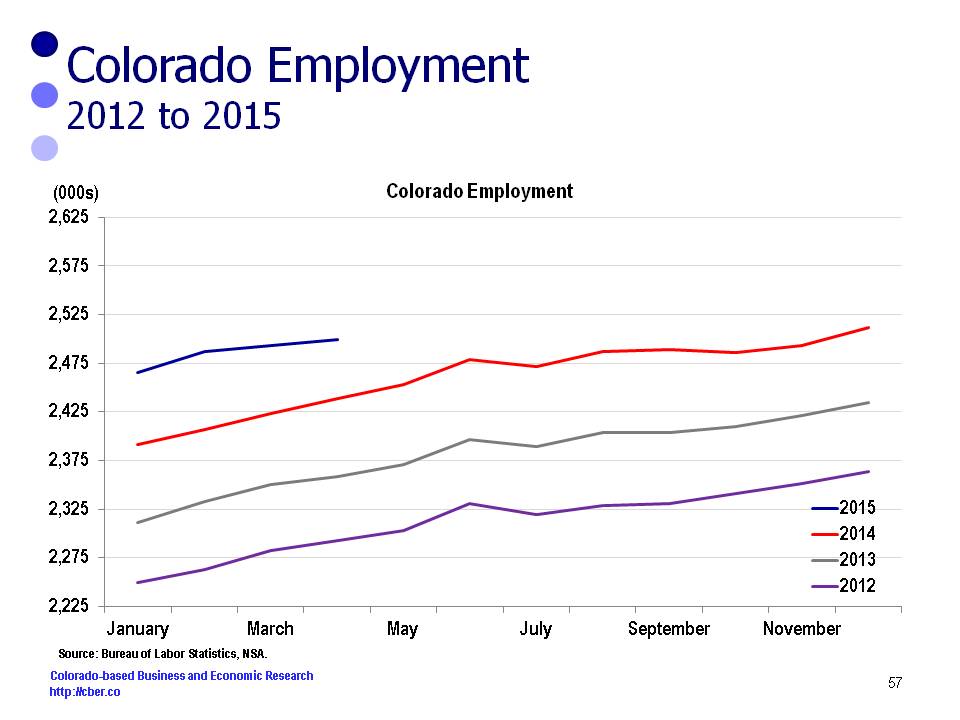

The state remains on track to add at least 71,000 jobs this year.

The BLS released their monthly employment report for Colorado earlier today. Rather than prepare a sector-by-sector analysis, the following comments evaluate the situation from 30,000 feet.

Colorado has had the perfect winter – snow in the mountains, but not so much that people couldn’t get to there to spend their money and ski. The state has had an excellent ski season which bodes well for hospitality industry employment. Good snow also means good rafting for the summer season.

A strong ski season also bodes well for the construction industry. Nationally, hotels and resorts had delayed repairs and expansions because of the recession. Upgrades and new construction that have been on hold are likely to occur in the months ahead.

A trip to DIA shows the importance of tourism to the state. Progress is being made on the Westin hotel located at the south end of the terminal. As well there are signs the light rail will soon be a reality. That will make it easier for travelers to connect to the metro area, which will further enhance Denver’s image as a place to hold conventions and conduct business.

It also appears the Gaylord project has cleared its latest set of hurdles and will begin construction soon. Shuttle drivers are anxiously telling their passengers where the project will be located.

The fact that Denver is on the short list for the Republican National Convention speaks to the increased reputation Denver is gaining as a place to host conventions. The fact that Colorado is a blue/purple state makes it an even more attractive destination. Wouldn’t the Republicans love to unseat the Democrats at a convention held in the Democrat’s backyard?

The snow and the cold of the winter season have not stymied construction along the Front Range. The state added over 10,000 construction jobs in 2013. Job growth has continued to be strong in 2014. Moving forward, the industry may be challenged to find sufficient workers, as unemployment in the industry has decreased substantially.

The construction industry will remain strong, with most of the growth coming from private sector investment. Despite improvement in tax revenues, the public sector is still not in a position to fund construction – such as schools or institutions.

Road construction has been held back by limited tax collections. One downside to improved fuel efficiency is less fuel is being consumed. The tax rates have not increased to support maintenance and repairs to our transportation infrastructure.

Residential construction will continue to improve, but will not approach the rates of growth that occurred prior to the Great Recession. For a variety of reasons, multifamily growth will remain strong. For example, young buyers prefer to live in the metro areas vs. the suburbs and many of them have high debt levels.

Obamacare enrollment has finally come to a close. For better or worse, the program is officially moving forward and healthcare organizations have greater clarity about how they can operate. They will be challenged by thin margins and will have to constantly be on top of their operations to remain profitable.

The industry continues to evolve rapidly. For example a focus for many organizations is bringing health care to local neighborhoods through urgent care and emergency facilities. The ACA will drastically impact the way healthcare organizations deliver services.

The oil and gas industry will continue to be extremely strong in Northern Colorado. In 2013 the state produced 64 million barrels of oil and about 80% was produced in Weld County. Colorado is one of the country’s top 10 states in terms of oil reserves. There are smaller counties that have enjoyed growth in oil production because of the Niobrara oil field, i.e. the industry is benefitting many parts of the state. Finally, the natural gas industry is strong on the western slope.

The state remains on track to add at least 71,000 jobs this year.