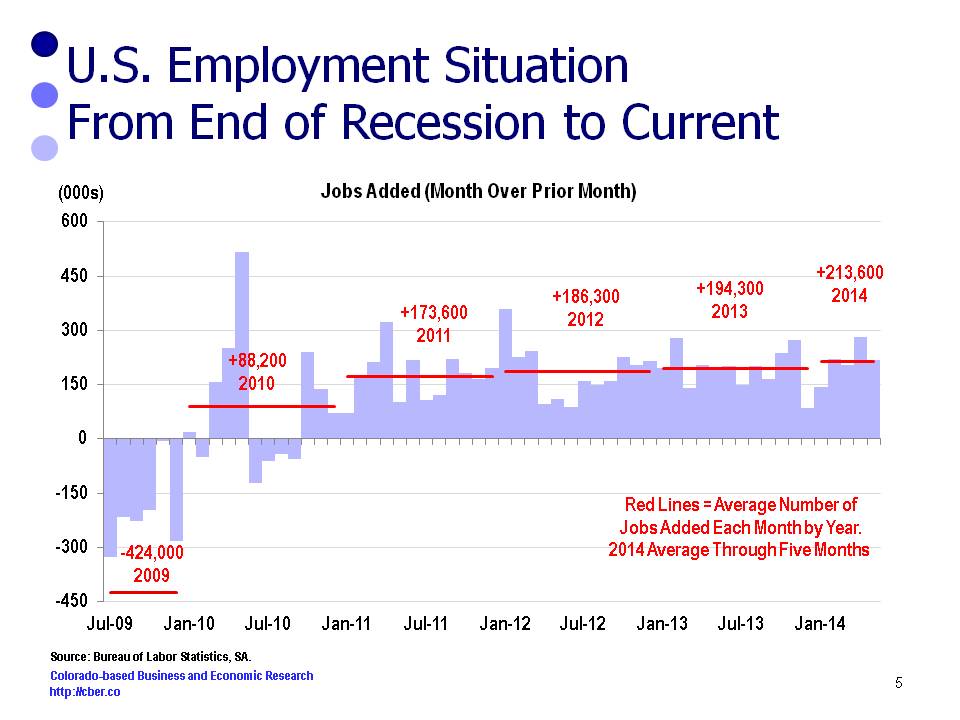

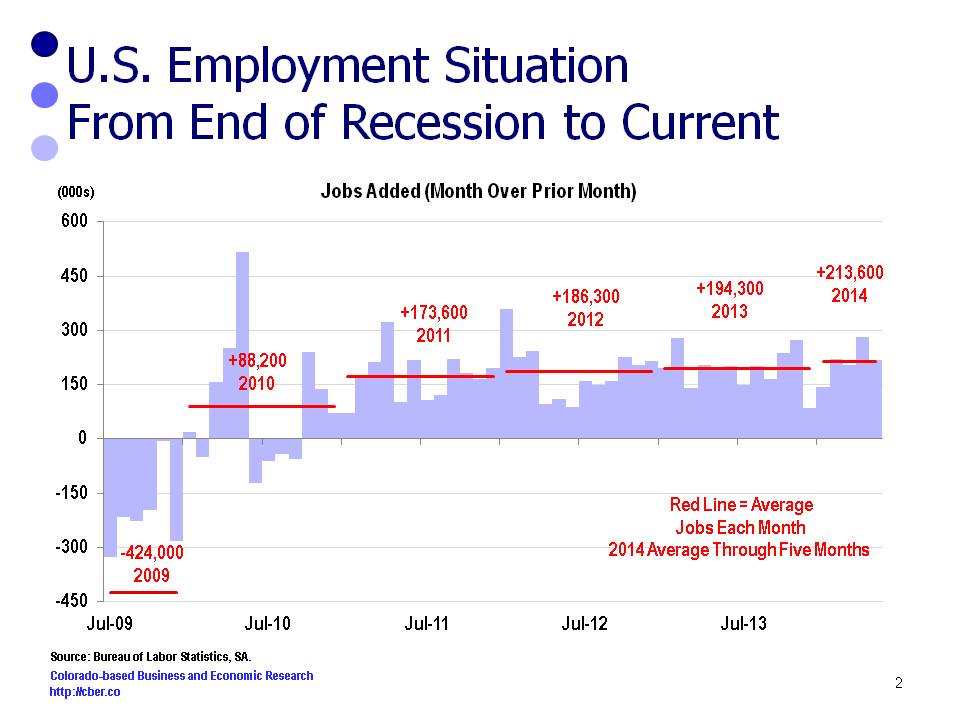

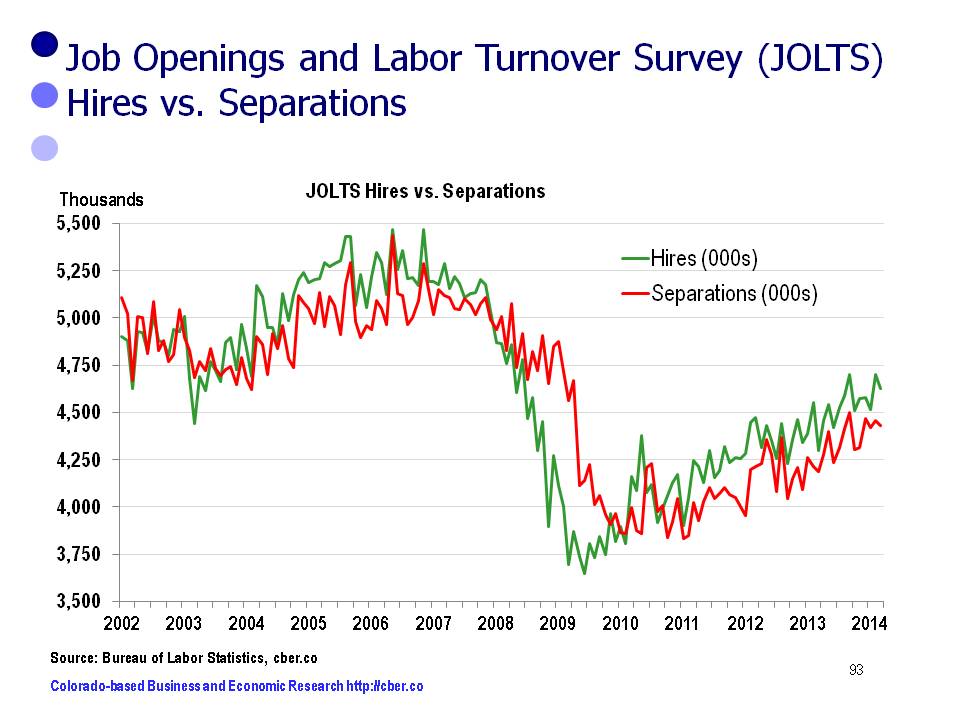

Through the first half of 2014, U.S. wage and salary jobs have been added at a slightly faster pace than 2013. On average 188,000 jobs were added each month during 2013. By comparison, an average of 194,000 jobs have been added for the first six months of 2014 compared to the first half of 2013. (Source: non-seasonally adjusted data).

Nationally, the unemployment rate continues to drop. It has declined from 6.7% at the end of 2013 to 6.1% at the end of June. A year ago it was 7.5%.

