On December 20th the BLS will provide their final 2014 Colorado jobs report.

Given the strength of the U.S. job growth reported earlier this month (321,000 jobs added), it is reasonable to think there will be solid job growth for November. While the economy has had its ups and downs, job growth remains solid, and is trending upwards.

The upcoming press release is somewhat irrelevant because the BLS will release the 2014 benchmark revisions in early March of 2015. That data is expected to show that the number of Colorado jobs increased by about 73,000, or 3.1%, during 2014.

The BLS began producing state employment data in 1939. The Job growth of 73,000 jobs in 2014 will be the tenth best year in terms of absolute job growth (the number of jobs added). On the other hand, 2014 will be the 38th best year in terms of relative job growth (percentage of job growth).

This year marks the only time that Colorado jobs have increased at an accelerating rate for four consecutive years. Between 2011 and 2014, Colorado has added about 231,000 workers (36,300 jobs in 2011; 54,400 jobs in 2012; 68,100 jobs in 2013; and 73,000 jobs in 2014.)

Looking ahead to 2015:

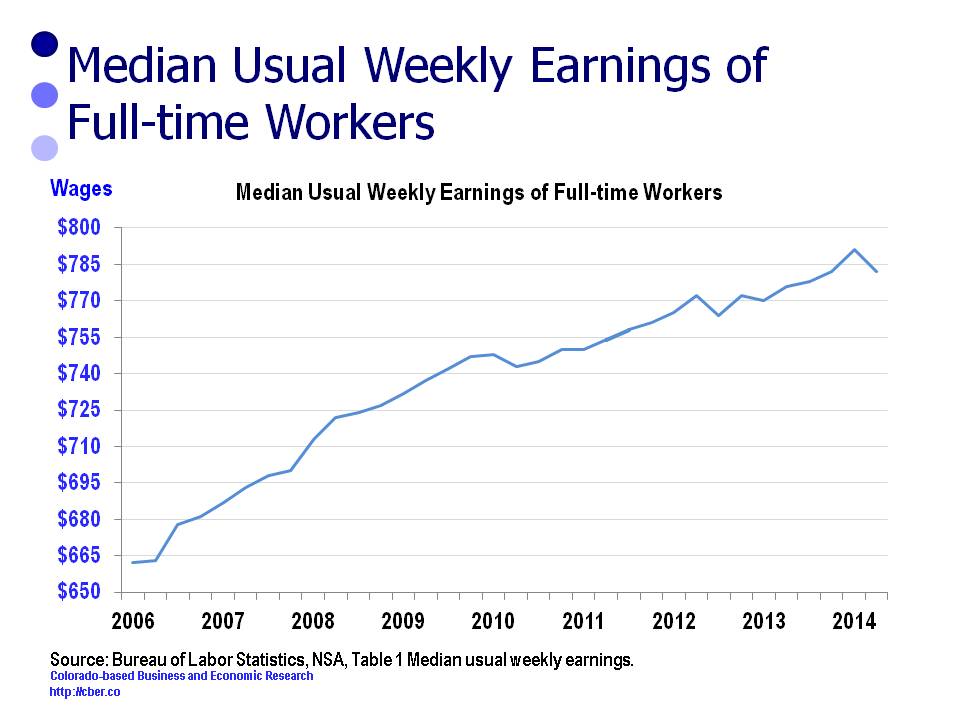

• The price of oil has declined precipitously because supply exceeds demand. As a result the price for a gallon of gasoline has dropped well below $3.00 per gallon. To date, the short-term impact of lower gas prices has been minimal. If prices remain low, Colorado’s frequent fuelers will realize savings of about $500 to $600 next in 2015. Because wage growth has been weak over the past four years, most people will not use the savings for discretionary purposes. Rather they will pay for rent, food, medical costs, and other necessary expenses that have risen at a rate faster than their wages.

• In the short-term (first half of 2015) lower oil prices may not have a significant impact on production and the number of workers in Colorado’s extractive industries. If prices are suppressed for an extended period, then production will fall. Initially, contractors and engineers will be laid off and production workers will be furloughed. Eventually smaller companies and suppliers will be impacted. The extractive industries have a comparatively small direct workforce; however, they indirectly touch many industries. They have a much bigger role in the Colorado economy than most people realize.

• A slowdown in the economies of China, Russia, and parts of the European Union may impact Colorado companies that export products and services globally.

• Wage growth has been extremely weak, particularly given the decline in the rate of unemployment this year. Although the unemployment rate is below 4.5% (the natural rate of unemployment), upward wage pressure has been felt in only a few industries, such as construction and finance.

• Retail sales have remained solid because of increased employment and in-migration. Stronger wage growth is needed to support significant growth in retail sales.

• The downward trend in the unemployment rate is a mixed blessing. It is great that more people have jobs, but labor shortages will occur in more industries during 2015 as the supply of trained workers is reduced.

• Health care costs will continue to be an issue in 2015. Participants in the Connect for Health Colorado program will not see minimal increases in their 2015 premiums. Unfortunately, the subsidies were reduced, which will cause costs for insurance to increase significantly for many families.

• Colorado’s housing prices continue to rise, which is good news for existing home owners. It is not such good news for renters and people moving to the state.

Despite these headwinds, there are plenty of reasons to be optimistic about the growth in the number of Colorado jobs and the overall economy in 2015.