Depending on your perspective…

• Debt is good if it is used to make purchases that stimulate consumption and economic growth.

• Debt can deter growth if debt service obligations prevent consumption and economic growth.

Whether or not you believe debt is good for the economy, one thing is for sure. Debt has increased!

Federal Debt

• 1966 to 2000 (34 years), $.3 trillion to $5.8 trillion; the level of debt increased by$5.3 trillion.

• 2000 to 2008 (8 years) $5.8 trillion to $9.4 trillion; the level of debt increased by $3.6 trillion.

• 2008 to July 2014 (68 months) $9.4 to $17.8 trillion; the level of debt increased by $8.4 trillion.

Public Debt has exceeded GDP since Q4 2012. The only other time that debt as a percent of GDP has been greater was during the 1940s.

Consumer Credit Outstanding

• In January 2006 Consumer Credit Outstanding was $2.37 trillion.

• In October 2014 Consumer Credit Outstanding was $3.28 trillion.

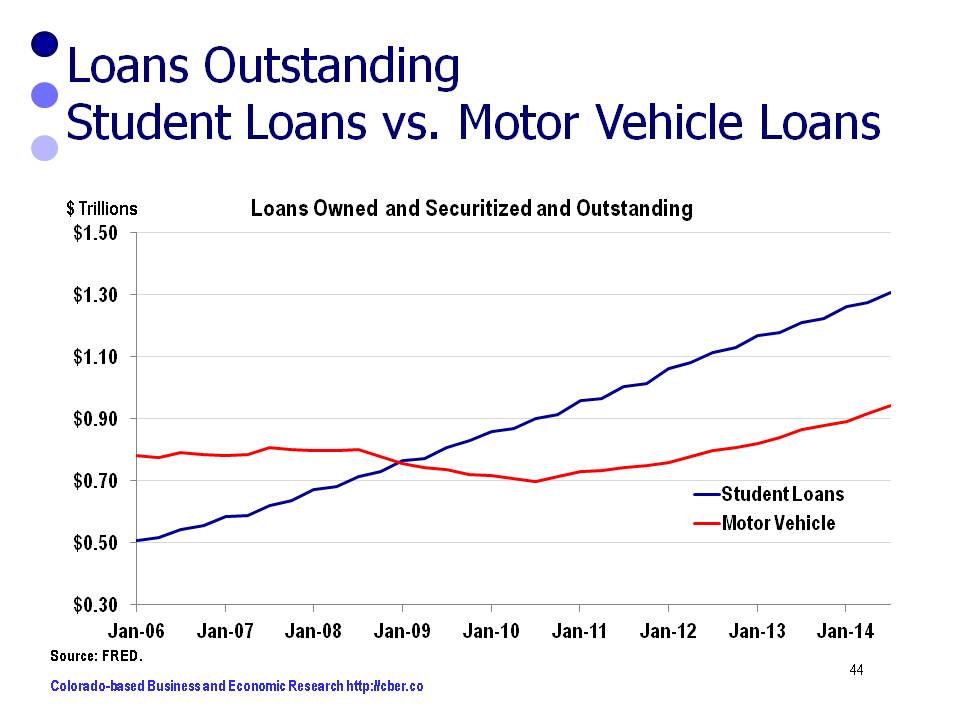

Student Loans

• In Q1 2006 Student Loans Outstanding were $500 billion.

• In Q3 2014 Student Loans Outstanding were $1.3 trillion.

Is this level of debt stimulating or preventing growth in the U.S. economy?

In June, 2008 consumers began deleveraging (this includes defaulting on loans). Their debt levels decreased for 27 months, until September, 2010. At that point their debt levels again began increasing and by June 2011 debt loads returned to the previous peak of June 2008. Since that time, they have been increasing at a rate similar to June, 2008.

In June, 2008 consumers began deleveraging (this includes defaulting on loans). Their debt levels decreased for 27 months, until September, 2010. At that point their debt levels again began increasing and by June 2011 debt loads returned to the previous peak of June 2008. Since that time, they have been increasing at a rate similar to June, 2008. Neither the debt levels of the federal government nor consumers are healthy for the economy in the long-term.

Neither the debt levels of the federal government nor consumers are healthy for the economy in the long-term.