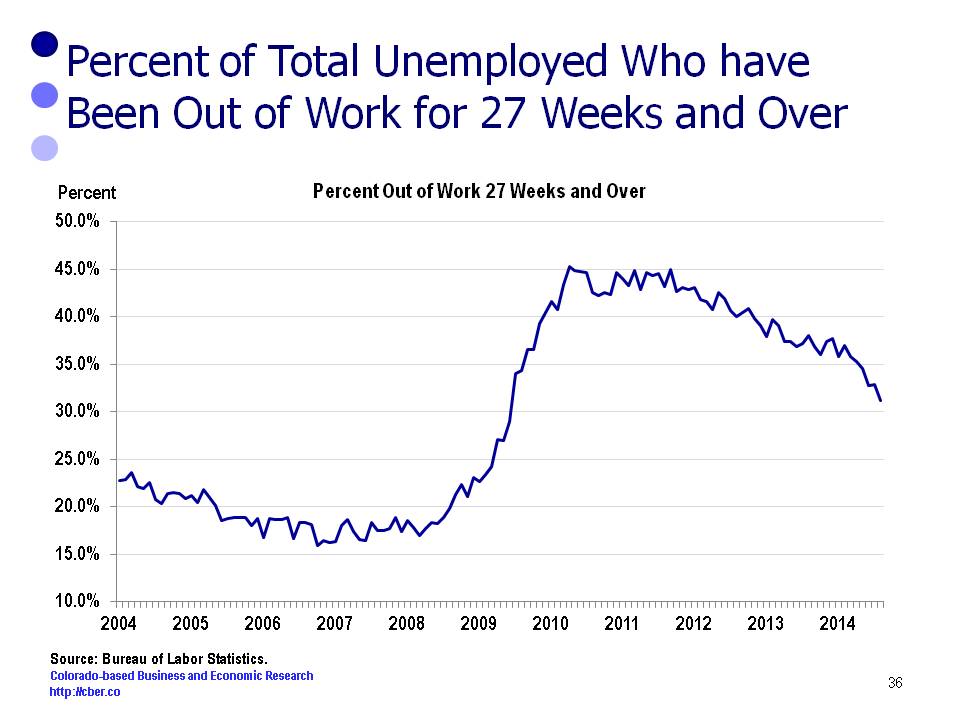

In addition, the number of unemployed continues to decline, dropping to 9,474,000 in June. This is down significantly from 11,747,000 a year ago. By comparison, there were 15,333,000 unemployed in April 2010 at the height of the Great Recession. On the other hand there were 6,731,000 in March 2007 just prior to the Great Recession. Despite the improvement, there are still a number of people struggling to find work.

A similar situation exists in Colorado. Unemployment continues to trend downward, but the number of unemployed remains higher than desired. It has decreased from 6.2% at the end of 2013 to 5.5% in June. Unfortunately, about 150,000 workers remain unemployed. While this number is decreasing at a painfully slow rate, it is about 60,000 greater than the low point in April 2007, the low point prior to the recession.

