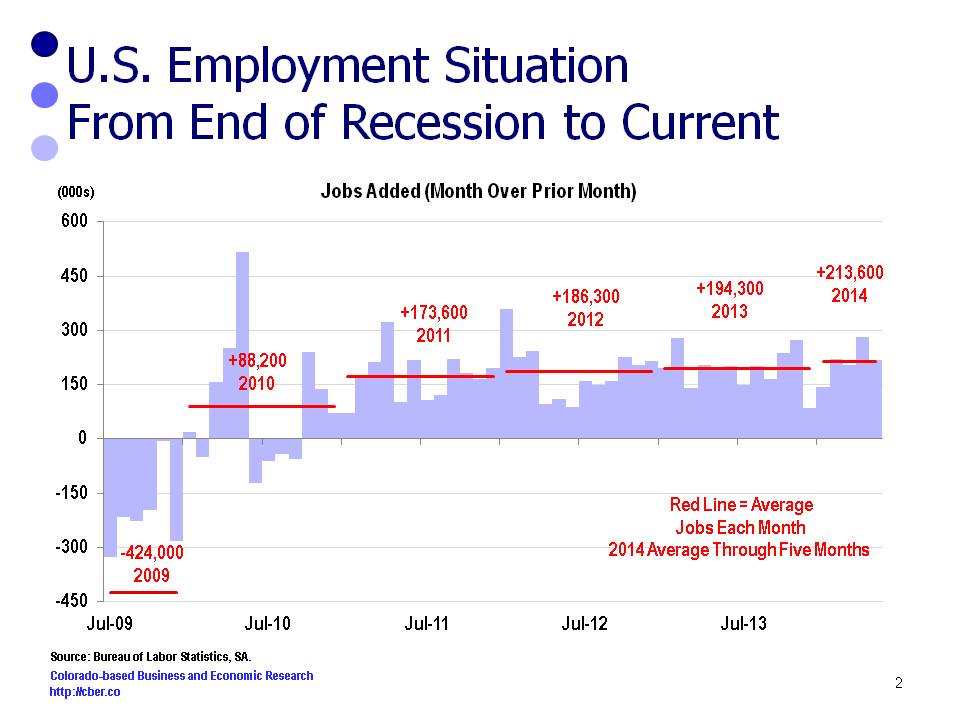

In January, cber.co released its economic forecast for Colorado. U.S. employment was projected to increase by 2.3 million jobs in 2014 and the state would add 68,000 to 74,000 jobs. The cber.co forecast is more aggressive than all other state forecasts.

After five months, it appears that U.S. and Colorado job growth will exceed cber.co projections. Through five months, U.S. jobs are being added at an average rate of 213,600 per month (or more than 2.5 million jobs per year) and the state is projected to add 67,100 jobs this year.

To digress for a moment…The most recent QCEW data published by BLS suggests the wage and salary data for Colorado will be higher than the current 2014 estimates. These projections are expected to be bumped upwards by as much as 10,000 in the March 2015 revisions.

In other words, the current wage and salary job growth estimates are not fully capturing the magnitude of job growth in Colorado.

There is a downside to the rapid rate of growth. In 2013, the Consumer Price Index for Colorado rose by 2.8% versus 1.5% for the U.S. Major contributors to the higher rate for Colorado was higher rental and home prices, significant increases in heating utilities, and higher medical costs. Higher housing prices are a function of Colorado’s strong housing market and decreased inventories, while increased utility costs may be related to state energy policy.

After a rugged start to the year at the national level (-2.6% Real GDP Growth in Q1), the nation will see solid growth in the economy for the remainder of the year. What is good for the U.S. is also good for Colorado. All indications are that the state will likely record accelerating job growth for the fourth consecutive year.