The U.S. economy is currently stronger than it was in 2014. The good news is the Colorado economy is outperforming the U.S. economy in three key areas:

• The Colorado rate of population growth in 2015 is projected to be 1.6% vs. 0.7% for the U.S.

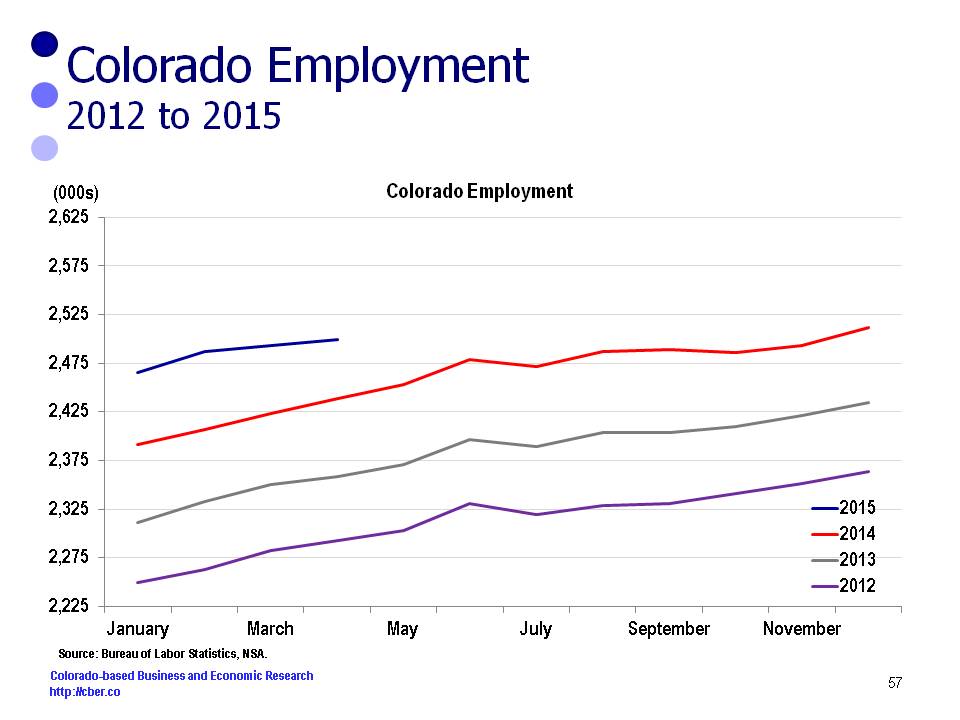

• The Colorado rate of job growth in 2015 is currently projected to be 3.0% vs. 2.2% for the U.S.

• The recently released GDP data shows that Colorado outperformed the U.S. in the rate of growth, 4.7% vs. 2.2% in 2014.

Currently, the strengths of the national economy outnumber the risks. With that in mind this post reviews the manner in which these strengths will impact the Colorado economy. For each strength the impact on Colorado is highlighted in italics.

The Fed – Janet Yellen has indicated the Federal Reserve is confident the U.S. economy is performing well enough that interest rates can be raised.

Colorado has experienced stronger economic growth than the nation throughout the first half of the year. The state will continue to experience solid growth in the second half of the year.

Real GDP – After a weak start in Q1, Real GDP growth for the year is projected to be in the 2.5% to 2.9% range – better than last year.

In 2014, Colorado’s rate of Real GDP growth was more than twice that of the U.S. Solid growth is expected to continue in 2015.

Retail – The woes of Q1 seem to be behind us. Consumer spending is expected to be stronger in the second half. This may lead to strong back-to- school sales – a significant source of sales for retailers.

The Colorado economy had strong momentum coming into 2015. It did not experience problems felt elsewhere in Q1. Population and job growth will drive continued solid retail growth in 2015.

Jobs – The U.S. is on track to add more than 3.0 million jobs this year. The unemployment rate and the long-term unemployment rate have continued to decline.

As the year has progressed, U.S. job growth has increased at a solid, but decreasing rate. A similar trend may be happening in Colorado.

Consumer Sentiment – According to the Consumer Sentiment Survey, consumers are upbeat.

The mood of shoppers in the malls and the waiting times at local restaurants suggests that Coloradans are upbeat about the economy.

Industry Sentiment – Purchasing managers have a positive outlook for both goods and services. Manufacturing is more sluggish and may remain that way through the end of the year.

Continued optimism in the non-manufacturing sectors points to ongoing solid growth for these sectors and the Colorado economy.

Inflation – Inflation is below the Fed’s target rate of 2.0%. As interest rates increase, inflation will approach the target rate.

The increase in Colorado housing prices will cause the state’s rate of inflation to further exceed that of the nation.

Construction – There is strong activity in both the residential and non-residential markets. Construction job growth will be constrained by the lack of trained workers.

Despite the lack of trained construction workers, Colorado’s construction industry is responsible for about 18% of the jobs added in 2015.

Housing Prices – The housing market remains strong – too strong in some areas.

Home owners like having greater equity and local governments benefit from higher property taxes.

These strengths of the national economy have created momentum that will strengthen the U.S. and Colorado into 2016.