This post summarizes the economic impact of the coal mining industry in the Yampa-White River Region (Moffat County, Rio Blanco County, and Routt County) of Northwest Colorado and the state. It will focus on the two North American Industrial Classification System (NAICS) Sectors 211111 – Bituminous Coal Surface Mining and 212112 – Bituminous Coal Underground Mining, which are included in IMPLAN category 21.

The key employment findings of the report are:

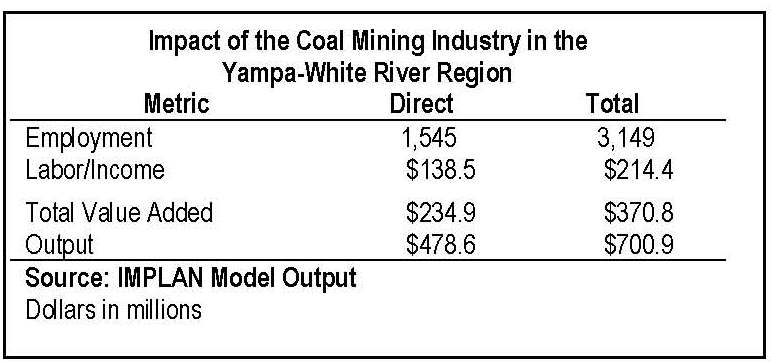

• There are 1,545 direct employees in the Yampa-White River Region working in the coal mining industry. Overall there are 3,149 employees in the Yampa-White River Region working in the coal mining industry (direct, indirect, and induced).

• There are 3,469 direct employees in the state coal mining industry. Overall there are 8,467 employees working in the state coal mining industry (direct, indirect, and induced).

The key output findings of the report are:

• Direct output within the Yampa-White River Region associated with the coal industry is slightly less than $478 million. Direct output within the region associated with the coal industry is slightly less than $701 million (direct, indirect, and induced).

• Direct statewide output for the coal industry is slightly less than $1,052.1million. Direct statewide output for the coal industry is $1,838.0 million (direct, indirect, and induced).

To gain an appreciation for what these numbers mean and the impact of the coal mining industry, it is important to put them in perspective.

• At the state level, the coal mining industry is small. It is one of 405 industries, it accounts for .11% of total direct employment and .37% of total direct output. The industry has a higher than average output for employee level than other industries.

• At the industry level, the Yampa-White River Region employs 44.5% of the direct employees in the state’s coal mining industry. In addition, it accounts for 45.5% of the state’s direct coal mining output.

• At the regional level, the coal mining industry accounts for 4.6% of the region’s total direct employees, but it is responsible for 17.4% of the region’s total direct output. Clearly, output per worker for the sector is greater than the average.

• There are 188 industries in the Yampa-White River Region compared to 405 for the state. The region is less diversified than the state, which accentuates the importance of dominant role the coal mining industry plays in the Yampa-White River economy.

• Average wages, without supplements, for the region are $84,544 for surface mining and $90,132 for underground mining. Average wages are well above the state average for all industries. About 73% of the direct workers in the region are wage and salary employees.

The report was funded by the Economic Development Council of Colorado and local economic development organizations. For a full copy of the report, please click here.