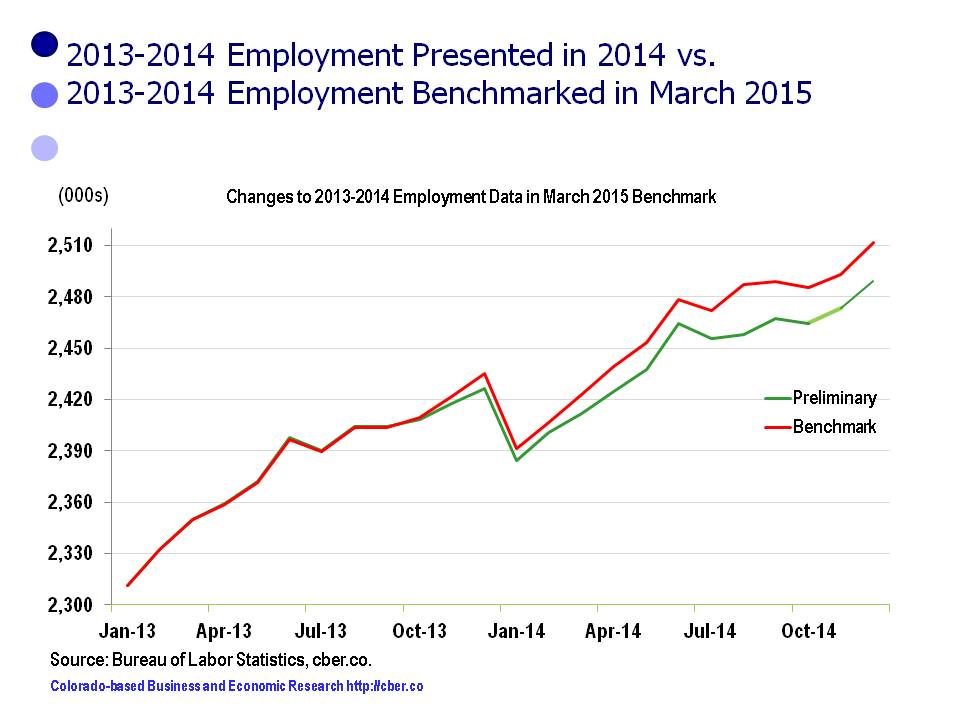

The Bureau of Labor Statistics released their benchmark revisions for 2014 Colorado employment in March. The upward revisions were significant and showed that Colorado added 78,900 wage and salary jobs. The final revisions for 2013 were minimal.

The data provided no surprise for those who gauge economic growth by the activity on the streets. The magnitude of the upward revision was disappointing for those who rely heavily on accurate jobs data to make critical business decisions.

In fairness to BLS, it is a challenge to report employment data in periods of strong growth and decline. As has been the case with many public and private organizations, BLS has been expected to provide more accurate estimates in shorter time frame at a lower cost. That is not always an equation for high accuracy.

The “preliminary” data showed that Colorado employment was increasing at a decreasing rate in the second half of 2014. The “benchmark” data shows there was actually strong growth. In addition, their estimate methodologies caused noticeable errors in key industries. In other words, industries that were thought to be having a really strong impact on the growth of the state were only having a strong impact on it.

It is important to understand the significance of the difference between the preliminary and the benchmark data.

Most economic forecasts for 2015 were based on the preliminary 2014 data – the data with the errors. Most likely these forecasts will not accurately account for the actual magnitude of job growth in 2014 which may cause errors in their estimation of growth in 2015.

Use caution when reviewing any Colorado jobs forecasts for 2015. Most are likely to contain biases resulting incorrect assumptions derived from the 2014 data.

The good news is the state added jobs at a faster rate than anticipated. Most likely Colorado will enjoy a similar rate of growth in 2015.