Click here for monthly updates

Colorado Economic Forecast 2024 (January 2024)

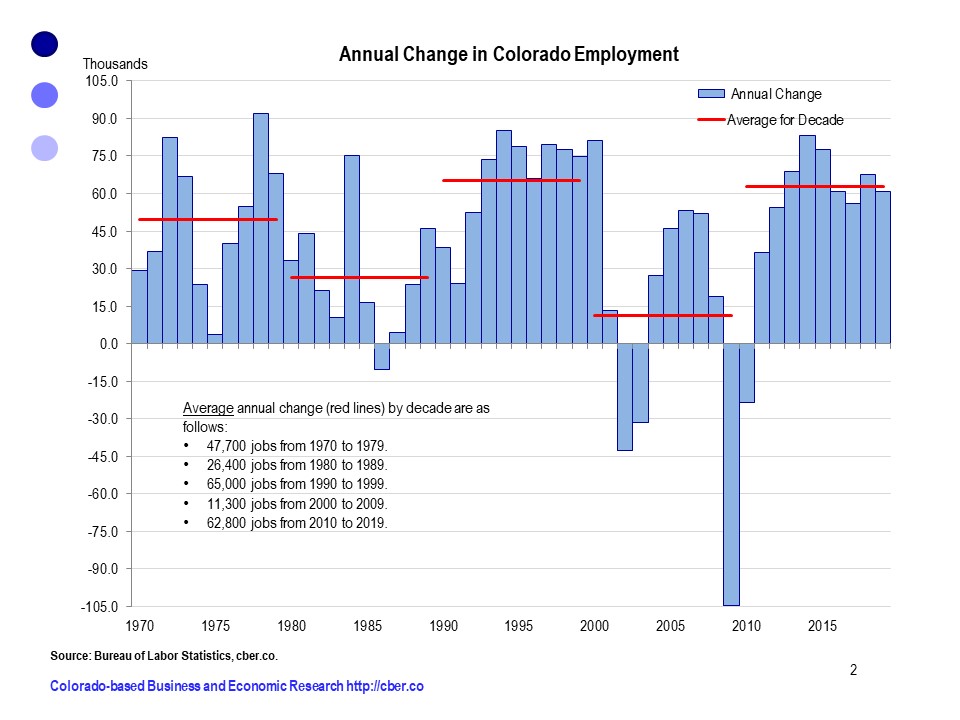

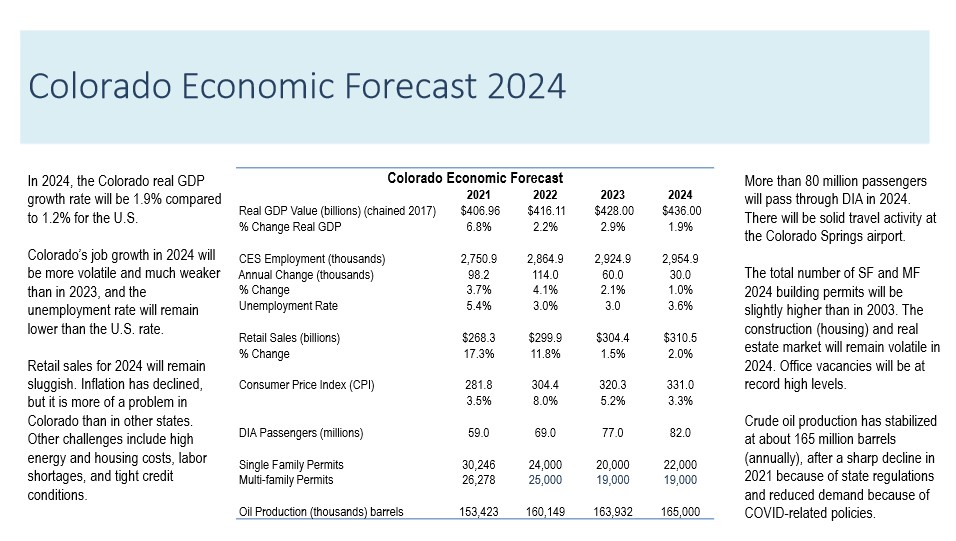

The Colorado forecast called for a recession in 2023. Fortunately, it has not happened – yet. Employment increased by 60,000, but slower job growth and possibly a recession are on tap for 2024. Colorado will continue to be challenged by many of the problems it faced in 2023. Housing permits (a leading indicator) will remain lower than usual, the office vacancy rate in Denver is around 30%, retail sales have slowed, inflation will remain higher than in other states, and companies will continue to struggle to find workers despite low unemployment rates.

