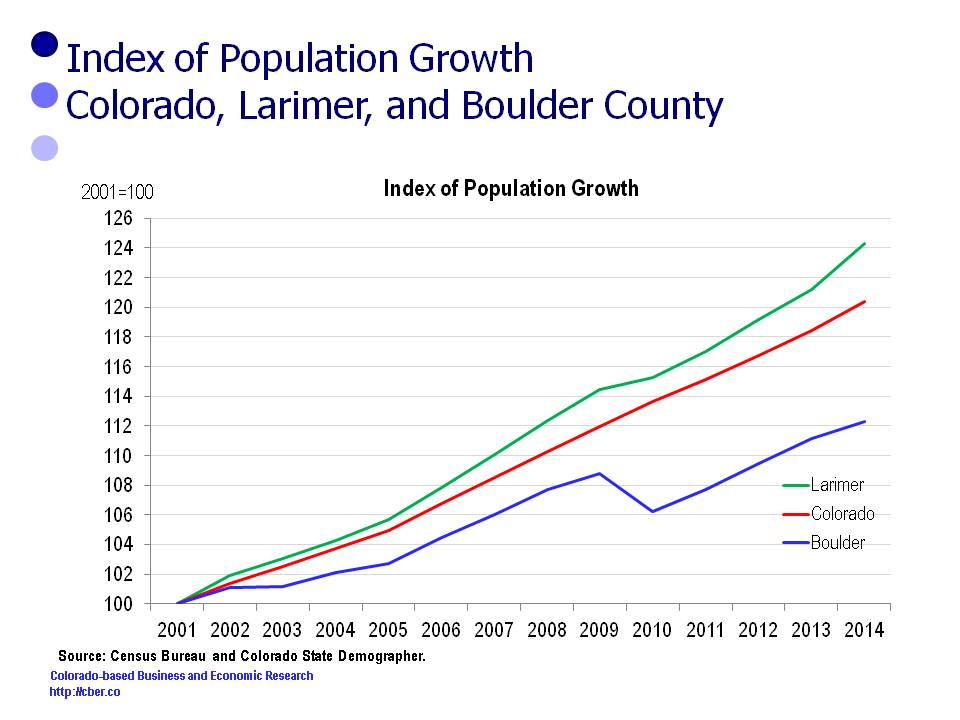

Colorado is noted for its diverse geography and population. In July 2014 the total Colorado population of the state’s 64 counties was 5,353,471, up from 4,338,801 in 2000 and 5,050,289 in 2010.

Colorado has 7 Metropolitan Statistical Areas (MSA). As expected, the Colorado-Lakewood-Aurora MSA is the largest with slightly more than half the state’s population. There are 4,688,482 people living in the 7 MSAs, or 87.6% of the state’s population

| Denver | 2,753,338 | 51.4% |

|---|---|---|

| Colorado Springs | 711,364 | 13.3% |

| Fort Collins | 323,863 | 6.0% |

| Boulder | 313,708 | 5.9% |

| Greeley | 276,079 | 5.2% |

| Pueblo | 161,782 | 3.0% |

| Grand Junction | 148,348 | 2.8% |

In 2014 the state had 11 counties with populations greater than 100,000. Combined their population was 4,371,483, or 84.2% of the total Colorado population.

| County | Population |

|---|---|

| El Paso | 665,070 |

| Denver | 664,220 |

| Arapahoe | 618,341 |

| Jefferson | 558,532 |

| Adams | 480,317 |

| Larimer | 323,863 |

| Douglas | 314,592 |

| Boulder | 313,708 |

| Weld | 276,079 |

| Pueblo | 161,782 |

There are 27 counties with a population between 10,000 and 62,000 people. These 27 counties have a combined population of 710,198. Broomfield is the largest county in this group with 61,826 people and

Yuma is the smallest with 10,132.

Colorado has 26 counties with a population less than 10,000 people. The combined population of these counties is 118,421. Of this group, 3 counties (Hinsdale, San Juan, and Mineral) have populations less than 1,000.

The populations for each of the state’s 64 counties is listed in the table below.

| County | Population | % Total |

|---|---|---|

| El Paso | 665,070 | 12.42% |

| Denver | 664,220 | 12.41% |

| Arapahoe | 618,341 | 11.55% |

| Jefferson | 558,532 | 10.43% |

| Adams | 480,317 | 8.97% |

| Larimer | 323,863 | 6.05% |

| Douglas | 314,592 | 5.88% |

| Boulder | 313,708 | 5.86% |

| Weld | 276,079 | 5.16% |

| Pueblo | 161,782 | 3.02% |

| Mesa | 148,348 | 2.77% |

| Broomfield | 61,826 | 1.15% |

| Garfield | 57,548 | 1.07% |

| La Plata | 54,014 | 1.01% |

| Eagle | 52,831 | 0.99% |

| Fremont | 46,294 | 0.86% |

| Montrose | 40,904 | 0.76% |

| Delta | 30,027 | 0.56% |

| Summit | 29,399 | 0.55% |

| Morgan | 28,254 | 0.53% |

| Montezuma | 25,812 | 0.48% |

| Elbert | 24,144 | 0.45% |

| Routt | 23,896 | 0.45% |

| Teller | 23,394 | 0.44% |

| Logan | 22,088 | 0.41% |

| Chaffee | 18,454 | 0.34% |

| Otero | 18,380 | 0.34% |

| Pitkin | 17,645 | 0.33% |

| Park | 16,383 | 0.31% |

| Alamosa | 15,870 | 0.30% |

| Gunnison | 15,660 | 0.29% |

| Grand | 14,505 | 0.27% |

| Las Animas | 14,060 | 0.26% |

| Moffat | 12,870 | 0.24% |

| Archuleta | 12,249 | 0.23% |

| Prowers | 11,985 | 0.22% |

| Rio Grande | 11,574 | 0.22% |

| Yuma | 10,132 | 0.19% |

| Clear Creek | 9,153 | 0.17% |

| Conejos | 8,229 | 0.15% |

| San Miguel | 7,823 | 0.15% |

| Kit Carson | 7,818 | 0.15% |

| Lake | 7,349 | 0.14% |

| Rio Blanco | 6,607 | 0.12% |

| Huerfano | 6,428 | 0.12% |

| Saguache | 6,206 | 0.12% |

| Gilpin | 5,830 | 0.11% |

| Crowley | 5,551 | 0.10% |

| Bent | 5,539 | 0.10% |

| Lincoln | 5,508 | 0.10% |

| Washington | 4,769 | 0.09% |

| Ouray | 4,587 | 0.09% |

| Phillips | 4,380 | 0.08% |

| Custer | 4,373 | 0.08% |

| Baca | 3,624 | 0.07% |

| Costilla | 3,556 | 0.07% |

| Sedgwick | 2,331 | 0.04% |

| Dolores | 1,933 | 0.04% |

| Cheyenne | 1,870 | 0.03% |

| Jackson | 1,388 | 0.03% |

| Kiowa | 1,385 | 0.03% |

| Hinsdale | 769 | 0.01% |

| San Juan | 718 | 0.01% |

| Mineral | 697 | 0.01% |

| Colorado | 5,353,471 | 100.00% |