On August 7th, the Bureau of Labor Statistics released its monthly update for U.S. nonfarm payroll employment. The number of jobs increased by 215,000 in July and U.S. job growth falls in the solid-to-strong category.

The areas with the largest increases were retail trade, health care, professional and technical services, and financial activities.

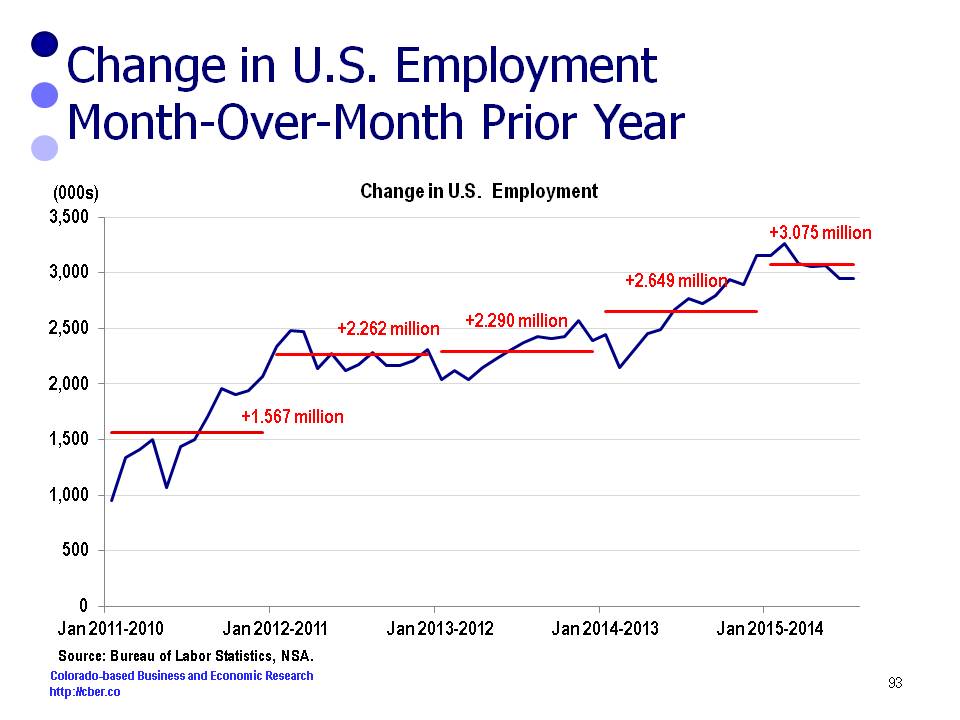

Average U.S. employment for the first seven months of 2015 is 3.1 million greater than the same period in 2014. That is about 256,000 net new jobs per month.

If job gains continue at the current pace, average annual wage and salary employment for 2015 will be about 142 million. As a point of reference, the 2015 population will be about 322 million.

Throughout 2015, U.S. employment has continued to post steady gains (month-over-month prior year) although there has been a slight downward trend since the change in employment peaked in February.

This downward trend is thought to be normal volatility and not a cause for concern. Even with the decrease, the number of jobs added this year will be well above the 2014 total.

All eyes are on the Fed and how they will interpret the latest news from BLS. They would like to see strong job and wage growth before they start raising interest rates; however it is most essential for them to see sustained, solid U.S. job growth. Unfortunately, for workers wage growth is less critical.

The consensus among most economists is that gradual rate hikes will begin in September.

The bottom line – the Fed will raise interest rates and U.S. employment will increase by 3.1 million this year. At this point, both are positive signs for the U.S. economy.