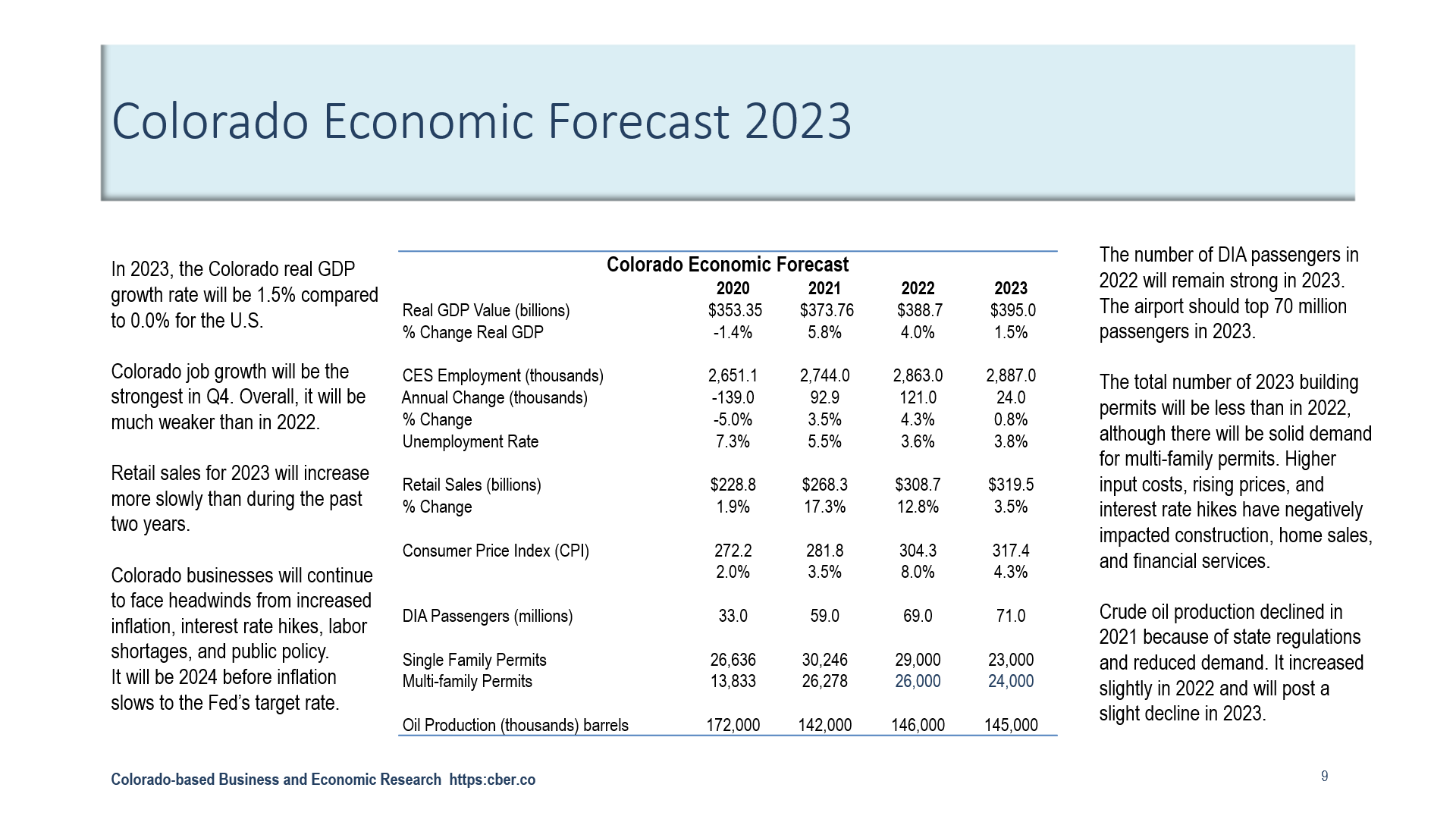

Colorado Economic Forecast 2023 (January 2023)

The Colorado real GDP growth rate for 2023 will be 1.5% compared to 0.0% for the U.S.

The state labor market will be weak, 24,000 jobs will be added.

Retail sales will decline in 2023 as a result of inflation, higher interest rates, other headwinds, and ineffective public policy. Click here for 2023 Colorado Economic Forecast,

————————————————————————————————–

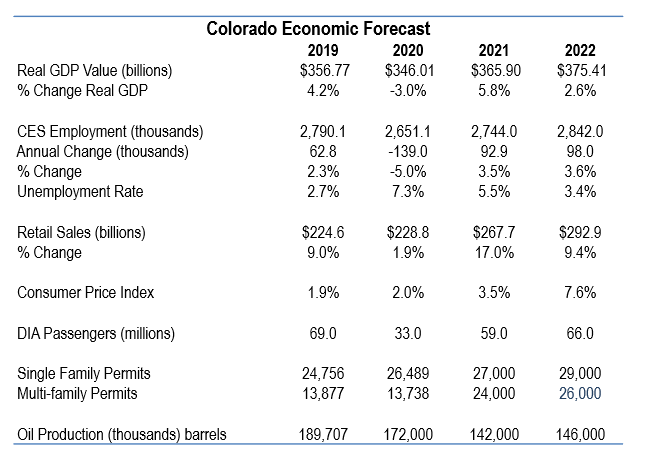

Colorado Economic Forecast 2022 (August 22, 2022 Update)

The Colorado real GDP growth rate for 2022 was revised downward to reflect slower growth in Q4.

The state labor market will remain strong through eight months, followed by a slowdown that continues into 2023.

Retail sales will remain strong in 2022. They will increase at a slower rate than in 2021. A portion of the 2022 growth reflects inflated prices.

