During this election season the politicians have raised the question, “Are we better off now than we were four years ago?” It is easy to find data that supports or rejects the notion that “we” are better off today, but it is difficult to provide a clear cut answer either way.

U.S. Output

• Real GDP output is stronger than 4 years ago, although it is increasing at a less than desirable rate.

• Since 1930 Real GDP has increased 64 of 82 years, or 78% of the time. It has declined in back-to-back years from 1930 to 1933, 1945 to 1947, 1974 to 1975, and 2008 to 2009. It is very simple. Because the U.S. population is growing there is increased demand for goods most of the time, hence increased output.

U.S. Debt

• From 1966 to 2000, the Federal debt rose from $.3 trillion to $5.8 trillion. By mid-2012 it has reached almost $16 trillion.

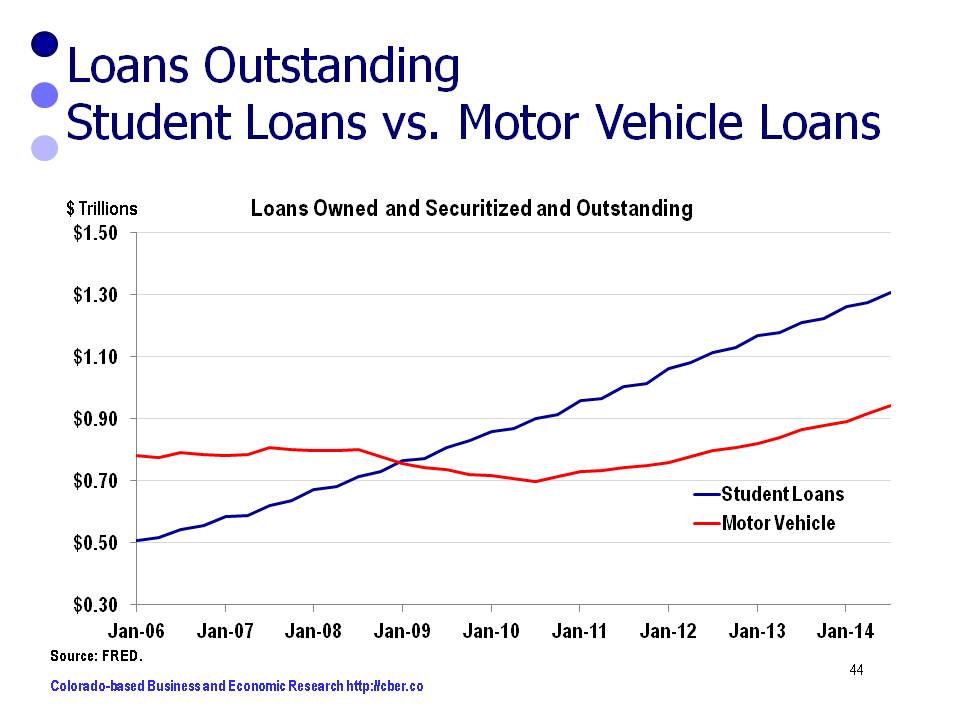

• From Q3 2008 to Q4 2010 consumers began deleveraging. Since then, they have continued to take on debt at a pre-2008 pace.

• While an argument can be made that it was necessary for the U.S. to incur a portion of the debt to prevent a depression, it is difficult to justify the over-consumption by consumers.

U.S. Employment and Unemployment

• During the 69 months between January 2007 and September 2012 the U.S. lost jobs in 31 months and gained jobs in 38 months.

• In 2012, total U.S. employment is below total employment in 2008; jobs are being added at a faster rate than they were in 2008.

• In 2012 the number of jobs added is trending upward, whereas it was trending downward in 2008.

• The number of unemployed workers is much higher in 2012 than in 2007 and 2008.

• The unemployment rate in 2012 is much higher than in 2008.

• In 2012, the unemployment rate and the number of unemployed workers is trending downward, whereas, it was trending upward in 2008.

• Since 1940 U.S. employment has increased 54 of 72 years, or 80% of the time. Five of the 14 declining years have occurred in the past decade (2002-2003 and 2008-2010). The increase in population coupled with the increase in demand for goods and services has generally resulted in an increase in jobs.

Financial Well-Being

• The 2012 Credability Consumer Distress Index is above the 2008 level and trending upwards (this is good news). Consumers are still “At Risk.”

• Health Care Coverage – The 2011 percentage of coverage is slightly below the 2008 level.

• Dow Jones Industrial Average – the DJIA is about 4,800 points above its level at this time (October) in 2008.

• Housing prices – Nationally, 2012 housing prices are below 2008 levels.

Transportation

• Average gas prices for 2008 were $3.21 per gallon. Through the first 44 weeks of 2012, average prices are $3.57 per gallon.

• After bottoming out in early 2009 U.S. auto sales have trended upward and are approaching 15 million a year. Sales in 2012 are better than 2008.

For more detailed analysis of the state of the economy compared to four years ago, visit https://cber.co or click here.

©Copyright 2011 by CBER.

In June, 2008 consumers began deleveraging (this includes defaulting on loans). Their debt levels decreased for 27 months, until September, 2010. At that point their debt levels again began increasing and by June 2011 debt loads returned to the previous peak of June 2008. Since that time, they have been increasing at a rate similar to June, 2008.

In June, 2008 consumers began deleveraging (this includes defaulting on loans). Their debt levels decreased for 27 months, until September, 2010. At that point their debt levels again began increasing and by June 2011 debt loads returned to the previous peak of June 2008. Since that time, they have been increasing at a rate similar to June, 2008. Neither the debt levels of the federal government nor consumers are healthy for the economy in the long-term.

Neither the debt levels of the federal government nor consumers are healthy for the economy in the long-term.