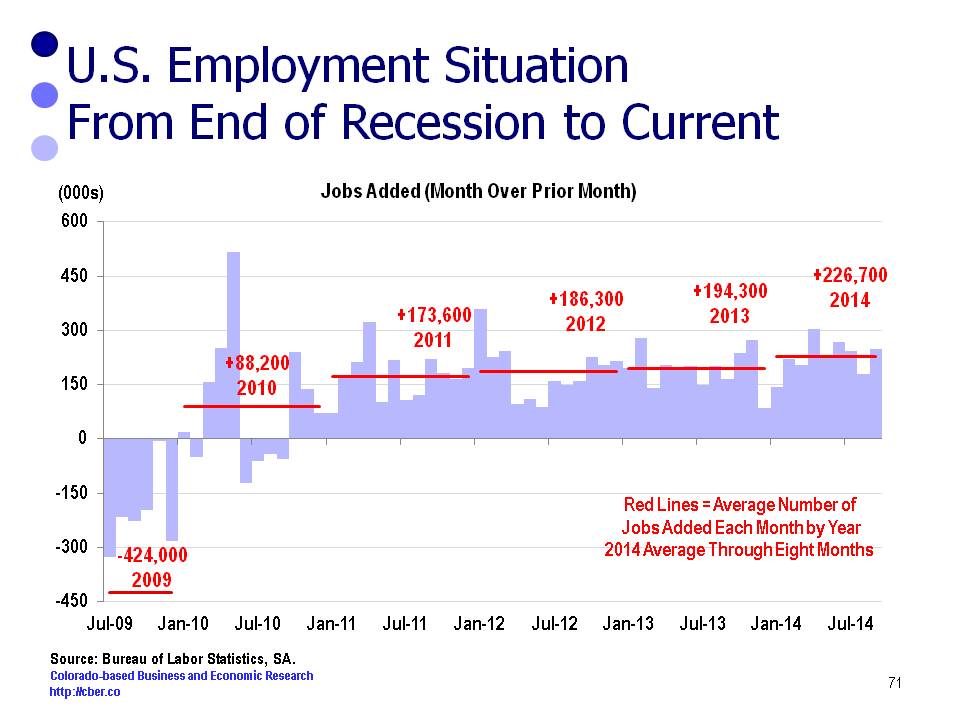

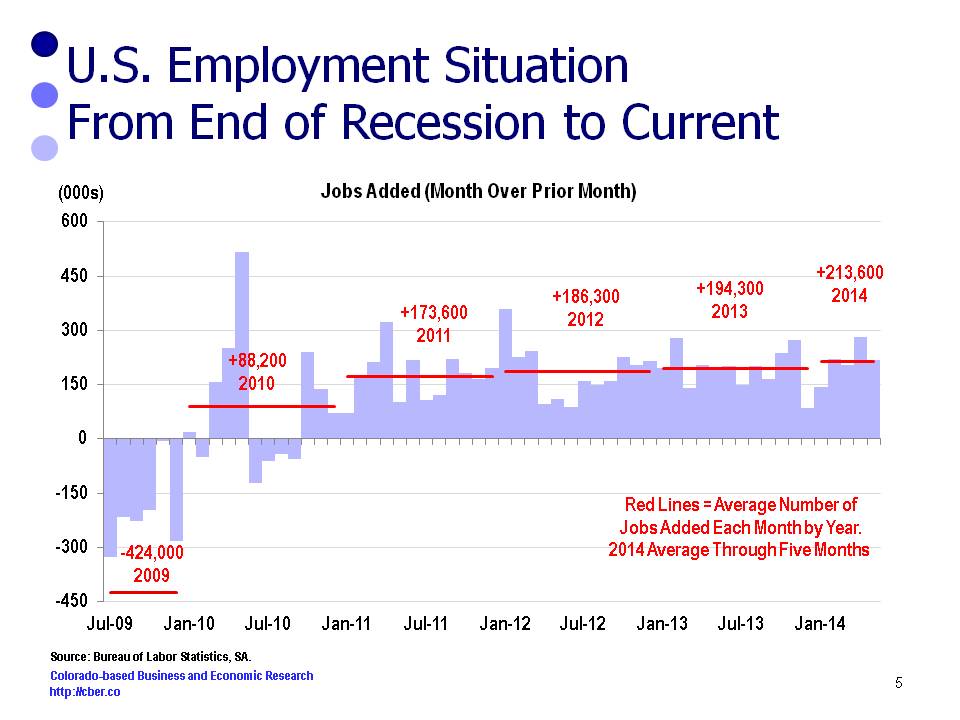

On November 6th, the Bureau of Labor Statistics released its monthly update for U.S. nonfarm payroll employment. The number of seasonally adjusted jobs increased by 271,000 in October. Over the previous 12 months, employment has increased by an average of 230,000 workers per month. That equates to 2.8 million per year.

The unemployment rate was down from 5.7% to 5.0% a year ago and 5.1% in the previous month. The number of unemployed persons was down from million a year ago to 7.9 million in October.

The areas with the largest increases were professional and business services (PBS), health care, retail trade, food services and drinking places, and construction.

• Employment in the PBS Sector increased by 78,000 in October, compared with an average gain of 52,000 per month over the prior 12 months.

• Health care employment increased by 45,000 jobs in October. Over the past year, health care has added about 41,200 jobs per month, or slightly less than a half million jobs for the year. About 27,000 jobs were added in ambulatory health care services and 18,000 in hospitals.

• The number of retail trade jobs increased by 44,000 in October. This is well above the average monthly gain of 25,000 jobs for the past 12 months. In October about 20,000 were added in clothing and accessories stores, 11,000 were added in general merchandise stores and 6,000 were added in automobile dealerships.

• About 42,000 workers were added in food services and drinking places in October. For the past year the monthly average has been about 31,000.

• Finally, construction employment rose by 31,000 in October. This is slightly higher than previous months. About two-thirds of the October growth was in nonresidential specialty trade contractors.

On the down side, mining employment fell by 5000 workers. The sector peaked in December 2014 and has since shed 109,000 jobs.

Employment in other major industries was similar to the prior month.

It was encouraging to see this level of job gains. Next month, we will learn whether the level of October employment was a “one hit wonder” or a reversal of the downward trend that has been taking place since the second quarter.