Colorado businesses will face headwinds from increased inflation, supply chain disruptions, labor shortages, interest rate hikes, and ineffective public policy.

The number of DIA passengers has increased rapidly in 2022. The year-end total will be less than for 2019.

The demand (based on the number of building permits) will continue to exceed the supply because of in-migration and the Marshall Fire. The total number of building permits will be slightly more than in 2021. Higher input costs, rising prices, and interest rates will negatively impact construction, and home sales, and financial services.

The production of crude oil declined in 2021 because of state regulations. Oil production will increase slightly in 2022.

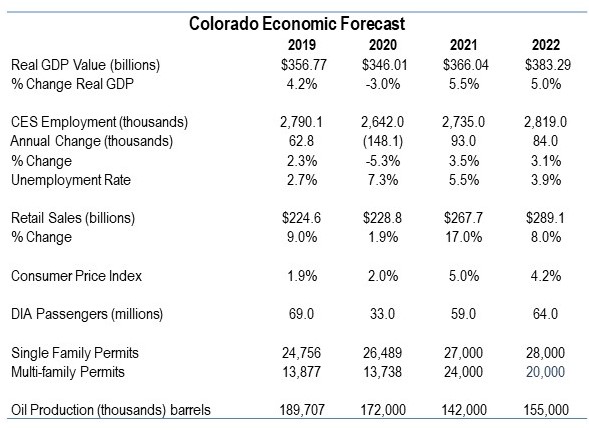

Click here for the 2022 Colorado Economic Forecast. Released January 20, 2022

Colorado’s real GDP growth rate will be greater than the U.S. rate in 2021 and 2022.

