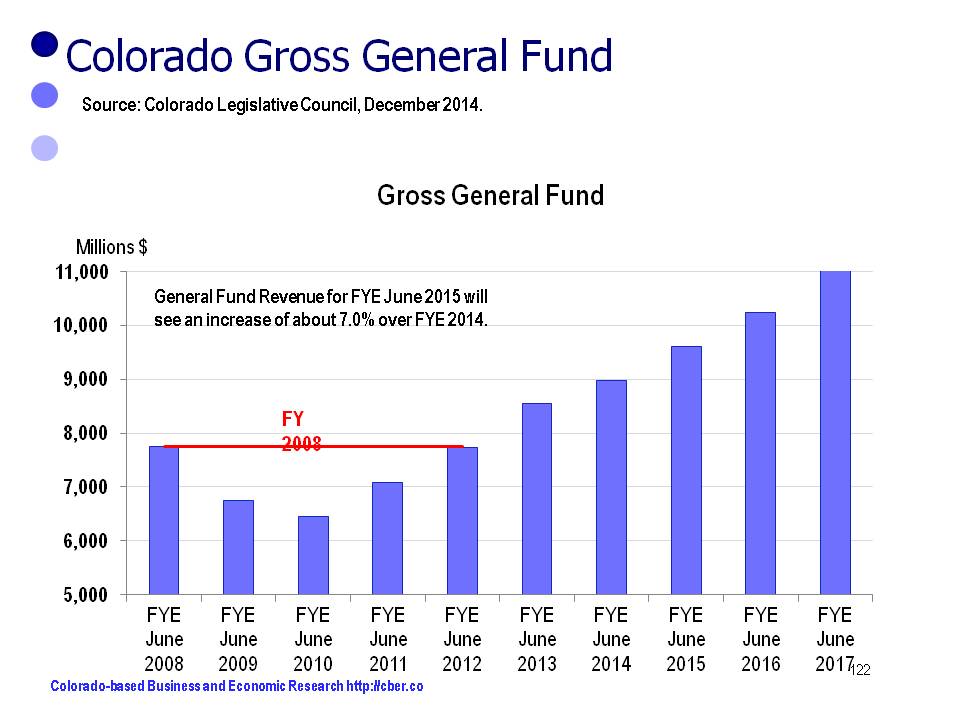

The projections of the Colorado Legislative Council and the Governor’s Office of State Planning and Budgeting show continued solid economic growth for the next three years, 2015 through 2017. From the perspective of the state government, the most important part of those projections is the budget for the General Fund.

General Fund Revenue for FYE June 2015 will increase to $9.6 billion, an increase of about 7.0% over FYE 2014. By 2017 the General Fund is expected to exceed $11.1 billion.

Sales Tax Revenue accounts for about one-fourth of the Gross General Fund. The Sales Tax Revenue for FYE 2015 is projected to be approximately $2.6 billion.

Net Individual Income Tax accounts for about two-thirds of the Gross General Fund Revenue. The Individual Income Tax Revenue for FYE 2015 is projected to be about $6.1 billion.

It is important to put these projections in perspective because times weren’t always as good as they are today. In 2008 the Gross General Fund was $7.7 billion. It fell to $6.5 billion in 2010 and has climbed upwards since.

The following economic projections will have an impact on the economy and revenue collections by the state through FYE 2017:

• Sustained job growth.

• Solid consumer confidence.

• Continued net migration.

• Strong equity markets, even though they may be volatile.

• If sales tax projections are correct, FYE 2014 to FYE 2017 would be the best four-year period for tax growth since FYE 1997 to FYE 2000.

• Lower gas prices may increase retail sales which could increase tax revenues in the short-run.

• Improved labor markets will create upward pressure on wages. This will potentially increase individual income taxes, but possibly decrease corporate income taxes.

• There is an expected TABOR surplus that will reduce individual income taxes beginning in FYE 2016.

• Corporate profits may be lower because of increased labor and capital costs and a reduction in tax incentives.

It will be interesting to look back in 2018 and see which of these economic projections have transpired.