In October, the Bureau of Labor Statistics reported the Colorado Mining Sector employed about 35,000 workers, or about 1.4% of the state’s 2,534,600 wage and salary employees.

In 2014 the GDP for the Colorado Mining Sector was $19 billion, or 6.2% of the 2014 Colorado GDP. More importantly, the Mining Sector accounted for about 18.2% of the growth in the state’s GDP.

In a nutshell, mining employment is a small portion of total employment in Colorado. On the other hand, the industry makes a major contribution to the GDP.

The Oil and Gas Industry accounts for about 75% of the employment and GDP total.

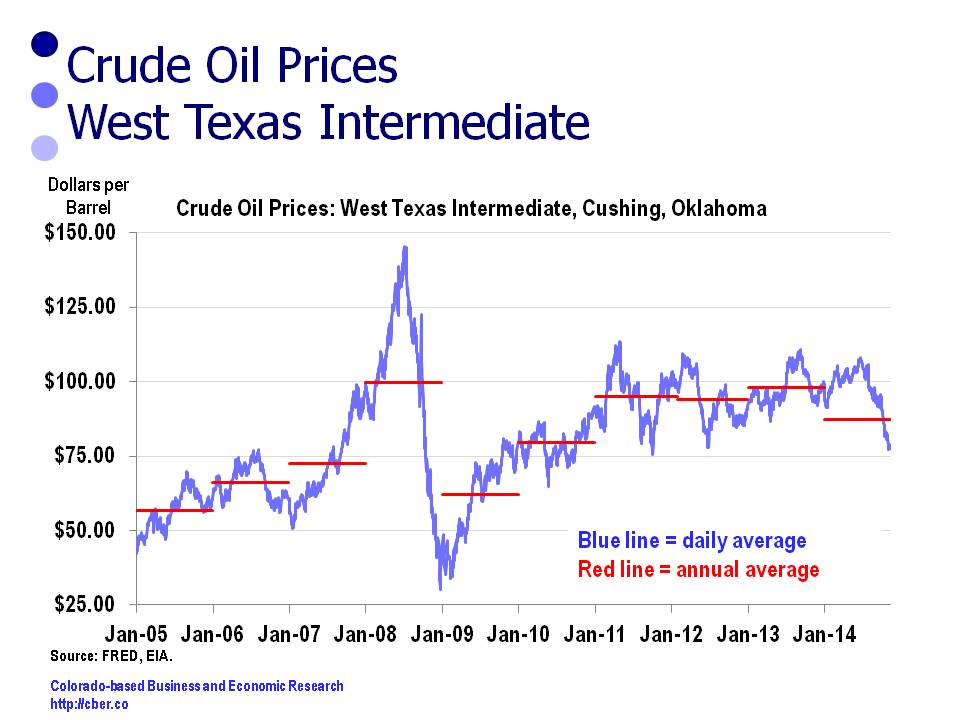

With that as a background, it is easy to see why state leaders were concerned when the price for a barrel of oil plummeted to below $40 per barrel in a matter of months.

To make matters worse, the Bureau of Labor Statistics may have overstated employment in the Oil and Gas industry by as much as 4,000 workers. In other words, the data for the state does not appear to have measured the direct, indirect, and induced impact of lower employment caused by lower prices for a barrel of oil.

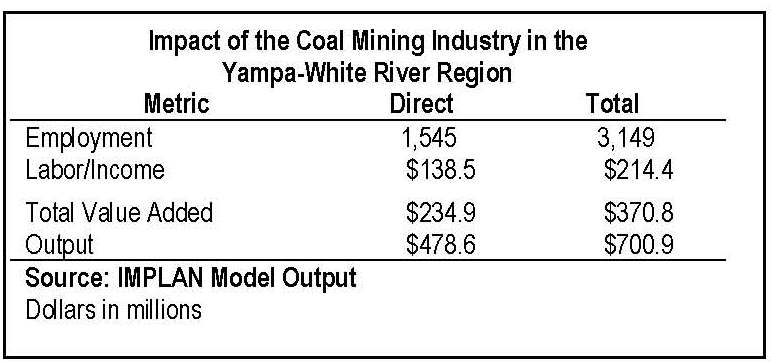

A quick analysis using IMPLAN shows the loss of 3,200 oil and gas workers and 800 support workers would result in a loss of $4.2 billion in economic activity and a total loss of 12,486 jobs. The direct average annual wages for the oil and gas industry are $96,425 and the direct average annual output per worker is $701,480.

The Bureau of Labor Statistics will update wage and salary data for 2015 in its benchmark revisions next March. At that point we will have a better look at the magnitude of the layoffs in the Mining Sector in 2015.

While we are anxiously awaiting the update, the reduction in mining employment is not a number we really want to see – it will be ugly!