Employment will return to its February 2020 level in the second half of 2022. The labor market expanded at a faster pace than expected in 2021. It will taper off in 2022.

Retail sales rebounded in 2021. Growth will be slower in 2022.

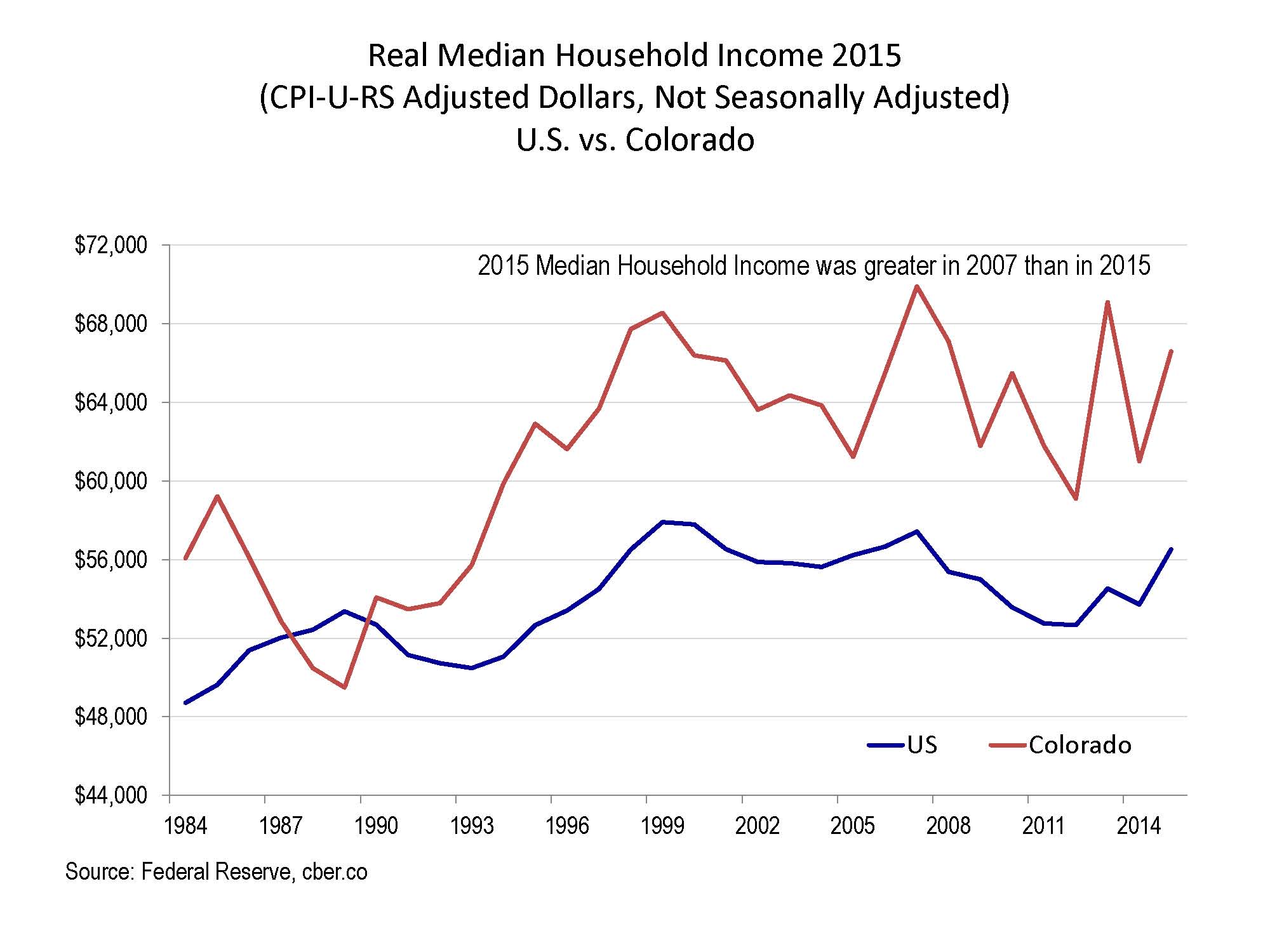

In 2021 and 2022, Colorado inflation will be greater than in recent years. The increased inflation will negatively impact economic growth in the months ahead. Typically, the Colorado CPI exceeds the national rate.

In 2021, DIA was one of the busiest airports in the country. The number of passengers was ten million less than the total for 2019. The number of passengers will increase by five million in 2022.

There was an increase in the number of building permits issued in 2021. The number of permits issued in 2021 as demand exceeds the supply and 1,100 homes were destroyed in the Marshall Fire.

The production of crude oil declined in 2011 because of state regulations. Oil production will increase slightly in 2022 as the economy returns to “normal.”

——————————————————————————————-

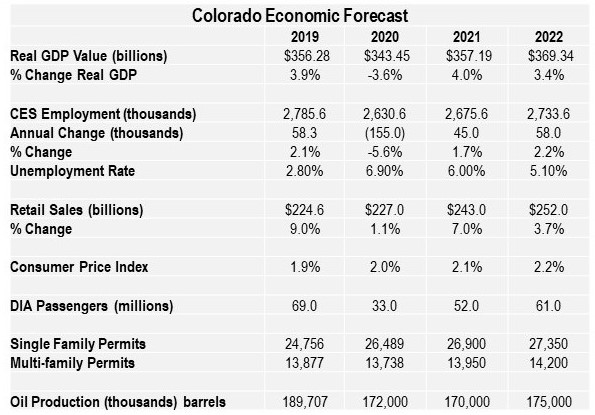

Click here for the 2021 Colorado Economic Forecast.

Colorado’s real GDP growth rate for 2021 will be slightly higher than the rate for the U.S. It will return to its pre-pandemic value in late 2021.

Colorado employment posted declines in Q4 2020. The negative trend will continue in Q1 2021. The increasing number of unemployment claims will cause Colorado’s unemployment rate to be greater than most states.

