National Economy

The Colorado economy is outperforming the U.S. economy. Recent strength in the U.S. economy is a positive sign for Colorado.

Nationally, employment remains strong. The non-seasonally adjusted data shows that an average of 230,000 jobs have been added each month through seven months. Most likely the U.S. will add about 2.5 million jobs this year.

On a positive note, the labor force participation rate appears to have bottomed out.

Real GDP increased by 4.0% in Q2. The reasons for the increase in the real GDP were:

- Stronger personal consumption.

- Greater private inventory investment.

- Increased residential fixed investment.

- Stronger non-residential fixed investment.

- Improved state and local government spending.

- Greater demand for exports

Factors that offset the growth were:

- Increased demand for imports.

- Decreased federal government spending.

An area of potential concern is construction. Hopefully the industry is taking a breather after its recovery from the Great Recession. The number of building permits issued over the past year has been flat.

In addition, the housing market is cooling off. The rapid appreciation in housing prices is tapering off.

Both manufacturing and services have been solid since the second half of 2009. At least this is being reflected in the growth of the GDP.

Implications of the National Economy on Colorado

These indicators have several implications for Colorado. The short-term outlook points to stronger personal consumption, which bodes well for retailers and tourism, particularly if Mother Nature cooperates by bringing early and frequent snow for the ski season.

Stronger retail sales will add to the coffers of the state and local governments, which should point to continued increases in government spending. This would benefit everything from schools to infrastructure.

On the downside, lower or constrained government spending could impact the military and federal facilities and laboratories. This has the potential to impact the universities and federal facilities in Colorado Springs, Denver, Boulder, and the Northern Colorado metro areas.

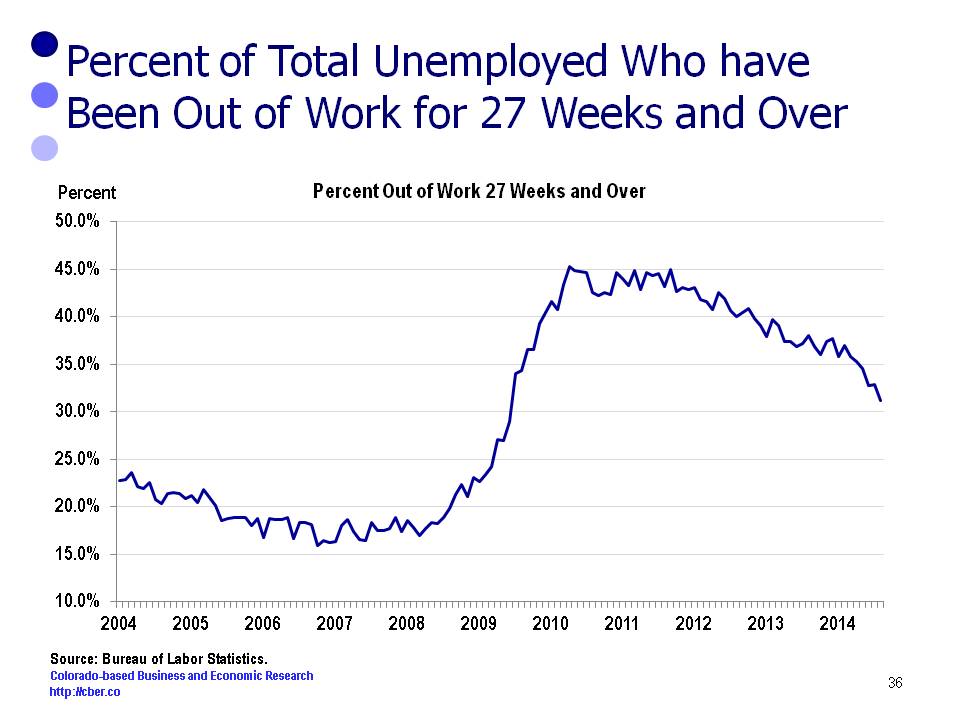

The unemployment rate and the number of unemployed continue to trend downward; however, critical labor shortages are developing in many occupations. This is particularly critical to high-tech industries.

Labor shortages are impacting all industries in Northern Colorado which is experiencing rapid growth as a result of the extractive industries boom. Workers are being raided from other companies and industries, which will ultimately drive wages up.

The Colorado construction market still appears to be solid and the value of residential housing is growing, albeit at a slower rate than last year. At the same time the Dow Jones Industrial Average is about where it was at the end of 2013.

Appreciation in the housing and equity markets play into consumer confidence. If consumers feel their house and investments have appreciated, their wealth on paper is greater, and they are more likely to purchases goods and services.

Colorado Economy

The following five sectors account for about 45% of total jobs in the state, yet they are responsible for almost 75% of the jobs added this year.

- Accommodations and Food Services

- Health Care

- Construction

- Professional and Scientific Services

- Retail Trade.

All of these jobs are important to the state for various reasons.

- About 10% of all jobs are in the Accommodations and Food Services sector. AFS has accounted for about 20% of the jobs added this year. As a major component of the tourism sector, AFS is an important part of the economy in all 64 counties.

- Just under 11% of the state’s s jobs are in the Health Care sector. This category has accounted for about 15% of total jobs added this year. The Health Care sector affects our quality of life and plays a key role in the economy in all 64 counties.

- The Construction industry is small by comparison, with about 5.0% of total state jobs. Approximately 12% of the job growth is in this category. A segment of the Construction jobs are tied to the growth of the extractive industries.

- A portion of the Professional, Scientific, and Technical jobs are a key part of the state’s advance technology industries. They account for about 8% of the jobs and 11% of the job growth.

- Finally, Retail Trade jobs account for almost 11% of total jobs and 11% of total job growth. The retail sector is critical to most local governments because a majority of their revenue is derived from retail sales taxes.

Through seven months of 2014, the average job growth is about 67,300 greater than the same period in 2013.