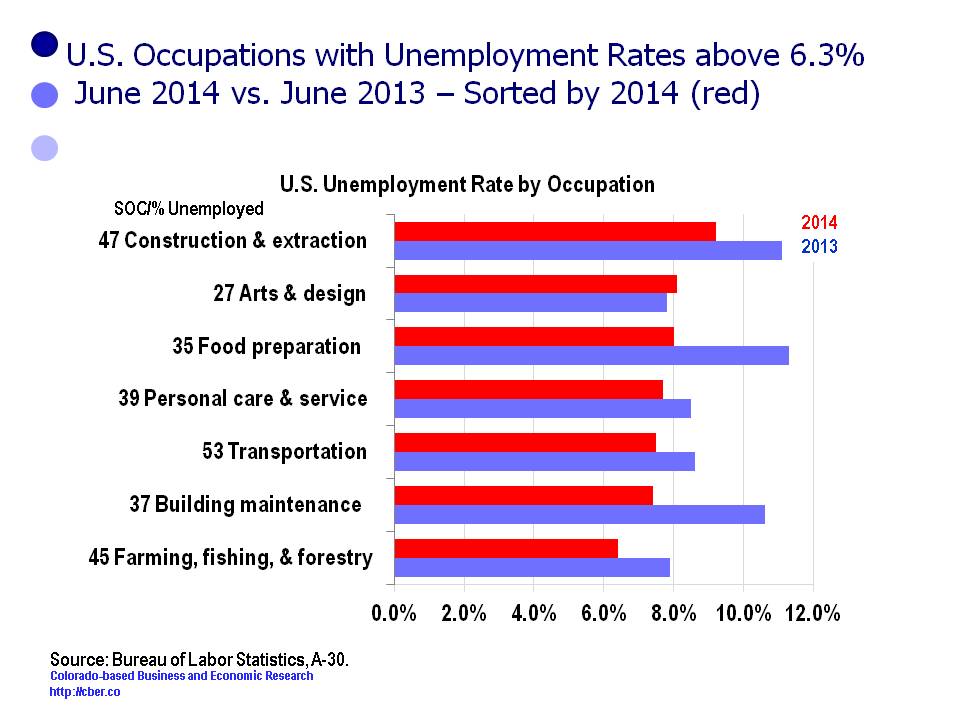

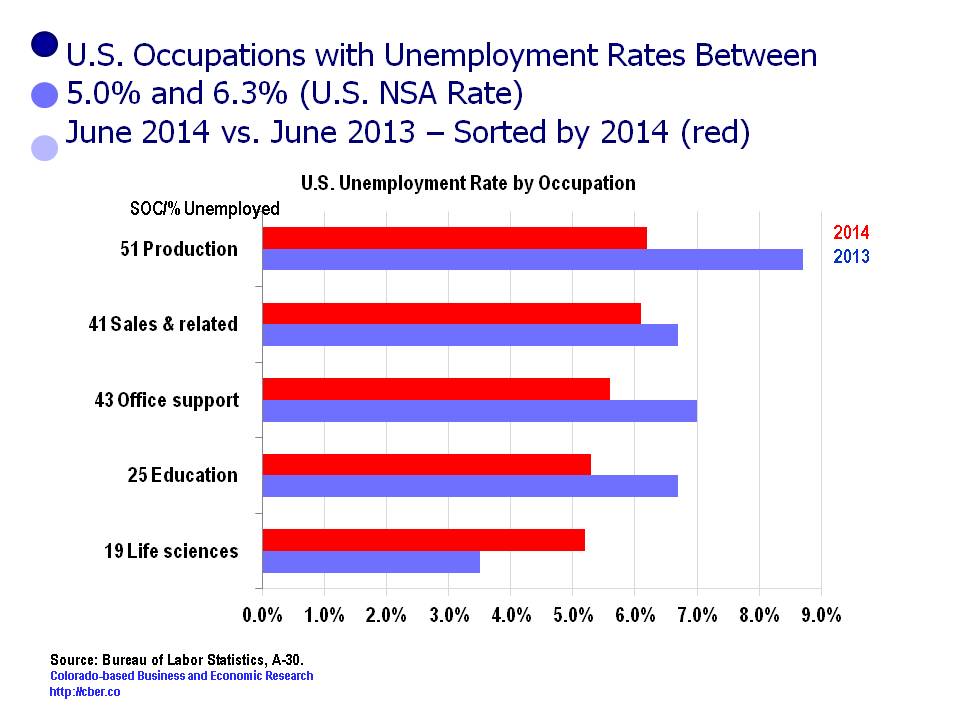

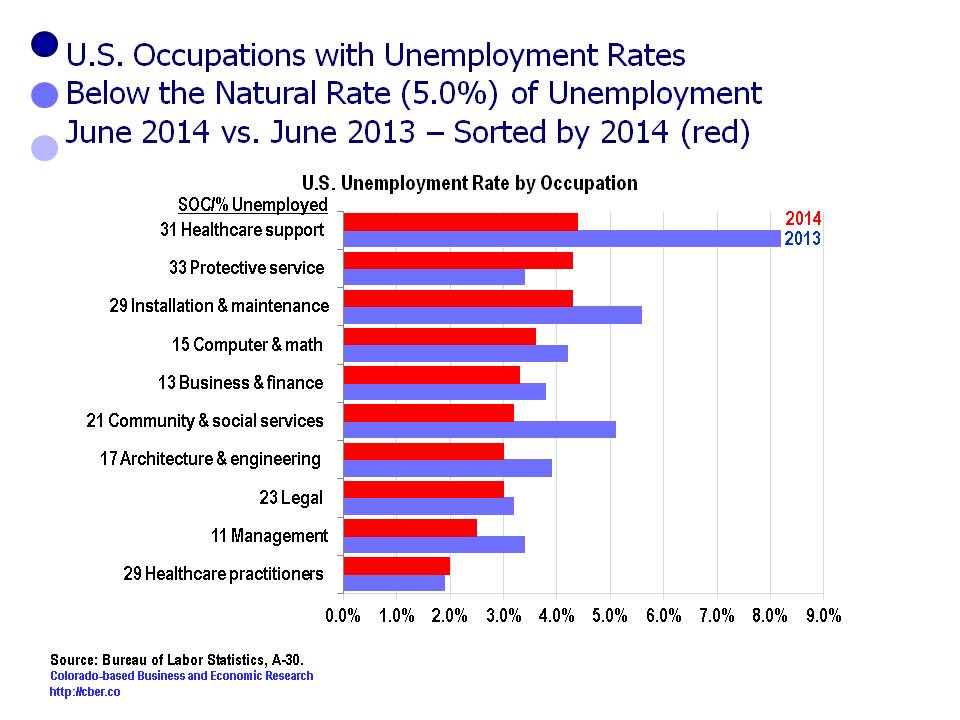

While the decrease in unemployment is a positive sign, some industries such as construction, manufacturing, and segments of high-tech are struggling to find trained workers. In smaller metro areas such as Weld County there will be a domino effect as higher paying jobs in the oil and gas industry may pull workers from local manufacturers, hotels and restaurants, and construction companies.

The situation is slightly different for some rapidly expanding high-tech industries that require specialized talent (software, technicians, machinists, etc.). Talent attraction is a necessary option for supplying trained workers for these rapidly growing companies. This can be a challenge because there are national shortages in key occupations for the high-tech industry. It is important for Colorado to “train their own” but at the same time Colorado must continue to attract workers from other states.

Through the first six months of 2014 Colorado has added 67,000 jobs compared to the same period last year. Looking ahead, Colorado will continue to see strong growth through the remainder of the year. In certain parts of the state, that growth will occur as an indirect result of the extractive industries and agriculture. In the metro areas, it will be driven by broad-based growth across many industries. The leading areas of growth will continue to be tourism, construction, health care and sectors that are related to advanced technology.