Retail sales will rebound in 2021 as a result of pent-up demand. Sales will level off at pre-pandemic levels in 2022.

In 2021 and 2022, inflation will be slightly higher than the CPI rate for the U.S.

The number of passengers through DIA in 2020 was about half of the 2019 total. Domestic flights will return to their 2019 level in 2023. International flights will return to their pre-pandemic level in 2024.

There was an increase in the number of building permits issued in 2020. There will be more permits in 2021 as the population increases. Also, there is a need for affordable housing in the metro areas.

State regulations and reduced demand caused a decline in oil production in 2020. The production of oil will be flat in 2021 and 2022.

Click here for a copy of the 2020 Economic Forecast or click here for an executive summary.

Highlights for 2020

- Global GDP 3.0%

- U.S. GDP 2.0%

- U.S. Consumer spending 2.0%

- U.S. Employment 1.5 million jobs or 125,000 per month

- U.S. Annual unemployment rate 3.6%

- U.S. Consumer price index 2.1%, core index 2.0%

- U.S. Real disposable personal Income 4.1%

- U.S. Advanced retail sales, excluding food service sales, 3.3%

- U.S. Automobile and light truck sales, 16,8 million units

- U.S. Crude oil production up from 12.24 million barrels/day to 13.3 b/d

- U.S. Average price for WTI crude per barrel, $59.25.

