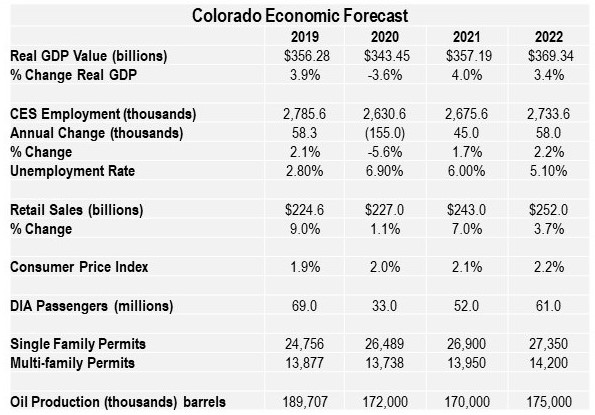

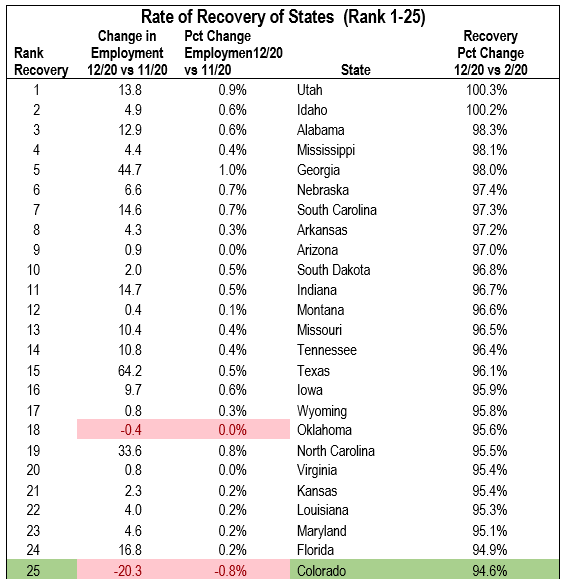

Last summer, Colorado was one of the top states in the recovery from the C-19 pandemic. As time has passed, its economic performance has gotten worse.

The most recent release of data from the Bureau of Labor Statistics shows that Colorado lost 20,300 jobs in December, compared to November. December was the second consecutive month that the state lost jobs.

The unemployment rate jumped to 8.4%. That rate was the 48th highest rate in the country. It was slightly worse than New York but less than California, Nevada, and Hawaii.

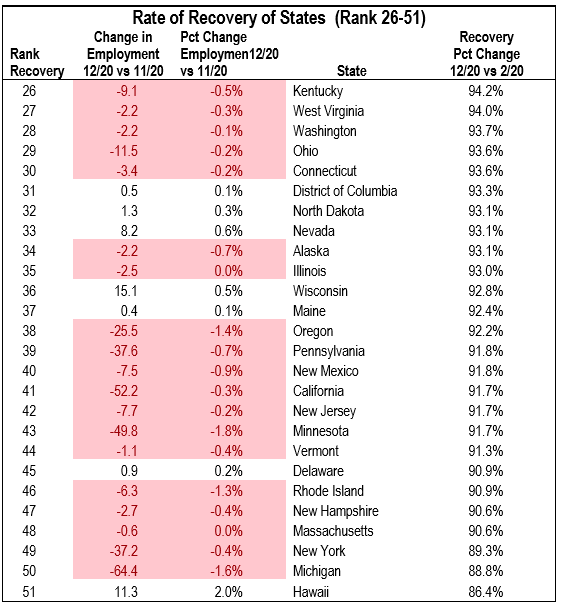

The two charts in this post show the following:

- Column 1 is the rank of the recovery (column V).

- Column II is the absolute change in employment from November 2020 to December 2020.

- Column III is the percentage change in employment from November 2020 to December 2020.

- Column V is the percentage recovery from February 2020 to December 2020.

Colorado (green) has the 25th lowest percentage of recovery, 94.6%. Two states, Utah and Idaho, have already returned to their employment pre-pandemic employment levels.

The chart above shows that 2 of the 25 states lost jobs between November and December.

The chart below shows that 19 of 26 states lost jobs between November and December.

State and local leaders have struggled to maintain a balance between the number of new C-19 cases and deaths and the health of the economy. Stay tuned.