The Northern Colorado Metropolitan Statistical Areas (MSAs) are leading job growth for Colorado. Through five months of 2014, the leaders in MSA job growth were Greeley and Fort Collins.

The MSA job growth rates for five months follow:

- Greeley 5.4%

- Fort Collins 3.5%

- Boulder 3.1%

- Denver 2.8%

- Pueblo 2.1%

- Grand Junction 1.4%

- Colorado Springs 1.2%

The rate of growth for the state was 2.9%.

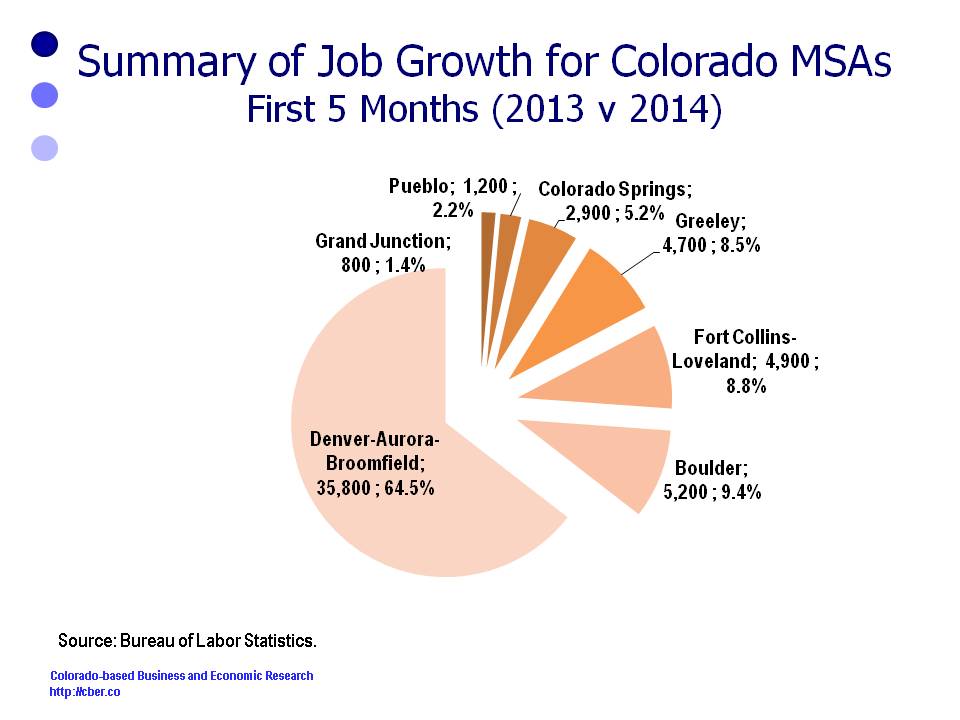

The MSA job growth for five months follows:

- Denver 35,800

- Boulder 5,200

- Fort Collins 4,900

- Greeley 4,700

- Colorado Springs 2,900

- Pueblo 1,200

- Grand Junction 800.

For the first five months of 2014 Colorado added about 67,100 workers compared to the same period in 2013. About 11,600 were outside the seven MSAs.

As expected Denver added the greatest number of jobs. The percentage of MSA job growth follows:

- Denver 64.5%

- Boulder 9.4%

- Fort Collins 8.8%

- Greeley 8.5%

- Colorado Springs 5.2%

- Pueblo 2.2%

- Grand Junction 1.4%

Combined, the Northern Colorado MSAs added 17.3% of all jobs. The state’s seven MSAs accounted for about 83% of total job growth in the state for this period.

Though most of the state’s land mass is rural, most of the job growth is in the seven MSAs.