- Population 72,400 people

- Natural rate 24,400 people

- Net migration 48,000 people

- Annual unemployment rate 3.6%

- Consumer price index 2.2%

- Private hourly earnings 3.5%

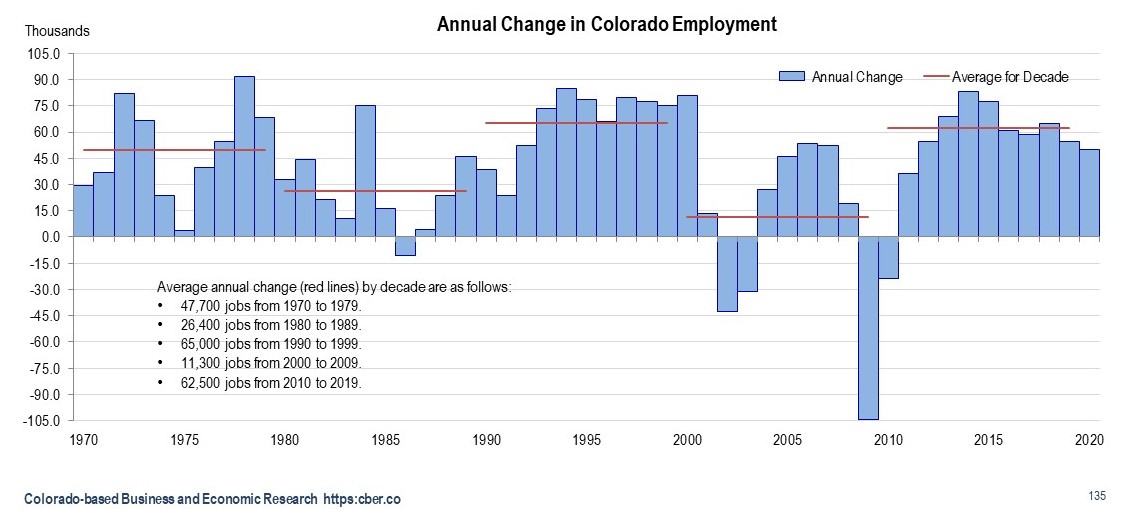

- Employment 50,000 workers, or 4,167 per month, 1.8% growth

- Leading job growth: PST, health care, construction, T&W, manufacturing

- Total building permits, similar to 2019.

- Crude production 15.5 to 16 million barrels.

To get all the details, click here for a copy of the 2019 cber.co Colorado Economic Forecast.

Highlights

- Global real GDP will increase by 3.1% in 2018.

- U.S. real GDP will be 2.6%.

- The U.S. will add 2.0 million workers.

- Colorado will add 61,000 workers, job growth will be 2.2%

- Job growth will be driven by Construction: Accommodations and Food Services; Professional, Scientific, and Technical Services; Health Care, and Retail Trade.

- Colorado Economy – In 2019, The Colorado economy will mirror the slowing in the global and U.S. economies.

- Real GDP – The Colorado real GDP growth rate will be greater than the U.S. rate and will be driven by health care, real estate, and the extractive industries in 2019.

- Net Migration – Net migration has trended downward since 2015.

- The natural rate of increase in population will remain flat as a result of the decreasing fertility rate.

- Employment – Colorado job growth, 2.2%, will be less than 2018.

- Unemployment – The unemployment rate will increase to 3.3%.

- Lack of Trained Workers – The Colorado economy is not operating efficiently because the unemployment rate is too low. There are not enough qualified and trained workers in many sectors.

- Colorado’s Three Economies – There are three economies in Colorado: Front Range, micropolitan areas such as Durango, and rural Colorado. It is an understatement to say that many rural counties are significantly challenged.

- Retail/Accommodations and Food Services – Retail trade and the AFS sector are evolving, in part because there are too many firms. Sales growth will reman solid, but employment growth will be modest.

- Construction – Construction along the Front Range has benefitted from the warm and dry winter, but it has been constrained by the lack of qualified workers.

- State/K-12 – State government and K-12 education are likely to see significant job growth in 2019.

- Weather – The weather will continue to have a significant impact on the tourism, agriculture, and construction industries.

- Inflation – The Colorado inflation rate will decline; however, it will be greater than the U.S. rate.

- Future Economic Drivers – Welcome to the Spaceport and Gaylord – economic drivers of the future! In addition, companies such as Lockheed continue to secure business that make Colorado a leader in technology.

- Legislature – As has happened in the past, there is likely to be overreach in the legislature. Important issues will be addressed, but it is unlikely that critical needs, such as transportation will not be adequately addressed.

The 2018 Forecast called for 54,000 jobs to be added in 2018. Click here for the forecast. Click here for an abbreviated version of the forecast.

——————————————————————————-

The cber.co 2017 Colorado Economic Forecast provided three scenarios for economic growth this year. Highlights from the most likely scenario follow:

• Global real GDP growth will increase by 2.9% in 2017.

• 2017 U.S. real GDP growth will be in the range of 2.1% to 2.5%.

• There were be an increase of 1.9 to 2.1 million U.S. employees in 2017 – down from about 2.5 million in 2016.

• In 2017 Colorado will see job growth in the range of 57,000 to 63,000 workers (2.2% to 2.4% growth).

• Growth will be broad based and driven by the Health Care, Accommodations and Food Services, and Construction.

Click here for a copy of the 2017 cber.co Colorado Economic Forecast.

——————————————————————————-

The cber.co 2016 Colorado Economic Forecast provided three scenarios for economic growth this year. Highlights from the most likely scenario follow:

• Global real GDP growth will increase from 2.5% in 2015 to 2.8% in 2016.

• 2016 U.S. real GDP growth will be in the range of 2.3% to 2.7%, about the same as 2015.

• There were be an increase of 2.7 million U.S. employees in 2016 – down from about 3.0 million in 2015.

• In 2016 Colorado will see job growth in the range of 67,000 to 73,000 workers (2.7% to 2.9% growth).

• Growth will be broad based and driven by the Health Care, Construction, and Accommodations and Food Services.

Click here for a copy of the 2016 cber.co Colorado Economic Forecast.

——————————————————————————-

The cber.co 2015 Colorado Economic Forecast provided three scenarios for economic growth this year. Highlights from the most likely scenario follow:

- Real Global GDP growth will increase from 3.2% in 2014 to 3.4% in 2015.

- U.S. Real GDP growth will be in the range of 2.5% to 2.9% for 2015.

- There were be an increase of at least 2.6 million U.S. employees in 2015.

- In 2014 Colorado will see job growth in the range of 73,000 to 79,000 workers (3.0% to 3.2% growth).

- Growth will be broad based driven by the Construction; Health Care; Accommodations and Food Services; Professional, Scientific, and Technical Services, and Retail Trade Sectors.

Click here for a copy of the 2015 cber.co Colorado Economic Forecast.

Click here for a copy of the recalibrated 2015 cber.co Colorado Economic Forecast. The original forecast was updated to account for significant benchmark revisions to the 2014 Colorado employment data.

——————————————————————————-

The cber.co 2014 Colorado Economic Forecast provided three scenarios for economic growth this year. The most likely scenario foretells the following:

•U.S. Real GDP 2.3% to 2.7%.

•The U.S. will add at least 2.3 million workers.

•Colorado will account for 3.0% of U.S. jobs added.

•Colorado will add 68,000 to 74,000 workers.

In 2014, the leading sectors for growth will be:

- Construction

- Professional, Scientific, and Technical Services

- Accommodations and Food Services

- Retail

The Federal Government will be the only sector to shed jobs in 2014.

Originally, Healthcare was listed as a leading sector. In March 2014, the size of the healthcare sector was diminished as several private sector organizations were purchased by state organizations. As a result, the 2014 cber.co projections for healthcare job growth will be less than anticipated.

Click here for a copy of the 2014 cber.co Colorado Economic Forecast.